The Foundations of Investing: Know What You Own and Why You Own It

Investment ManagementMay 21, 2025

In Part I and Part II, we focused on things that should be actively avoided to achieve success as an investor. For Part III, we are discussing something we need to actively do. “Know what you own and why you own it” is a simple concept, but the practice of it is often missing in action, whether it is someone opening their first investment account or the most sophisticated people on Wall Street aiming to beat the market.

This phrase was made famous by legendary investor Peter Lynch, who managed the Fidelity Magellan Fund and is considered one of the greatest investors of all time. The genius of Lynch’s investing philosophy lies in its simplicity. He even wrote a best-selling book about how it could be applied. The most important aspect of his philosophy is this idea that you should know what you own and WHY you own it. In other words, investors need to have an understanding of what is in their portfolio, why it is there, and how it will behave in different scenarios. In Lynch’s view:

“If you can’t explain to a 10-year-old in two minutes or less why you own a stock, you shouldn’t own it… Stocks aren’t lottery tickets. Behind every stock is a company. If the company does well, over time the stocks do well, and vice versa. You have to look at the company—that’s what you research.”

Here is the thing though, this concept is not just for professional money managers and it doesn’t just apply to individual stocks. If you own mutual funds or ETFs, do you generally know what the underlying assets within these investments are? Do you know what they cost? Have you defined the overarching goal(s) for your various accounts? Given this added context, we believe it is essential for everyone aiming to create, build, and preserve wealth to know what they own and why they own it. Here is why:

- It provides a sense of organization and clarity of purpose.

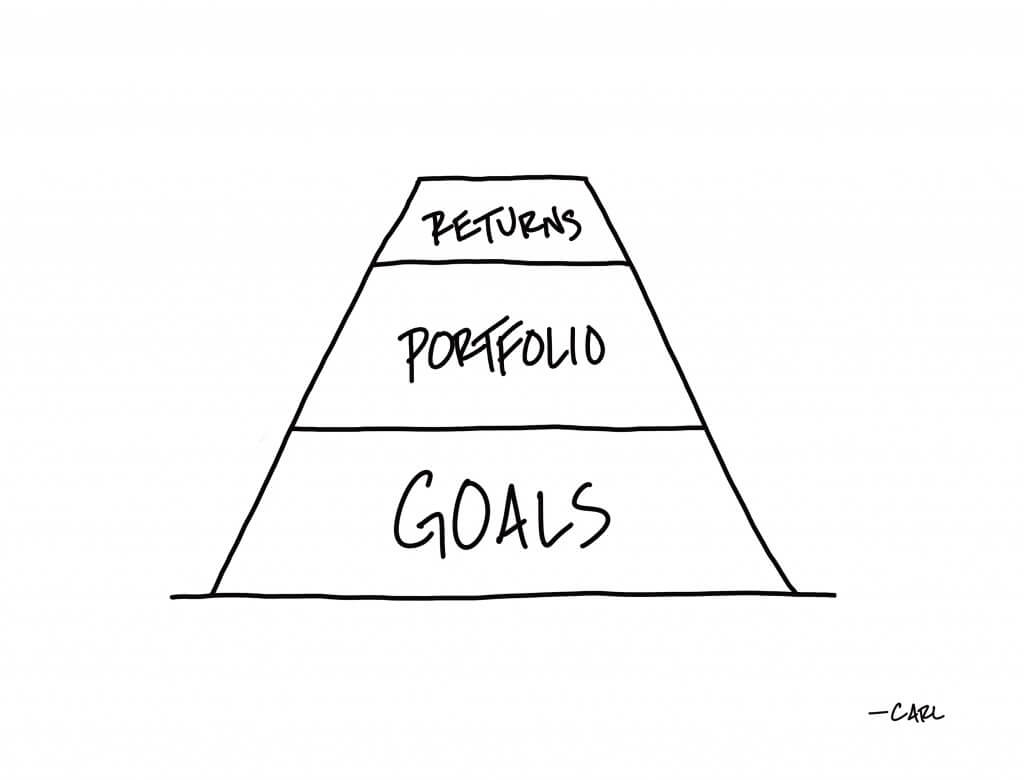

Investing success boils down to identifying your individual goals and then matching the risk you take with the time horizon in which you may need the money. Put more simply, it comes down to understanding what you are trying to accomplish, how you are trying to accomplish it, and where you are trying to accomplish it. We need to be able to invest for our goals in the short-term, the long-term, and everything in between at the same time. Therefore, we should be giving specific “assignments” to specific parts of our investment portfolios. Different accounts should have different goals and timelines, and thus different investment strategies will be appropriate. If you are building a “rainy day fund” you may need sometime next month, it probably shouldn’t be invested in stocks. If you are saving money you don’t expect to touch for years, cash is probably not the best option.

Regardless of how much money you have or what stage in life you are in, this process of assigning different goals to different “buckets” helps your money compound while avoiding mistakes. It also ensures you manage your expectations appropriately while understanding what you are paying along the way. Understanding at a high-level where you will spend money from first in retirement, or where you should invest most aggressively helps alleviate confusion and anxiety. Most importantly, it becomes much easier to make informed financial decisions and provides clarity so you can align your assets with your overall goals and values.

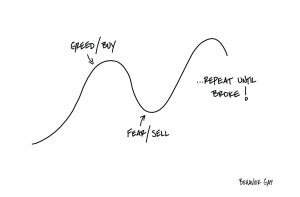

- It helps you stay focused on the things that matter.

To be clear, this is not to say people need to understand the nuances and details of each specific investment like Peter Lynch, or that you should spend hours doing research on stocks and watching the financial news. In fact, it should mean just the opposite. For example, should a 30-year-old dollar cost averaging into a retirement account with index funds care about what the stock market is doing today if they know their investment horizon for that account is 30 years from now? Should a retiree lose sleep about the potential for a recession this year if they know they have a few years of spending properly allocated and available to them? If you understand what you are trying to accomplish and what you own to help you accomplish it, you can think less about money and more about the things that really matter to you.

A good financial strategy should be designed to give you the best possible chance to accomplish your specific goals. Everything else is noise. Trying to beat the market or outperform some arbitrary benchmark can just make things more stressful and confusing. As Ben Carlson wrote in a recent article “Real risk for investors has nothing to do with underperformance or black swans or recessions or market crashes or any of that stuff we obsess about all the time. The real risk is that you don’t reach your financial goals. I’ve never met a single successfully retired person who got to that point by paying attention to alpha or Sharpe ratios.” Most people would rather know they are putting themselves in a position to be financially confident about the future so they can live the life they want. Know what you own and why you own it.

Citations:

One Up On Wall Street, Peter Lynch, 1989

What We Believe: Principles of Investing, Scott Clemons, Brown Brothers Harriman, March 12, 2018

How Should You Judge Your Investment Performance? Ben Carlson, A Wealth of Common Sense, June 23, 2023

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. This publication should not be interpreted as legal, tax, or investment advice. For more information, please visit alliancewealthadvisors.com/legal-disclosures