Foundations of Financial Planning: Focus On What You Can Control

Financial PlanningApr 17, 2025

In Part I of this Foundations Series, we outlined the importance of gaining a better understanding of our emotions and behaviors. Part II was all about stepping back and taking inventory of our current situation. Now that we have done those things, it is time to act to improve our situation and plan for the future. Where to start though?

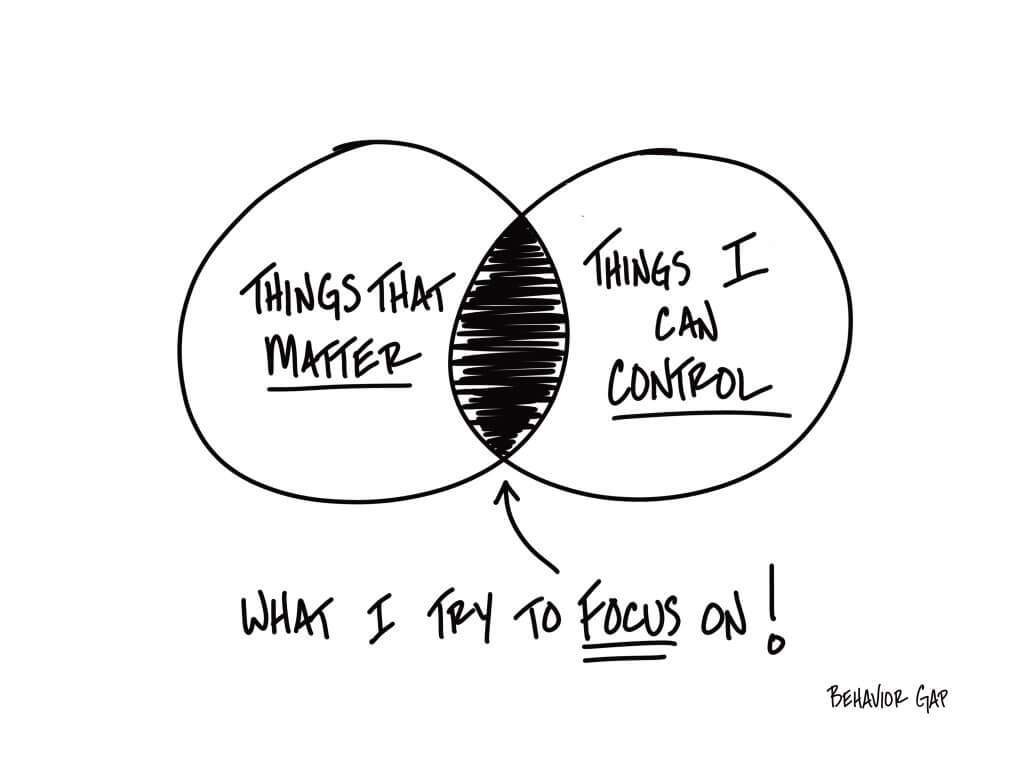

Greek Stoic Philosopher Epictetus once said: “the chief task in life is simply this: to identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control.” While we can’t say for sure, we are pretty certain he wasn’t talking about financial planning given that he lived 2,000 years ago. Still, this core tenant of Stoic philosophy very much applies. Let’s discuss why.

Most of what is written and acted upon when it comes to financial planning and investing is focused on the endless number of external factors happening around us. The financial media (and industry in general) focus almost entirely on how our financial lives are impacted by outside influences. “Bonds did this”, “stocks are doing that” or “this is what the Fed will do next” form the basis of most things you will read. You must then digest this information and deduct how it will impact your life and decision-making process (if at all). The problem with this is that the market’s behavior in the short-term is based on billions of inputs that are known and unknown. Things like the interest rate environment, central bank policies, corporate earnings expectations, corporate balance sheets, wars, access to credit, tax policy, unemployment, consumer spending, consumer confidence, corporate wrong-doing, price to earnings ratios, housing data, trade policy are some of the infinite number of variables being considered by millions of people. You then need to interrupt how those people will feel about the variables they decide to care about at a given time.

While being informed is obviously essential, there are two major flaws in only focusing on the external variables of the financial world:

- Focusing on things outside of our control is the main driver of financial anxiety. It can leave you feeling constantly exposed, worried, and prone to emotional decision-making in times of stress. This can set you up to start sounding and feeling a lot like the financial version of Eeyore from Winnie the Pooh.

- Humans are bad at forecasting the future

We talk all the time about how attempting to predict the future in the short-term is not a part of our planning or investing philosophy. No one has ever shown the ability to do it well over time, and we’re not going to pretend to be the first. We prefer to position our clients to accomplish their goals regardless of what happens next, rather than playing a game of pin the tail on the donkey trying to guess what the future might look like. We need to be willing to play a different game.

Having a margin of safety and maintaining flexibility are key characteristics of good planning. These things are also squarely in our control. When done well, they blunt the impact of the crazy things the world will throw at us that we didn’t see coming. Writer Morgan Housel put it well in his book The Psychology of Money: “The wisdom in having room for error is acknowledging that uncertainty, randomness, and chance—’unknowns’—are an ever-present part of life. The only way to deal with them is by increasing the gap between what you think will happen and what can happen while still leaving you capable of fighting another day.”

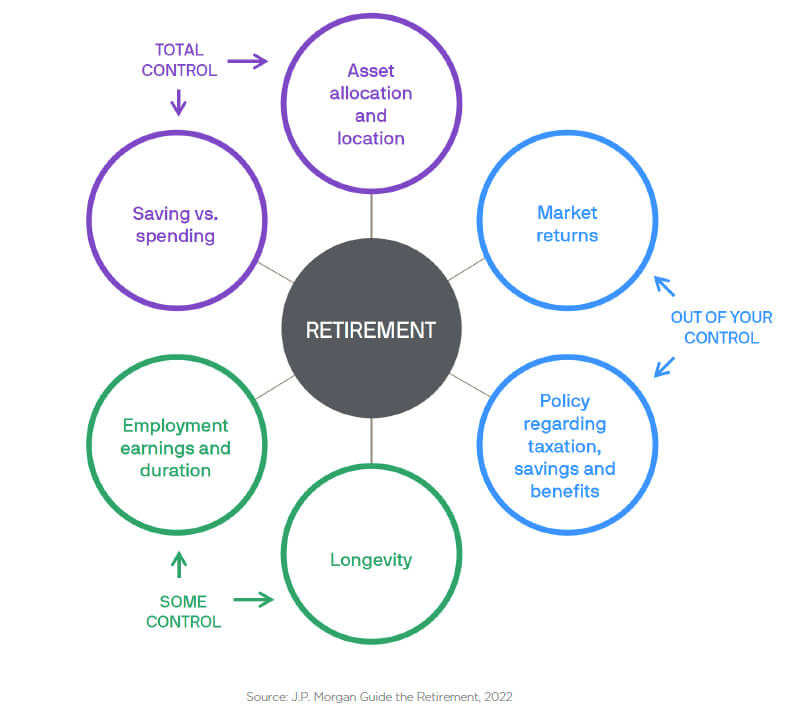

We can prepare for life’s “unknowns” by being intentional when it comes to the thing we have the single most control over: our spending and saving. It sounds boring, but this will have the biggest impact on our ability to build wealth. It literally doesn’t matter how good of an investor you are or how much money you make if your savings rate is 0. In our view, setting up saving and spending needs in a way that insulates you from short-term swings that markets (and life) will inevitably bring is the name of the game. Financial planning isn’t about budgeting, it’s about “buffering”- creating a cushion to serve as a “life buffer”. This helps make unplanned life events, market volatility, and economic uncertainty less scary. It allows your head to hit the pillow just a little easier.

Rather than trying to predict the future, we spend our time helping clients better understand their situation while becoming more financially resilient today. By doing this we can then build wealth for tomorrow more effectively. Focusing on things you can control like sound decision-making, having a strong household balance sheet, and a disciplined process to organize your assets strategically can give you peace of mind and help you accomplish your goals regardless of what comes next. Legendary investor (and self-described Stoic) Benjamin Graham summed this concept up well in his book The Intelligent Investor: “investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

Citations:

The Daily Stoic, Ryan Holiday, 2016

The Adventures of Winnie the Pooh, A.A. Milne, 1928

The Psychology of Money, Morgan Housel, 2020

The Intelligent Investor, Benjamin Graham, 1949