A Lesson from Uncle Charlie

Investment ManagementOct 29, 2020

In today’s environment, nuanced discussion, long-term thinking, and the idea that things are never as good or bad as they seem in the moment do not get a lot of clicks on the internet or airtime on cable news. Instead, the focus in these forums is on simple narratives that prove one’s point, short-term thinking, and extreme pronouncements often bordering on exaggeration. In other words, the exact opposite of what it takes to be a good investor. As much as anything else, temperament, patience, perspective and a plan are essential when it comes to how you approach your money.

None of us can go more than five minutes of browsing social media, the internet, or television without getting exposed to something related to the election next week. This is especially true when it comes to the markets and the investing community. There is no shortage of content laying out how one side winning will spell disaster for certain stocks, sectors, and people’s investments accounts so I will leave that to others. As the saying goes, opinions are the most abundant commodity on the planet.

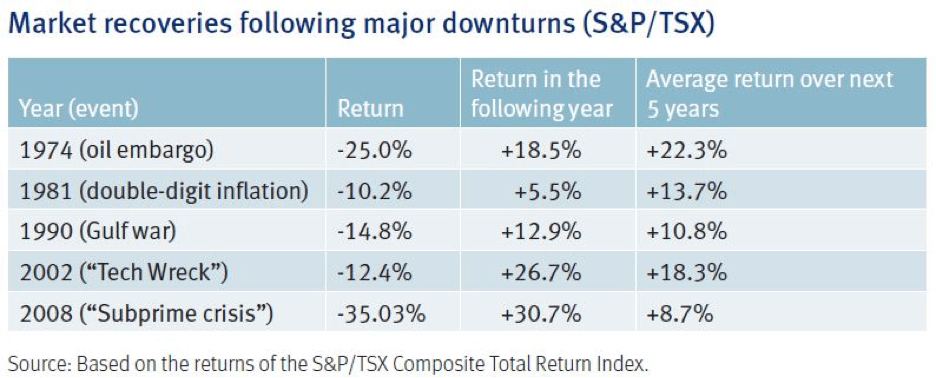

When it comes to how bad humans are at guessing what will happen next, the 2016 election and the last few years have only reinforced economist John Kenneth Galbraith’s famous line “The function of economic forecasting is to make astrology look respectable.” The same goes for stock market predictions. Attempts to try and time the market are not only risky, they simply do not work over time. Below is a chart laying out some of the major downturns since 1970. What is important when discussing market timing is that not only must you be right when deciding when to sell, but also in deciding to get back in to participate in the upside of the recovery. As you can see, if you sold even a portion of your equity holdings on the way down or during the recovery you would have missed out on a lot of potential compounding. Unfortunately, we will not get an alert on our phones that we have reached the bottom and it is time to get back in.

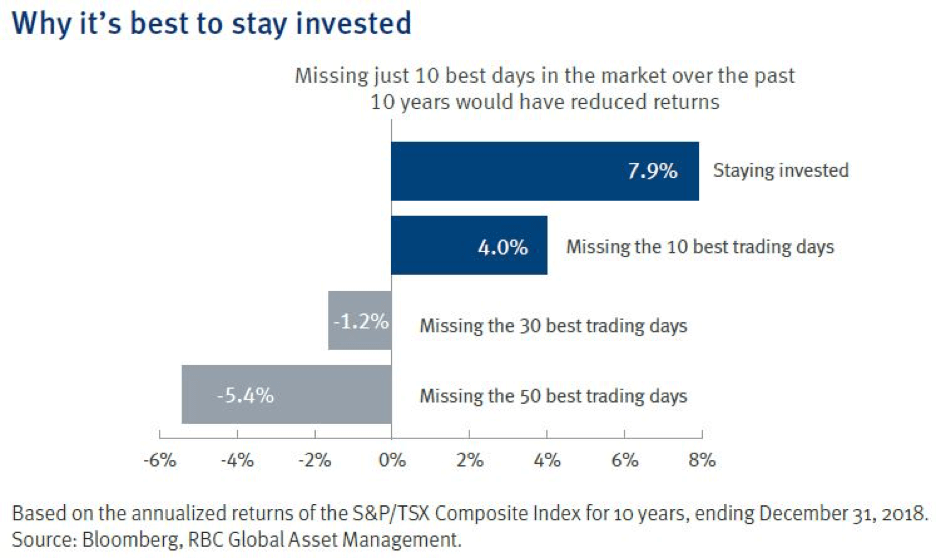

To further emphasize this point, the below data shows you what your return would be if you’re invested in the broad market during the ten-year period from 2008-2018. If you missed only the 10 best trading days, your overall return would be cut in half. Further, if you missed 30 or 50 best trading days over that same 10-year period, your return would actually be negative.

When it comes to being able to withstand the downturns and swings in the market, temperament, patience, and perspective are not enough when you’re going to bed worried about your finances, however. You must also have a plan and ensure you understand how your assets are invested. You want to ensure your portfolio has been constructed to protect on the downside and from short-term swings so you can stay in the game without affecting your quality of life. Finding this balance will allow you to participate in the long-term compounding that is the key to building wealth. Like Charlie Munger said: “the big money is not in the buying and the selling, but in the waiting.”