Introduction

Behavior > Everything Else

Taking Inventory

Focus On What You Can Control

Run Your Own Race

Introduction

Financial planning can mean different things to different people, but there are certain characteristics all plans should have in common. Working with a team of advisors who deeply understand your situation and the way you think about money is essential. It is also not a one-time exercise, but an ongoing strategic process that changes as your life does. As writer Morgan Housel says: “Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.” Good financial planning should incorporate your goals and values. It should be a dynamic process rooted in giving you flexibility as the environment changes, not about needing the market to behave a certain way. Here are our foundations of financial planning:

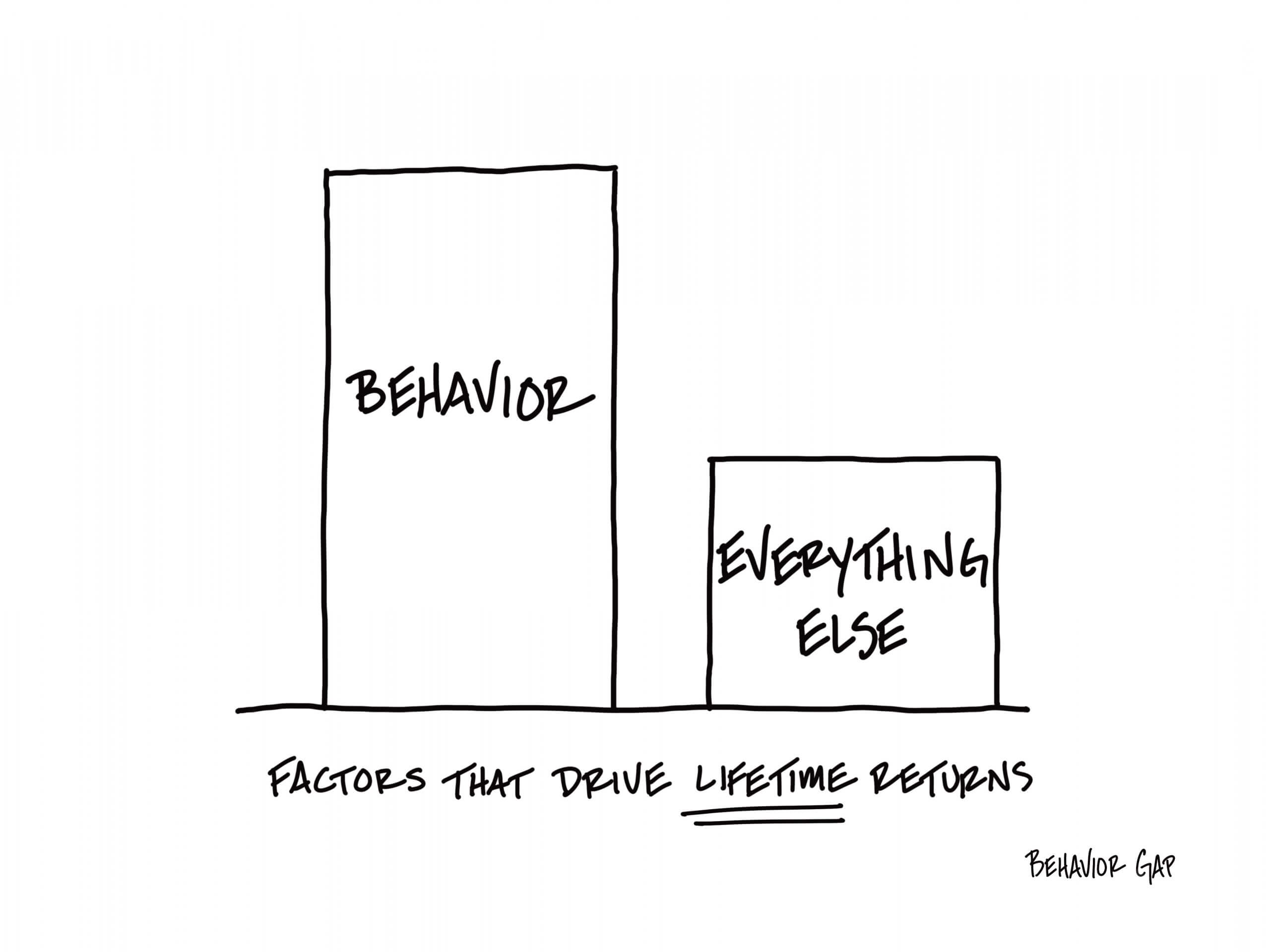

Behavior > Everything Else

Before moving forward with a plan, we must first step back. We must understand the actions (or inactions) that got you where you are today. By doing this you can better understand the behaviors, emotions, and habits that will help you move toward your goals in the future as well as those that won’t. Our instincts as human-beings, the same ones that allowed our ancestors to survive and avoid danger in all kinds of environments for thousands of years, make us lousy planners and investors. We must create a process that removes emotions from our decision-making as much as possible.

Our habits and mindset around money will have the biggest long-term effect on our financial outcomes. Like most things involving psychology, the foundation of our habits and internal narratives come from early on in life- what we learned from those who raised us and our earliest experiences with money. From there we tend to build hardwired habits and tell ourselves repetitive stories without even really knowing it. Before deciding on specific tactics around investment, tax-planning, or retirement strategies, your habits and beliefs with money must be well understood. By engaging with a fiduciary advisor who spends time asking questions, building a relationship, and understanding how you think about money, you can bring in a trusted outside perspective whose interests are aligned with yours. We all have different goals, worries, and personal histories. A good financial plan takes these into account. To plan for the future, we first need to understand our past.

Learn MoreTake Inventory

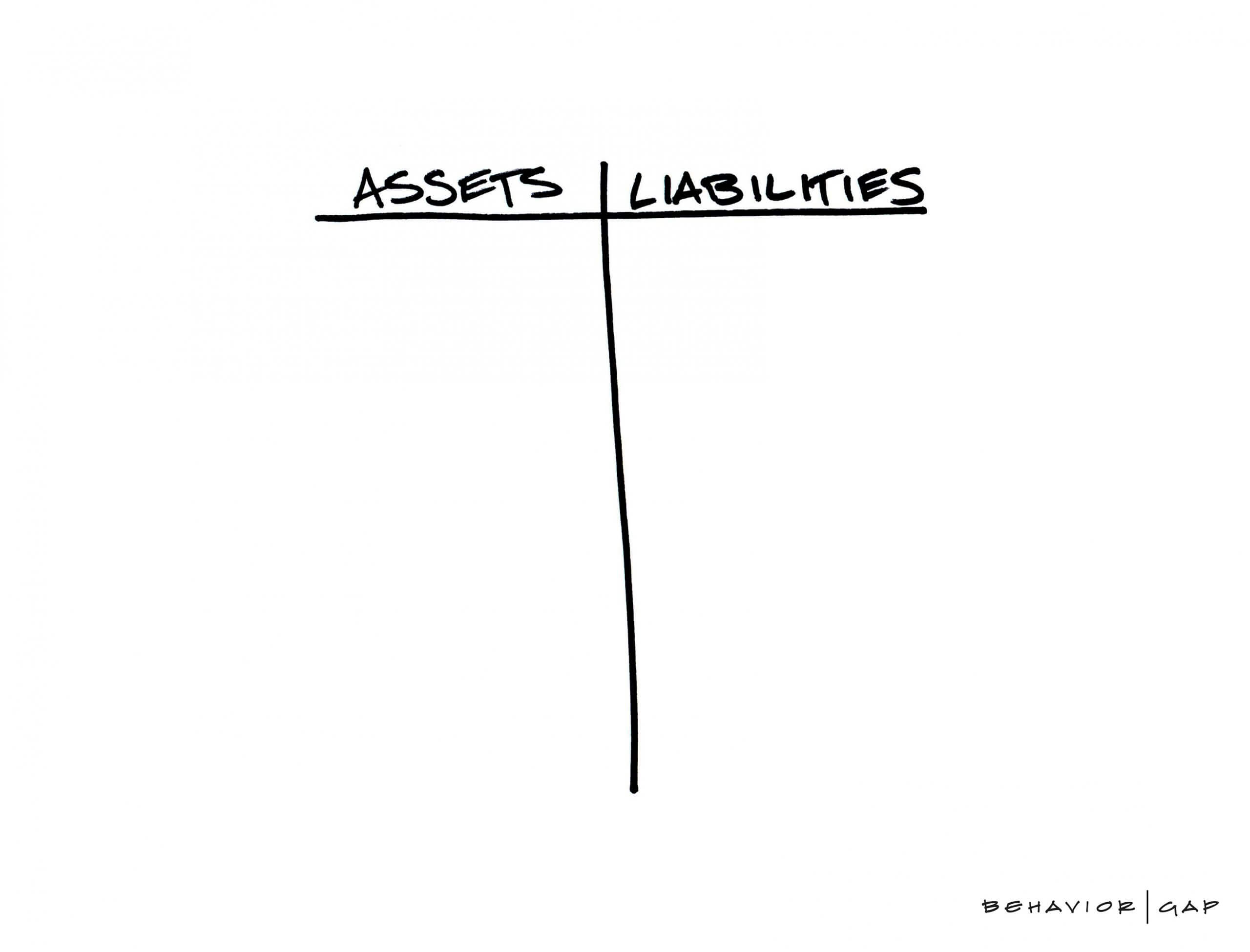

We must be willing to be honest about our current situation before we can change it. Before you set financial goals about where you want to be in one, five, or twenty years, you must first understand where it is you are today. If you are not taking a holistic view of your personal finances it is going to be really hard to accomplish your goals, regardless of what they are.

Forget stock market performance, fancy investment products, and what the talking heads have to say. The first step should be a broader financial discussion that considers your personal balance sheet. The balance sheet is the single best way to “take inventory” for yourself and your family about where you are, so you can then understand what you need to focus on moving forward. Working with an advisor to better understand your balance sheet will also prompt you to do some of that organizing of your finances you may be putting off. Maybe you have been meaning to get around to it since you changed jobs, got married, or are getting close to retirement. It can also uncover items you forgot about, aren’t paying attention to, or that may be holding you back at the moment. As Peter Drucker famously said, “you can’t manage what you can’t measure”.

Learn More

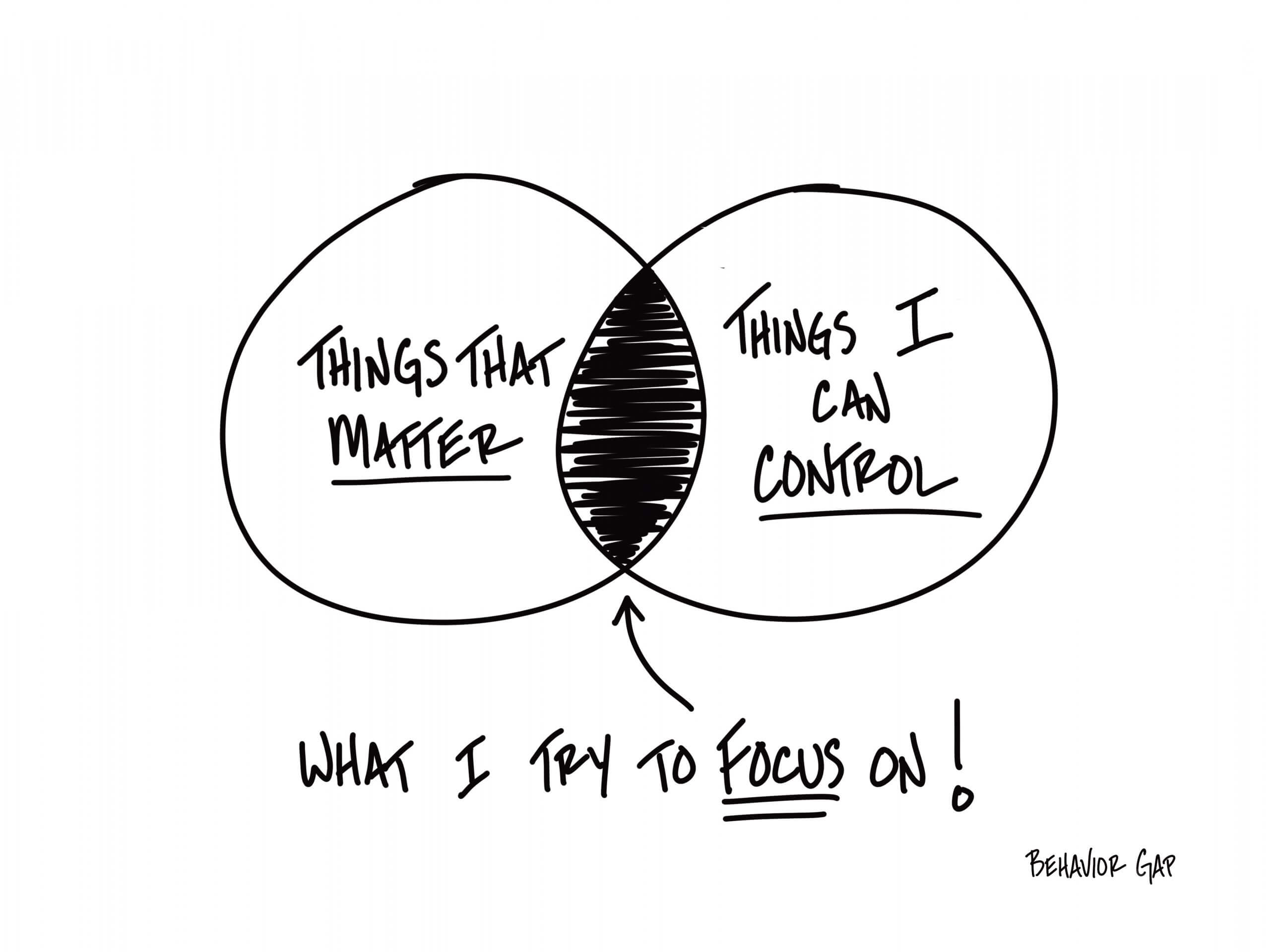

Focus on what you can control

Most of what is written about financial planning, investing, and markets is focused on the endless number of external factors happening around us in the financial world. “Bonds did this”, “stocks are doing that”, and “here’s why this is happening” or “this is what will happen next” form the basis of most things you will read. You must then digest this information and deduct how it will impact your life. The flaw in only focusing on the external variables of the financial world is it leaves you constantly reactive to things outside of your control. The world is too complex to digest an infinite number of variables and interpret them correctly all the time.

Human-beings’ inability to forecast the future makes us uncomfortable. It is why everyone from economists to people who get paid for sports gambling picks, to tarot card readers always have job security despite poor long-term job performance. We want to believe we can anticipate what will happen next, even though we are constantly taught the hard way that the future is unpredictable. When it comes to financial success, people shouldn’t need to perfectly forecast what will happen next to get good results. You need to be willing to play a different game. Rather than trying to predict the future, we spend our time helping clients better understand their situation while becoming more financially resilient today. By doing this we can then build wealth for tomorrow more effectively. Focusing on things you can control like saving vs. spending, building a strong household balance sheet, and a well-constructed portfolio can give you peace of mind and help you accomplish your goals down the road regardless of what comes next.

Learn MoreRun Your Own Race

While it seems obvious someone with a young family will have a plan that is completely different than someone who has been working for decades and saving for retirement, we don’t always acknowledge this fact. Different stages of life bring different financial challenges. We need to be willing to ignore what other people are doing and “run our own race”. However, the differences are not just rooted in different stages of life. You could have a friend or co-worker who is the same age with a radically different financial approach than you, and probably for good reason. Rarely do we see the whole picture, and someone else’s situation will almost never be an apples-to-apples comparison.

Instead of focusing on what other people are doing, we need to create a process that fits our situation. Author Ryan Holiday writes about the importance of having a process to accomplish big challenges: “Let’s say you’ve got to do something difficult. Don’t focus on that. Instead break it down into pieces. Simply do what you need to do right now. And do it well. And then move on to the next thing. Follow the process and not the prize.” That is directly applicable to a good financial planning process. Rather than panicking about how much money you need to retire some day or what others are doing, break the problem down into smaller more manageable pieces today.

There is an old saying often attributed to Theodore Roosevelt that “comparison is the thief of joy”. Regardless of where it originated, it is truer than ever in today’s social media focused world where we can constantly compare ourselves to millions of people at any point in time. Forget everyone else and instead build a plan based on what is important to you. Don’t think too much about what other people are doing. Their situation is different. Keep in mind that your parents, neighbors, friends, and everyone else’s race had a different starting line and will have a different finish line. Given this fact, it is okay if their approach is different. Run your own race.

Learn More