The Stock Market Doesn’t Care About What You Care About

Investment ManagementNov 20, 2020

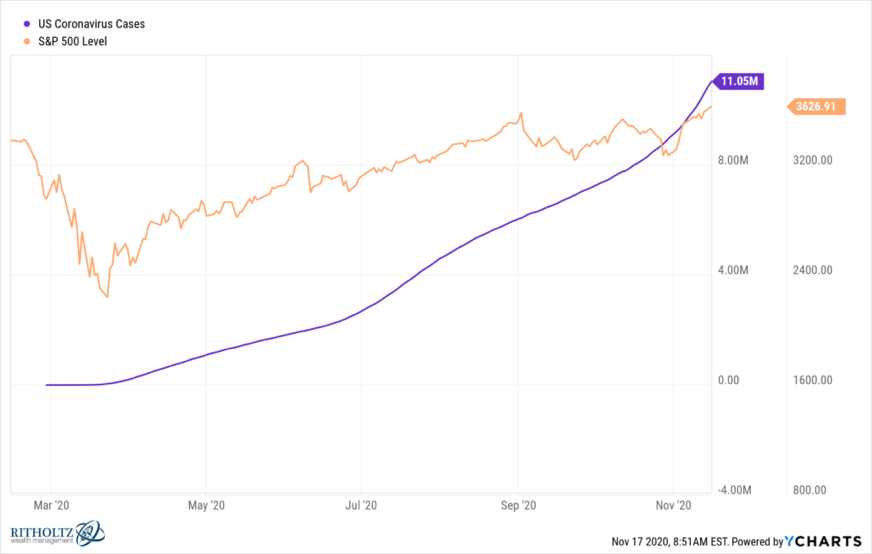

What if I told you… (*Thirty For Thirty Voice*) that 2020 would bring the first global pandemic in over 100 years, a simultaneous global economic shutdown for the first time in history, civil unrest that hasn’t been seen since the 1960’s (both domestically and abroad), a historically contentious U.S. election between two parties with widely differing views, and the sitting president would openly question the end result. Then, what if I asked you how the S&P 500 would perform so far in 2020? I know I wouldn’t have gotten the answer right. As I check my terminal while writing this article, we are sitting on a positive return of 10.34%. How is this possible?

It is not new to say that the news skews negative, and 2020 has been nothing if not an avalanche of it. What is new, is that there is an overflowing river of information at our fingertips at all times and all of a sudden, we have more time on our hands than ever to consume it. The human brain is hard wired over thousands of years to absorb and retain negative information much better than it does positive information. This “negativity bias” as neuroscientists call it, makes sense in the context of human evolution. When our ancestors saw someone get attacked by a sabertoothed tiger, eat something poisonous, or do something else that had a bad outcome, those who processed that information and learned from it quicker stayed alive longer. Unfortunately, media and technology companies are keenly aware of how the human brain’s operating system works. Their goal is to make money, and they do it through engagement (keeping your eyeballs on their platforms longer) and selling the resulting data they harvest. Eliciting negative reactions like stress, fear, and anger are great tools for them to accomplish their goal. Unfortunately, these emotions are also the root of bad investment decisions with severe long-term consequences. Making decisions based on what is directly in front of you or how you are currently feeling will likely lead you astray.

To oversimplify, the stock market’s behavior is based on millions and millions of inputs that are known and unknown: the interest rate environment, central bank policies, corporate earnings expectations, corporate balance sheets, wars, access to credit, tax policy, unemployment, consumer spending, consumer confidence, corporate wrong-doing, price to earnings ratios, housing data, trade policy (the variables are literally endless). The market processes all of this daily (rightly or wrongly in the short-term), and then determines what the businesses that make up the broader market are worth based on all of this information.

Over the long run this works pretty well. Those that try to guess what is important in the short run are not investing, they are speculating. While our negativity bias can focus our brains on things we have anxiety about and drive our decision-making and world views, those things are unlikely to line up with the what the collective stock market (investors and market participants across the globe) will be focused on tomorrow. As I wrote prior to the election, humans are comically bad at predicting what will come next and the behavior of markets.

It’s been said that good investing is like preparing for a long journey at sea. Expecting the weather to be sunny and the ocean to be calm during the whole trip doesn’t make any sense, so instead you prepare accordingly. You also choose the right vessel to get to your destination, and then don’t get surprised or overly concerned when storms arrive and pass. Preparing your portfolio for the storms that will come from time to time (through things like a fortress balance sheet and the proper asset allocation) allows you to avoid having to try and do something silly like staring at the sky worrying about the weather every day (timing the market).

Citations:

https://tonyisola.com/2020/11/hey-siri-whats-the-best-way-to-ruin-my-retirement-plan/

https://greatergood.berkeley.edu/article/item/how_to_overcome_your_brains_fixation_on_bad_things

https://www.forbes.com/sites/stephenmcbride1/2020/10/27/heres-why-the-stock-market-doesnt-care-about-next-weeks-election/?sh=1e850f9320ed

https://thereformedbroker.com/2020/11/17/dont-share-this-chart/

https://mailchi.mp/newsletter.bwater.com/beyondtheelection?e=7d8b02f041