Foundations of Financial Planning: Part I, Behavior > Everything Else

Financial PlanningJan 31, 2024

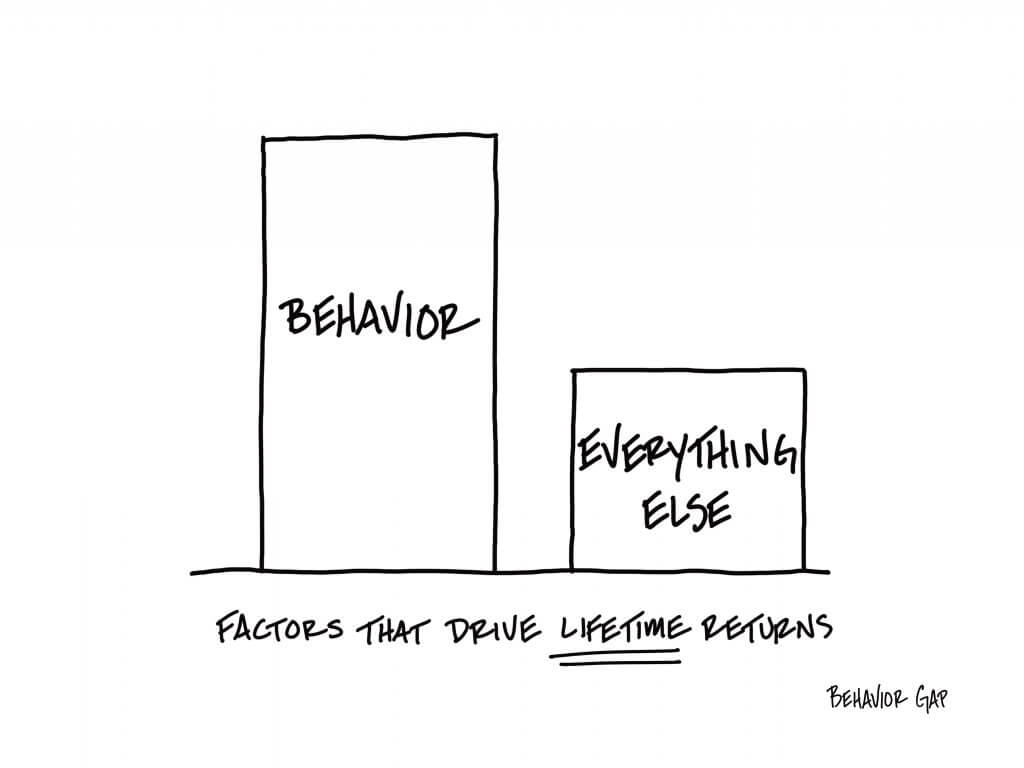

Before moving forward with designing a financial plan, we must understand the actions (or inactions) that got you where you are today. By doing this you can better understand the behaviors, emotions, and habits that help you move toward your financial goals as well as those that don’t. Financial planning is about building a process around how YOU think about money. It can’t be found in a textbook or created by an algorithm. There is no one size fits all strategy. Having a process designed for how you think allows you to be more methodical, disciplined, and long-term oriented. Simply put, a good process helps us remove decisions and think LESS about money. This is essential to having good outcomes. Why? Because while many in our industry won’t admit this, the truth is our behaviors, emotions, and mindset when it comes to money will have the biggest long-term impact on our financial outcomes. We need to plan accordingly.

Most of our habits and internal narratives come from when we are young. What we learned from those who raised us and our earliest experiences with money have a huge impact on each of us. We tend to build hardwired habits and tell ourselves stories early on in life, and then repeat them from then on without even really knowing it. These early influences shape our view of the world and inform our financial decisions. While this topic may not be particularly interesting (or comfortable) for everyone, no one is exempt from this fact. As Morgan Housel wrote in his book The Psychology of Money: “Your personal experiences make up maybe 0.00000001% of what’s happened in the world but maybe 80% of how you think the world works.”

For example, do you constantly struggle to spend within your means, or throw your hands up with thoughts like “I’ll never get out of debt”? Are you always taking big financial risks, or day trading based on what you think will happen next? Maybe you have too much cash sitting in a savings account to give you a feeling of security. Perhaps you tend to avoid thinking about money all together because it triggers stress. These are the types of recurring behaviors that are rooted in our subconscious for one reason or another. Trying to better understand the “operating system” that is our subconscious mind and how it is dictating our outcomes allows us to make better decisions. If we can identify our patterns of behavior, then we can make changes that work to our advantage and build a plan around them.

We all think we are rational, logical, and that we understand what we are thinking and the reasons we make decisions. This is simply not the case. A 2005 study by the National Science Foundation found that 95% of decisions are made by the subconscious mind up to seven seconds before we are consciously aware of the decision being made. This means that our conscious rational mind based in the prefrontal cortex part of our brain is in control a measly 5% of the time! This may all sound like a little much, but the overall point is this: before deciding on specific investment, tax-planning, or retirement strategies, your habits and beliefs with money must be well understood.

We all view risk and reward through our own unique lens rooted in our personal experiences. There is a reason it is called personal finance. Therefore, financial planning can’t have ironclad laws or rules like physics and engineering. Everyone’s perspective is different. It is also why a good financial plan must take into account not only your individualized situation, but also your distinct perspective when it comes to money and decision-making. What is right for someone else is not necessarily right for you.

As a general rule, if someone is insisting that only one specific product is the answer, chances are they are selling something. Calling a 1-800 number to have a planning conversation will probably lack the necessary nuance and context needed to really understand your personal situation. By engaging with a fiduciary advisor who spends time asking questions, building a relationship, and understanding how you think about money, you can bring in a trusted outside perspective whose interests are aligned with yours. We all have different goals, worries, and personal histories. A good financial plan takes these into account. To plan for the future, we first need to understand our past.