Introduction

There is no free lunch

You cannot time the market

Know what you own and why you own it

Everything compounds

Introduction

When it comes to investing success, people shouldn’t need to perfectly forecast the future to get good results. That is not a repeatable process. Many investors tend to focus on the short-term and make decisions based on the emotion of the current moment. For these reasons, our foundations of investing are focused on things that don’t change that often. As investors, this helps block out the short-term noise and focus on what matters. We are not short-term traders; we are long-term investors. We want our clients to succeed in a wide range of future scenarios. We believe good outcomes result not from concerning ourselves with the latest investment fad of the moment, but in having a good process to make sound investment decisions over the long run. Having a deep understanding of things like human psychology, market cycles, and the power of compounding can prevent mistakes and build long-term wealth. Here are our foundations of investing:

There is no free lunch

In investing, just like in life, there are no guarantees. As an investor, you must understand you cannot get something for nothing. Understanding that volatility and risk can never be fully removed is essential to making good decisions. Volatility can be measured by the size of the swings up and down in the short-term for an investment or the overall market. Withstanding it is the price you pay in the short-term to enjoy growth over the long-term. While it makes us uncomfortable, history shows basing decisions on it is a mistake. However, volatility and risk should be viewed differently. Risk should be viewed as the chance you will lose money permanently.

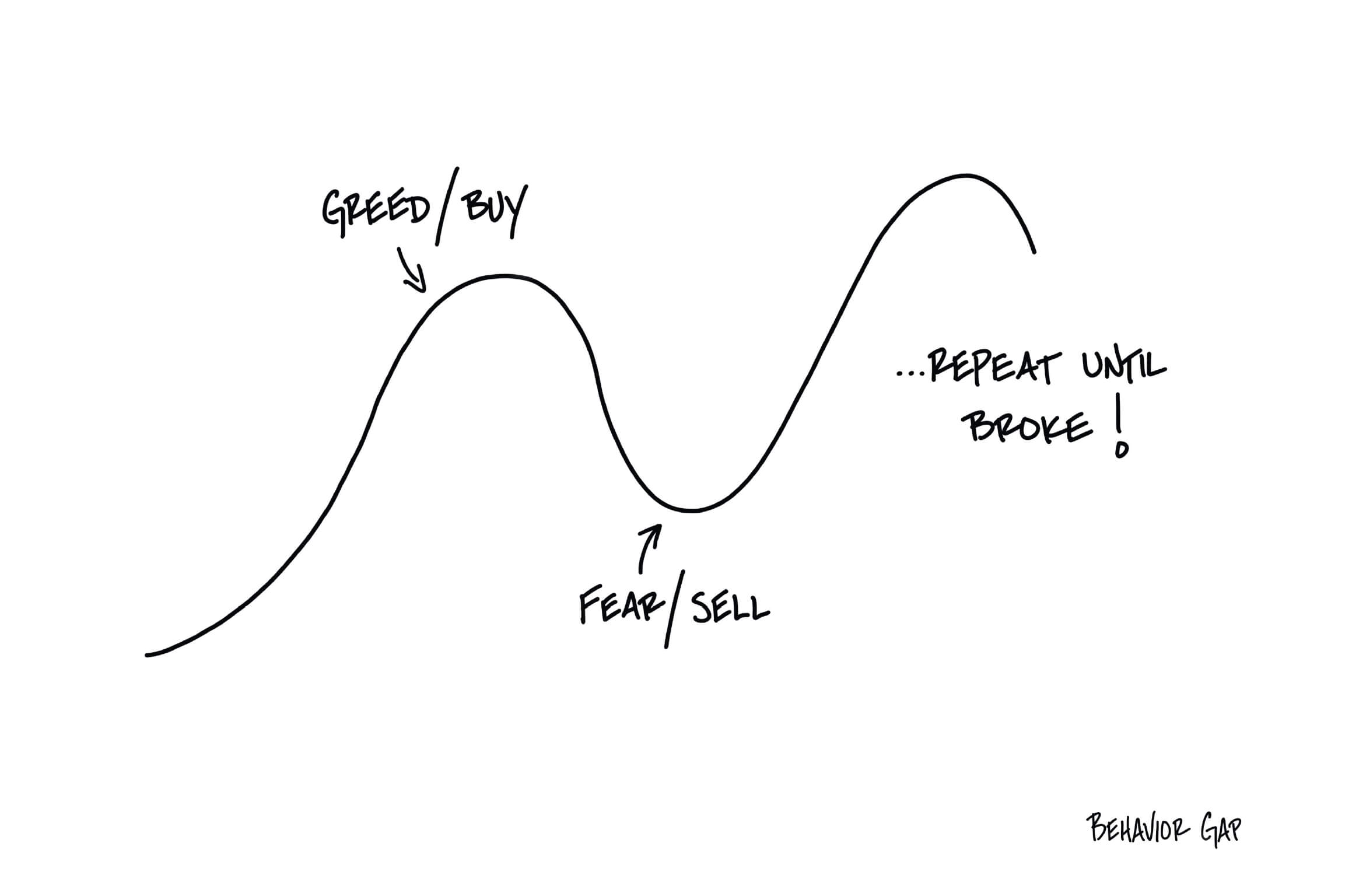

Learn MoreYou cannot time the market

Attempting to predict the future is not a part of our investment philosophy. No one has ever shown the ability to do it well over time, and we’re not going to pretend to be the first. We prefer to position our clients to accomplish their goals regardless of what happens next, rather than playing a game of pin the tail on the donkey trying to guess what the future might look like. Attempts to try and time the market are not only risky, but they simply do not work in the long run. What is important when discussing market timing is that not only must you be right when deciding when to sell, but also in deciding to get back in to participate in the upside of the recovery. Then you need to do it all over again. Rather than guess work, you’ll be much better off by taking a long-term view and focusing on your financial plan. It may be less exciting, but the slow, steady, diversified approach should prevail in the long run. Unfortunately, we will not get an alert on our phones that we have reached the bottom and it is time to get back in. Invest accordingly.

Learn More

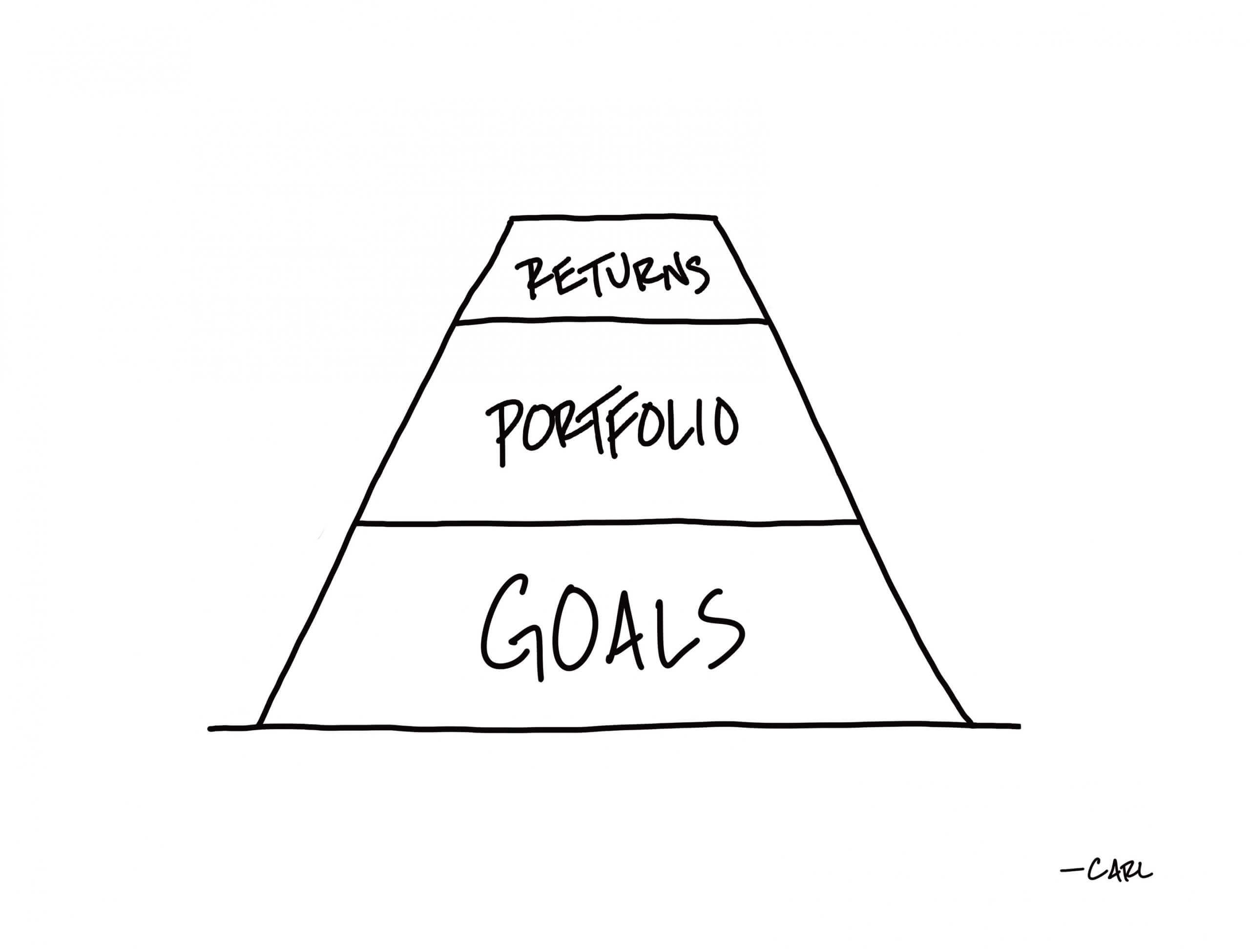

Know what you own and why you own it

Investing success often comes down to matching the risk you take with the time horizon in which you may need the money. Different accounts should have different goals and timelines, and thus different investment strategies will be appropriate. For example, a retiree’s rainy-day fund probably shouldn’t be allocated to stocks, while a young person probably shouldn’t be sitting on cash in their Roth IRA. You want to ensure your portfolio has been constructed to protect on the downside and from short-term swings so you can stay in the game without affecting your quality of life. That is not to say you need to understand the nuances and details of each investment, just that you generally understand what you are trying to accomplish. In other words, you need to know what you own and WHY you own it.

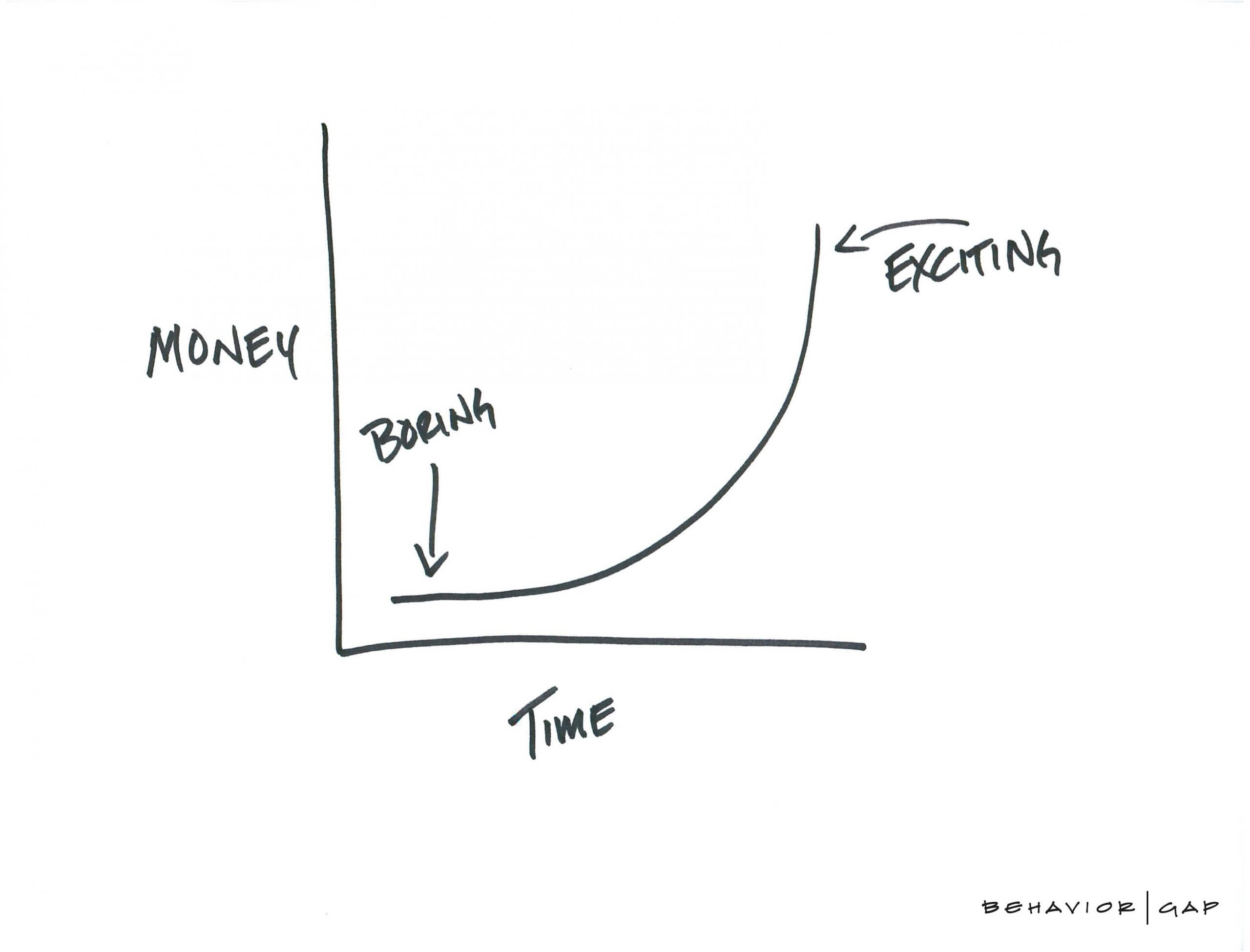

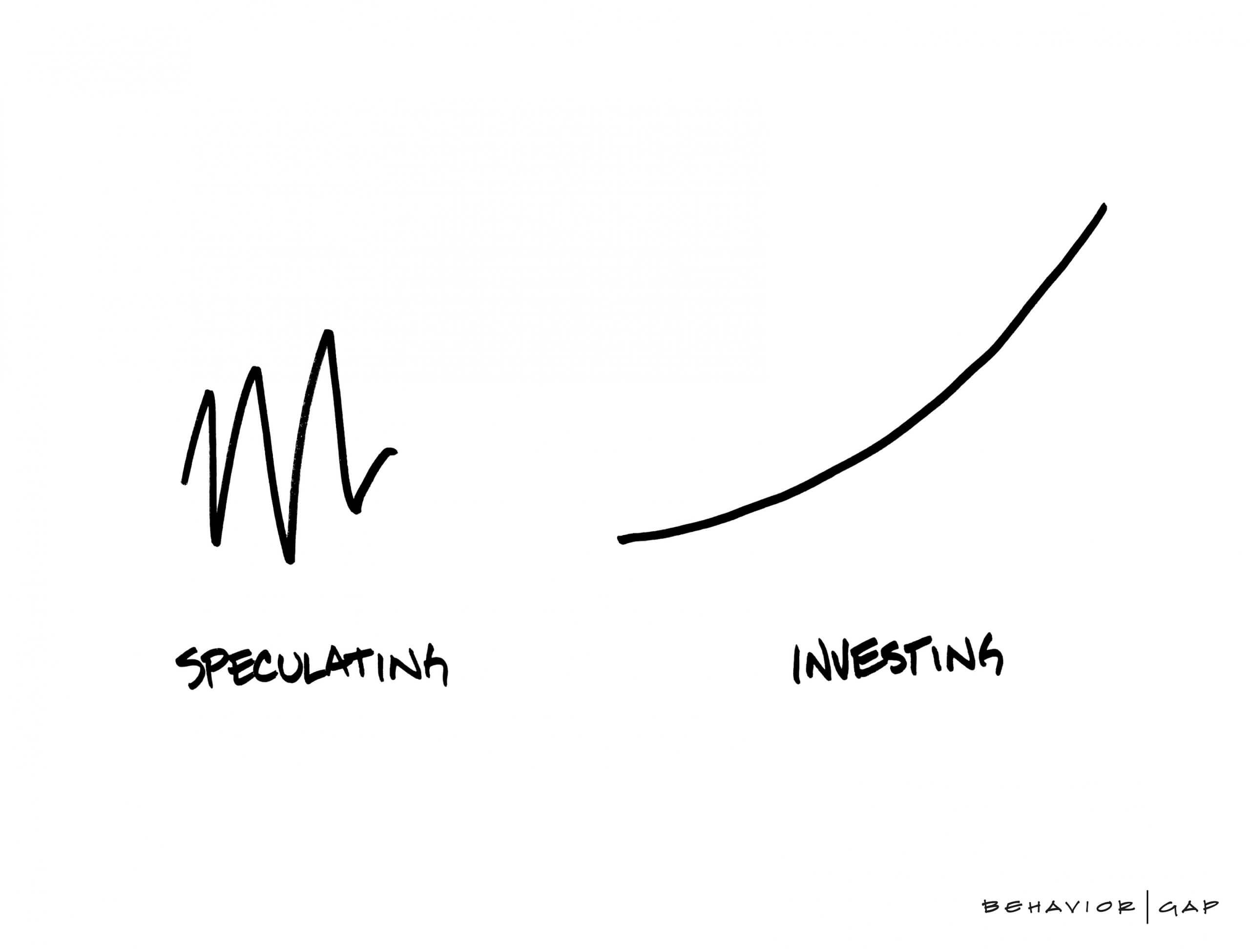

Learn MoreEverything compounds

The story goes that Albert Einstein called compound interest the most powerful force in the world. Regardless of who said it, they had a point. The key is in having this powerful force work for you, not against you. Many people lose sight of the fact that compounding capital at moderate rates for a long time will make you a multi-millionaire. In other words, it is not about speculating, it is about earning pretty good returns that you can stick with for the longest period of time. If you save and invest patiently, you can build real wealth. As Charlie Munger said, “the big money is not in the buying and in the selling, but in the waiting.”

Learn More