The Foundations of Investing: There is No Such Thing as a Free Lunch

Investment ManagementMay 08, 2025

The fast-moving world of finance constantly evolves, so being open-minded to new ways of doing things is important. However, just as importantly, we must always keep in mind some things that don’t change very much. Whether we admit it or not, people’s behavior is one of those things. Human nature just does not change a whole lot throughout history. We may have more information than ever before, but the same psychological biases and emotions that have influenced people’s investment decisions in the past will continue to do so today and in the future.

For this reason, the concept that “there is no such thing as a free lunch” is an important one to remember as an investor. It is a helpful reminder when our natural inclination to get something for nothing kicks in. In investing, just like in life, there are no guarantees. Despite whatever the latest financially engineered product or “can’t miss” investment of the moment is, we must never forget this fact. Everything has costs. We know this intuitively, but we usually have to learn (and relearn) it the hard way. Our brains are hard-wired to combat uncertainty and seek safety. Markets can often feel the exact opposite of those things. For this reason, Wall Street loves to tell you they know what is going to happen next. It is also why they sell products that promise safety, smooth returns, and protection from selloffs. The human brain instinctively craves a feeling of control and predictability in times of stress, and Wall Street knows it. Unfortunately, while the notion of a “free lunch” is a great sales tactic, there is no risk-free way to achieve one’s financial goals. The costs to any “free lunch” are always there, they are often just hidden.

The false sense of security that comes from avoiding the ups and downs of the markets can lead to huge mistakes and opportunity costs. Understanding that volatility and risk can never be fully removed is essential to making sound investment decisions. They are the cost of admission to experience the long-term benefits investing can provide. Now, let’s define what these two things are. While modern portfolio theory defines risk and volatility as the same thing, they are not.

Risk refers to the uncertainty or potential for loss in an investment. It encompasses a range of factors such as market fluctuations, interest rates, liquidity, economic conditions, industry trends, specific company risks, currencies, and credit. Volatility, on the other hand, is a statistical measure of the degree of fluctuation in the price or value of a financial instrument over time. It quantifies the speed and magnitude of price changes.

Let’s simplify this in English: Risk is the chance you will lose money permanently, while volatility is the size of the swings up and down in the short-term. Volatility is only one component of risk. They are obviously related, but it is an important distinction. Here is why:

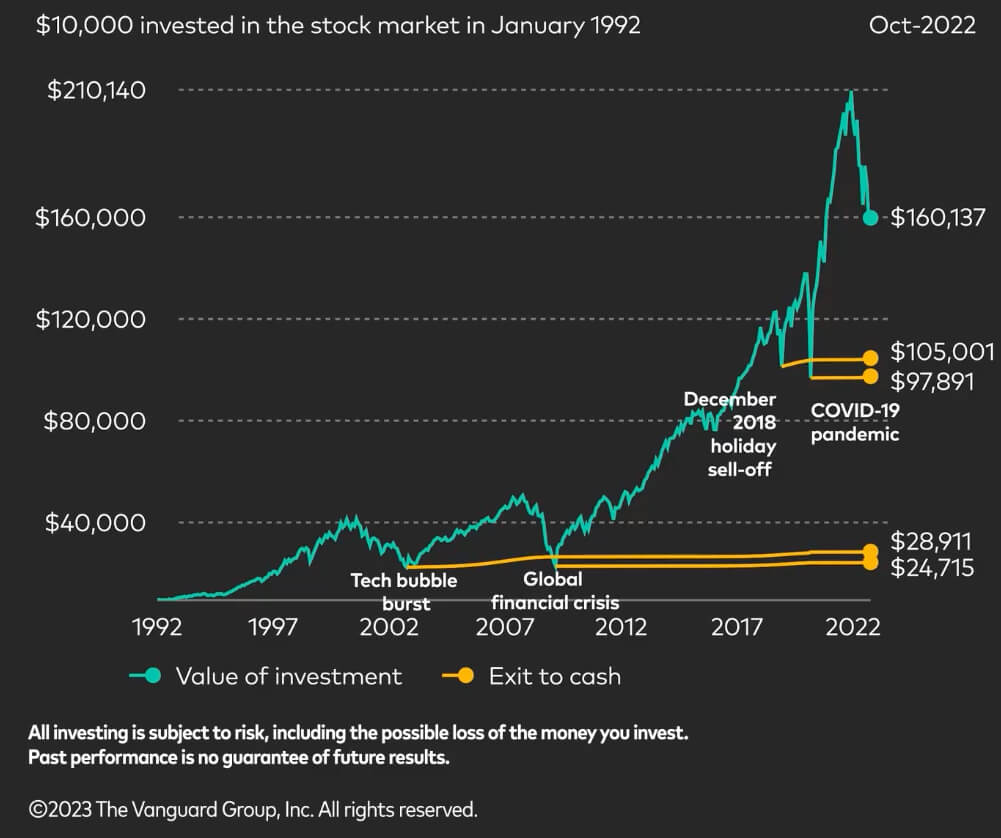

Withstanding market volatility is the price you pay in the short term to enjoy growth over the long term. While it makes us uncomfortable, history shows trying to avoid it is a mistake. The below chart shows what $10,000 would have grown to if you invested it in the stock market in 1992. The yellow lines represent what that money would have turned into if you sold out and went to cash at various times when the markets were volatile, and things were uncertain.

You could go back farther, and this same concept would hold true: ironically, moving to cash has been much riskier than withstanding volatility. Following the crowd or playing it too safe can lead to huge mistakes. History has shown that it has been the surest way to lose money during a selloff. In other words, human instincts can lead us to buy and sell at the exact opposite moments that we should. Obviously, this does not mean you can throw everything you have in the stock market and call it a day. Being strategic and understanding your own situation and goals must be step one. Matching up the risk you are taking and your time horizon is essential. Given that the whole concept of this article is that there are no guarantees, we should also mention that past performance is not a guarantee of future results.

Rather than trying to find ways to avoid the volatility that comes with markets, we need to play a different game. Instead, you can set up your household balance sheet in a way that insulates you from short-term swings and allows you to take advantage of the long-term gains. The bottom line is this: there is no way to participate in the upside of markets without being willing to experience the downsides that come with it along the way. We must accept the fact that when it comes to investing (and life), we cannot get something for nothing. There is no such thing as a free lunch.

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. This publication should not be interpreted as legal, tax, or investment advice. For more information, please visit alliancewealthadvisors.com/legal-disclosures