The Foundations of Investing: You Cannot Time The Market

Investment ManagementMay 14, 2025

In Part I of our Foundations of Investing Series, we highlighted how there are no special investment products or processes that are bulletproof. It requires discipline and sacrifices. We are going to build on that in Part II as we discuss market timing. The market is very unpredictable contrary to what you may see on TV. The talking heads make it sound like it is a piece of cake to sell, sit on the sidelines and get back in at the perfect time. The reality is that anyone promoting this approach is oversimplifying things in a way that is not helpful for the vast majority of investors.

There are times when it gets very tempting to listen to the voices around you telling you they know where the market is going next. This is where the discipline really needs to kick in because in order to successfully time the market, you have to be right twice. Let’s say you go with a gut feeling and liquidate your entire portfolio at or near a market peak. You feel pretty good about yourself as stocks fall and crisis sets in. That is until you start to feel the pressure of when to get back in. Those that have lived through the bad times know that the market usually turns around right when you’re ready to throw in the towel. By the time you have the courage to get back in, you likely missed a significant part of the recovery. All the experts with their predictions calling it a “dead cat bounce” or a “bear market rally” leave you reluctant to pull the trigger. That leads to the mental warfare of wondering if their forecasts will come to fruition right when you finally push the button to get back in. Suddenly, the smartest move of your life turns into a very stressful situation.

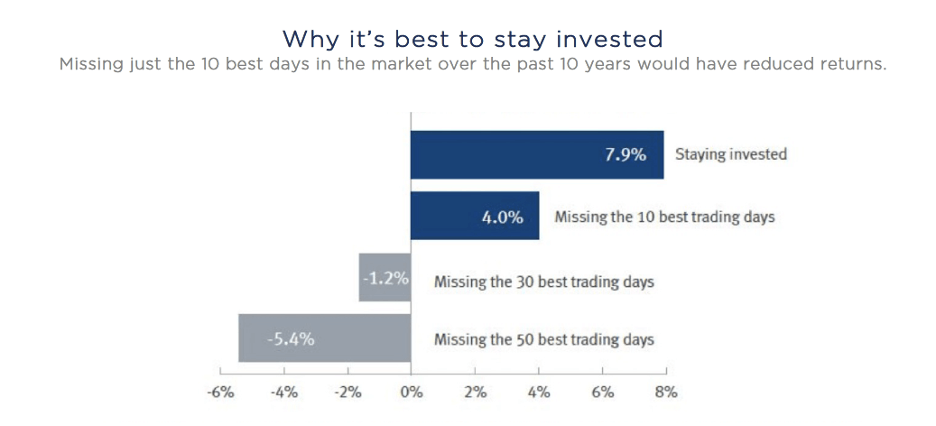

Markets can appear to be irrational in either direction for extended periods of time making it incredibly difficult to be right twice. The more optimal thought process, although it will certainly have some gut checks, is to forget about timing the market. Instead, think about how much time you have in the market. The more time you have in the market, the higher the likelihood of success. That’s why most asset allocators will recommend more equity exposure to those with longer time horizons. The chart below highlights the impact on returns when you miss the top trading days over extended time periods. Missing the 10 best trading days in the 10 year period cost 3.9% annually over 10 years. That is a remarkable statistic. To take it a step further, those big trading days often occur after significant drawdowns.

Nobody knows where the market is going at any given time. All the predictions are educated guesses and are usually wrong. Some make it sound so easy and that is where the temptation can set in. Utilizing a bucket approach to managing your money helps limit that temptation. It is a little easier to leave your long-term money alone knowing that your shorter-term money is safe if you need it. If you want to have some play money, have at it. Take a few dollars that don’t matter to you and try to play the market. For your more serious money, you’ll be much better off making a plan and sticking to it. While it won’t be as exciting, the slow and steady, diversified approach should prevail in the long run. You cannot time the market.

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. This publication should not be interpreted as legal, tax, or investment advice. For more information, please visit alliancewealthadvisors.com/legal-disclosures