The Illusion of Perfection

Investment ManagementApr 13, 2023

The Masters is the first major championship of the golf season as well as an annual sign of spring’s arrival. Last week, John Rahm won his first green jacket at the Masters Tournament. As Golf Digest’s Joel Beall put it, “Rahm stayed steady, remained patient and struck with precision. And for that he captured the 87th Masters Tournament.” What does this have to do with investing? Perhaps more than you think. Rahm’s ability to keep his emotions in check and avoid making big mistakes in tough conditions is a good analogy for investors. While no one at our firm will ever be confused with a professional golfer, we will do our best to explore why.

A round of golf can last hours and tournaments a few days, but where a player finishes can be dictated by just a handful of decisions. The same goes for people trying to create, preserve, and grow their wealth. Just a few decisions over a period of decades can have an outsized impact on one’s outcomes. Another parallel between golf and investing is that neither is about being perfect. Mistakes and bad outcomes are inevitable. Success isn’t about avoiding them completely; it is about managing them properly. No one is perfect. Whether you are two-time major champion John Rahm, who started his Masters with a double bogey on the first hole, or Warren Buffett the most famous investor in the world, who has made his fair share of investments that haven’t worked out. The key is mitigating those mistakes so we don’t make them with too much at stake or at the worst possible time. We also need to recognize when negative emotions are driving our decision-making process. Bob Rotella’s best-selling sports psychology book “Golf is Not a Game of Perfect” could serve stressed out investors well too.

After the sell-off in asset prices last year, continued economic uncertainty, and recent issues within the banking sector, it is natural for people to want to avoid the constant psychological roller coaster of markets. Our instinct is to do something to make the anxiety go away. Unfortunately, this instinct can often just make things worse. In 2008, many people sold all their stock holdings as the market declined 38%. They just couldn’t stomach seeing their investments decline any further. This is a common occurrence in every market cycle – the people who sell out don’t get back in to make up for their losses. Ben Carlson explains why history has shown this is a mistake:

“Market timing is always difficult but doing so in the midst of a market crash makes it exponentially harder from a psychological perspective. Hitting the eject button after suffering big losses can provide some sense of relief but any short-term feelings of comfort end up doing more harm than good. You become addicted to sitting in cash because it feels like the downside volatility will never end. And when stocks have a rip-your-face-off rally as they tend to do coming off a market crash, you talk yourself out of re-investing because you assume those gains aren’t going to last.”

Unfortunately, the people who sold out then missed out. One year after the market bottomed in the spring of 2009, the S&P 500 was up well over 60%. Two years later it had almost doubled. Zooming out further, by 2015 the stock market was up close to 200% from those lows. Carlson goes on to say:

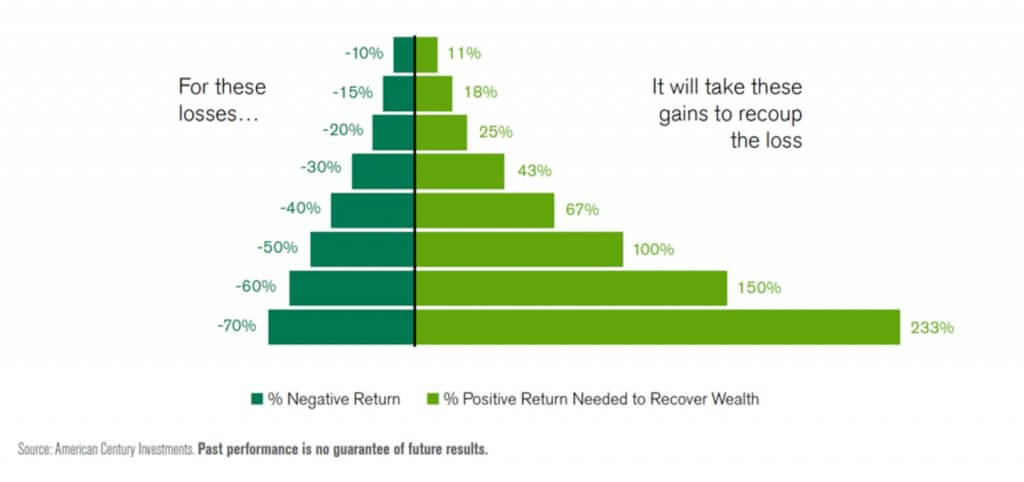

“It’s bad enough you have to sit through massive drawdowns in the stock market on occasion. But if you take the beatings AND miss out on the subsequent gains you end up losing twice.” Not only do we not know when a sell-off will end and the recovery will begin, but it can also become incredibly hard to make up for negative returns once an investor has locked in losses. The chart below shows how large your gains need to be to recoup realized losses:

The bigger the hole an investor digs when selling out, the larger the ladder they’re going to take to climb out of it. We need to insulate ourselves from the short-term swings with strategic planning designed for your situation. It is not about having perfect timing, perfect judgement, and perfect outcomes. Those are illusions we insist on chasing. We need to play a different game. Whether it is golf or financial planning, sustained success is not about being perfect. That is unrealistic. Instead, it will come from creating a process that allows you to improve over time, be unaffected by small mistakes, avoid big ones, and adapt as conditions change.

Citations:

Masters 2023: Jon Rahm’s Masters moment, Golf Digest, Joel Beall, April 9, 2023

One of the Biggest Mistakes in Investing, Ben Carlson, A Wealth of Common Sense, March 31, 2023

Golf and Investing: More in Common than You Think, American Century Investments, July 9, 2020