Retirement Savings Contribution Limits

Tax PlanningBy: Christopher D. Ross, CFP®

Feb 23, 2020

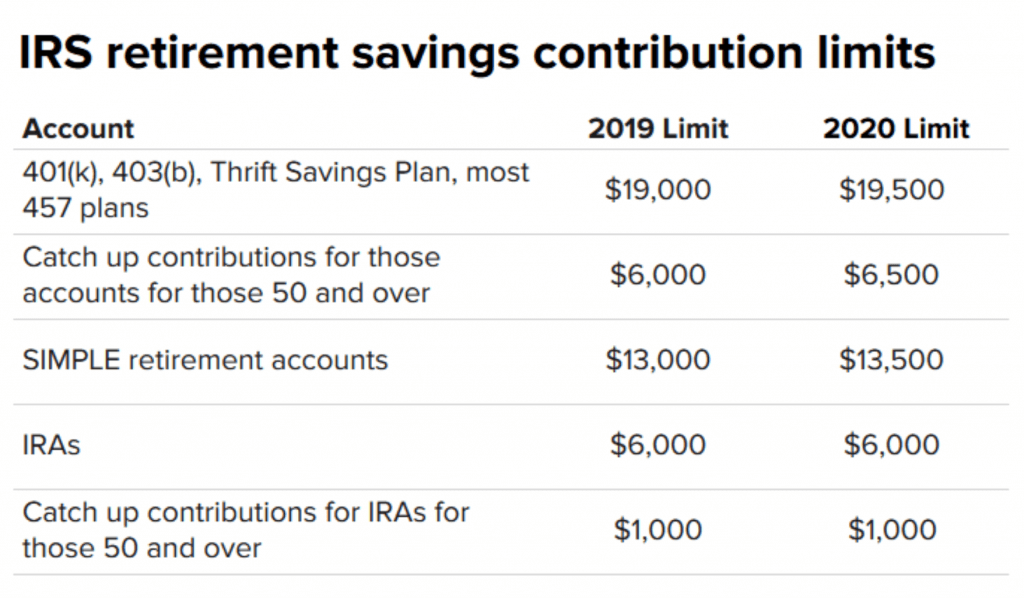

The I.R.S. increased the annual contribution limits on IRAs, 401(k)s, and other widely used retirement plan accounts for 2020.

This year you can put up to $6,000 in any type of IRA. The limit is $7,000 if you will be 50 or older at any time in 2020.1,2

Annual contribution limits for 401(k)s, 403(b)s, the federal Thrift Savings Plan, and most 457 plans also get a $500 boost for 2020. The new annual limit on contributions is $19,500. If you are 50 or older at any time in 2020, your yearly contribution limit for one of these accounts is $26,000.1,2

Are you self-employed, or do you own a small business? You may have a solo 401(k) or a SEP IRA, which allows you to make both an employer and employee contribution. The ceiling on total solo 401(k) and SEP IRA contributions rises $1,000 in 2020, reaching $57,000.3If you have a SIMPLE retirement account, next year’s contribution limit is $13,500, up $500 from the 2019 level. If you are 50 or older in 2020, your annual SIMPLE plan contribution cap is $16,500.3

Yearly contribution limits have also been set a bit higher for Health Savings Accounts (which may be used to save for retirement medical expenses). The 2020 limits: $3,550 for individuals with single medical coverage and $7,100 for those covered under qualifying family plans. If you are 55 or older next year, those respective limits are $1,000 higher.4

1. IRS.gov, 2019

2. IRS.gov, 2019

3. Forbes.com, 2019

4. CNBC.com, 2019

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information.

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with Alliance Wealth Advisors, LLC.

The views and opinions expressed herein are those of the speaker or writer and do not necessarily reflect the views of Alliance Wealth Advisors, LLC. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market.