Actively Managed Funds vs. Passively Managed (Index) Funds

Investment ManagementBy: Jude McDonough, CFP® AIF®

May 14, 2020

You may have heard about Index Funds as a viable way to get invested. They are known for their low cost as compared to actively managed funds. Furthermore, there is a perceived level of safety associated with them thanks to some TV personalities touting them as such. More on that a little later.

As I’ve mentioned many times, every financial decision has a tradeoff. Moreover, you shouldn’t put all of your eggs in one basket. That thinking is usually applicable when discussing how much money to allocate to one stock or sector. However, you can certainly apply it to investment strategies. What I mean by that is you don’t need to go “all in” on passive investing or active investing for that matter. What about a mix of both? Think about it. If you are building a diversified portfolio, you’ll want a mix of stocks and bonds of varying market capitalizations and geographies.

Statistics show that Large Cap US stock Index funds outperformed a very high percentage of actively managed funds over the preceding 5- and 10-year time periods. That is totally fine and the numbers don’t lie. However, one constant in investing is that past performance does not guarantee future results. The preceding 10-year period began at very depressed market levels coming off of the financial crisis of 2008. The unemotional aspect of passive investing worked out well as many of the underperforming active managers invested cautiously in anticipation of a repeat of 2008 that never really happened. The S&P 500, which is the index that the largest Index Funds track had a remarkable run experiencing the longest bull market in history until the recent Covid-19 Crisis.

Will the Large Cap US Index Funds continue to outperform for the next 10 years? I’ll tell you in 2030. Regardless of that, it would be prudent to look at the different pieces of your asset allocation and determine which are worth the cost of active management. Let’s take bonds for example. That is going to be a difficult place to navigate if and when interest rates start to go back up. How about Emerging markets? Some of the active managers have people on the ground in these economies to get a feel for the economic environment. These are two areas that we think active managers can add value in the coming years.

To take it a step further, you need to incorporate your overall investing experience into it. The actively managed funds hopefully earn their money by adding some protection on the downside.

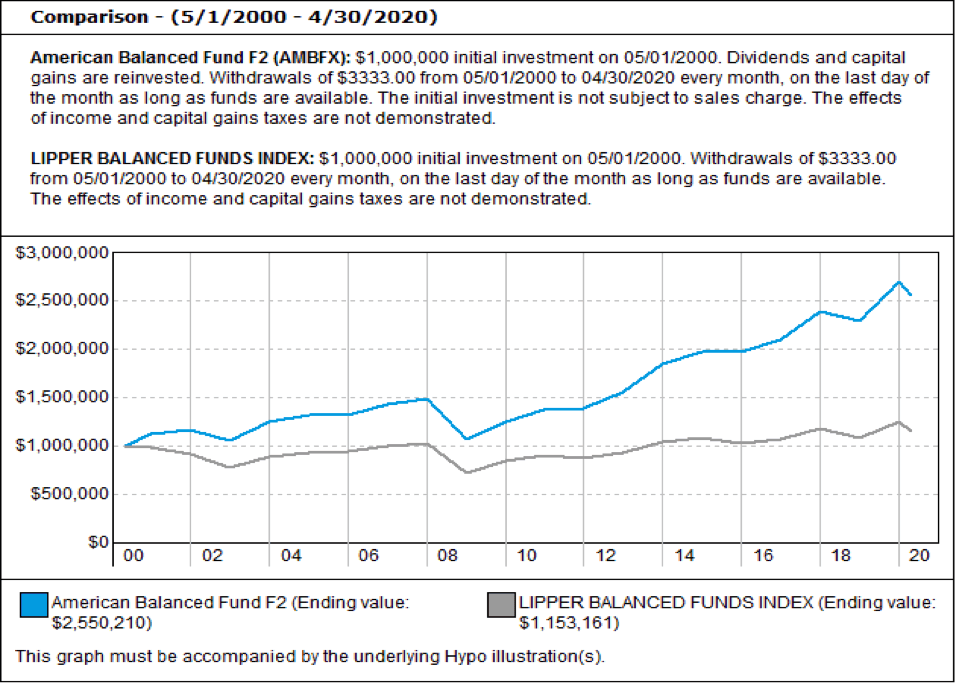

The below illustration highlights an actively managed balanced fund vs. a balanced index with monthly withdrawals over the last 20 years.

- Initial investment amount of $1 million

- The income was calculated with a fixed withdrawal of $3333 monthly or approximately 4% of the initial investment amount.

Whether you are a retiree taking monthly income for your portfolio or an investment committee with a spending policy, you have to consider the impact of withdrawals to your portfolio during downturns. The 20-year period in the illustration commences during a difficult market environment. The active manager was able to navigate that very well compared to the index and really got out ahead of the index setting the tone for the 20 years of outperformance.

The last point of this post circles back to the first paragraph and it pertains to the safety that many have come to associate with index funds. It depends on your definition of safe. They are safe in that the diversification associated with them all but eliminates your possibility of losing everything. However, when I think about safe investments, cash comes to mind. If you are invested in an index fund during a downturn, the one guarantee is that you will fully participate in the downturn. Conversely, you’ll fully participate in the comeback when things turn around. If you are comfortable with that and it feels safe, then the perception is right. If you were thinking more along the lines of no market risk, then it couldn’t be further from safe.

Chart: capitalgroup.com, 2020