Constructing Your Portfolio

Investment ManagementBy: Jude McDonough, CFP® AIF®

Jul 29, 2020

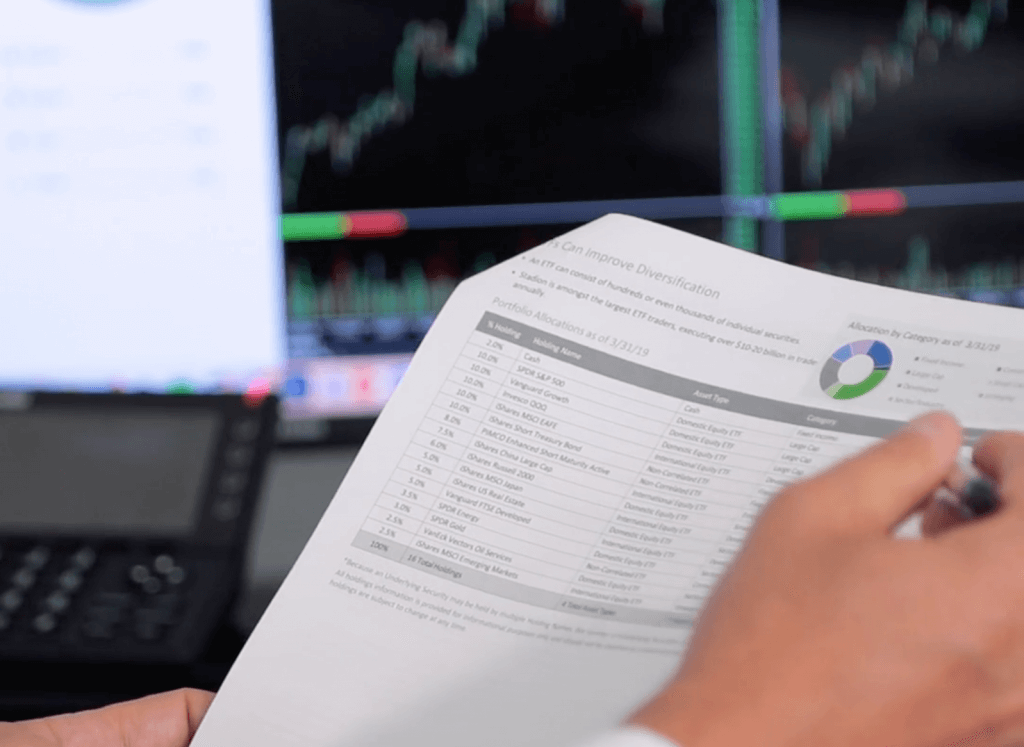

Once you determine how much risk you are comfortable with, the next step is putting together a portfolio. There are many different investment options to utilize in constructing a portfolio including individual stocks, individual bonds, mutual funds and exchange traded funds. Each of these vehicles gets you exposure to different sectors and asset classes. Oh, and you can’t forget about giving consideration to both active and passive strategies.

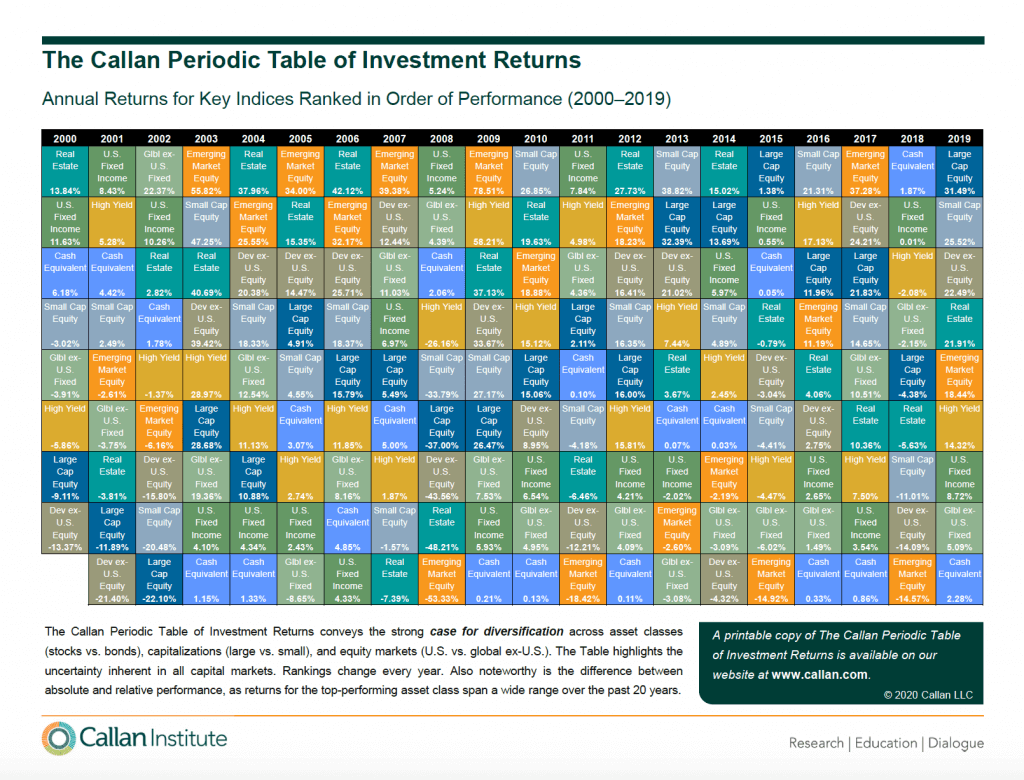

Why would you want exposure to all of these different asset classes and sectors? The short answer is for diversification. Trends don’t last forever. This year’s winners can be next year’s losers. The table below illustrates it perfectly as it highlights the performance of different asset classes over the last 20 years from best to worst in each year. Emerging Markets went from the top performer in 2017 to the bottom performer in 2018.

To take it a step further, you can look at the performance of different sectors with some examples in recent history. I’ll start with a good one. Technology stocks have outperformed over the last 1, 3, 5- and 10-year time periods. If you were all in on tech for the last 10 years, you are definitely going to question some of the points made in this post.

However, what if you were all in on energy or banks? That’s the bad side of it. Despite their nice dividends, the stock performance in these areas have been lackluster for a very long time. Sure, if you bought them at their lows in 2008, you don’t have much to complain about. However, if you’ve held them for the last 20 years, you certainly do. The XLE, which is an ETF that tracks the energy sector, has negative 1, 3, 5 and 10 year returns at the moment. The XLF, which represents the financial sector, has a nice looking 10-year number annualized around 9.50%. However, the 15-year number is annualized around 2%.

As fiduciaries to our clients, we have to take all of this into account when we are constructing our client portfolios. We can’t get caught up in chasing trends and taking excessive risk. We can’t move our portfolios to all technology because it seems so in favor right now. We can’t cut out international stocks completely because they have underperformed the US for last decade. We also aren’t going to completely abandon energy and financials despite the information in the prior paragraph. What we can do is increase our allocation to certain areas when we feel it is prudent. We currently have an overweight to technology in our portfolios because the outperformance and the positioning of the technology companies for success despite the virus cannot be ignored.

We have a process in place for constructing our portfolios. As independent advisors, we are able to gain perspective from a lot of the major financial firms to help us formulate our own strategies. We have regular calls with analysts from different firms and have regular meetings with our investment committee. A lot of time and energy goes into our portfolio construction because we value the trust our clients have given us. While it may be less exciting than chasing the next hot stock, we think our boring, disciplined approach will help us and our clients achieve our goals in the long run.

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market.