From Wall Street to The Great Wall: China’s “Growth Narrative” is Crumbling

Investment ManagementAug 24, 2023

Since the 1990’s, people have become accustomed to coverage of China’s economy being focused on its upward trajectory and staggering growth. It has been characterized as an unstoppable force. It is often described as a long-term threat to the United States’ post-World War II dominance. Decades of consistent growth and investment created the prevailing narrative that it was inevitable the Chinese economy would displace the U.S. as the largest economy in the world at some point. That narrative has changed drastically in recent years. Forget years, recent weeks. A Wall Street Journal headline this week read: “China’s 40-Year Boom Is Over. What Comes Next?” There is a lot to unpack when it comes to the world’s second largest economy, so let’s dive into what is going on in China and what it could mean for investors and the global economy.

The beginning of this shift seemed to coincide with certain events since the pandemic. First, China’s strict and prolonged lockdown policies severely hampered economic activity. Second, the economic reopening came much later than the rest of the world and has been very weak. Since the Trump years geopolitical tensions ratcheted up, and many Western companies have pulled back on their investments in China. As the rhetoric between countries became more heated throughout the pandemic companies began bringing more of their supply chains closer to home. When you combine all the above, it has created an uncertain outlook. This is an economy that has served as an economic engine for the world and was said to be the next “big thing” all investors needed to have exposure to.

It has been widely reported that the youth unemployment rate has been alarmingly high for a while now. It reached an all-time high of 21.3% in June. The Chinese National Bureau of Statistics then announced it would no longer report youth unemployment moving forward. This is a drastic step, even for a country known to have what we can nicely label “an interesting relationship” with economic data. This development is what led the negative sentiment around China to reach a fever pitch. The general idea is that if they are outright refusing to share certain economic data things must be even worse than originally thought. While the youth unemployment rate is a problem for the Chinese both politically and economically, it is also just a symptom of broader systemic issues facing the economy.

To be clear, the Chinese economy is one of the most complex and opaque subjects one can study. We obviously can’t cover it all in one article. If you want to read more though, there are lots of great resources. We enjoyed a recent article by Noah Smith, who has an excellent breakdown on this very topic titled “Why China’s economy ran off the rails.” In the meantime, here is the short version of the short version: after decades of growth that started in the 1980’s, the Chinese government pivoted from an export-led-economy (i.e., being “the world’s factory”) to a real estate-led economy during the 2008 financial crisis. This was done as the global recession hurt the demand for their exports. In non-economic jargon: struggling economies like the U.S. couldn’t buy as much of their stuff anymore. So they shifted resources to major real estate investments to avoid the economic hardships the rest of the world was dealing with. They did this by encouraging real estate development and financing major projects any time there were hints of a slowdown in the years that followed. Just how much real estate development occurred throughout China during this drastic pivot? Well, it was a truly hard to comprehend amount. One estimate is that China used more concrete between 2011 and 2013 for its building binge than the United States used in the entire 20th century. Like we said, hard to comprehend. Real estate related activity eventually became over 30% of total economic output. Lots of debt issuance and financial speculation followed, a real estate bubble inflated, and now it looks like it may be popping.

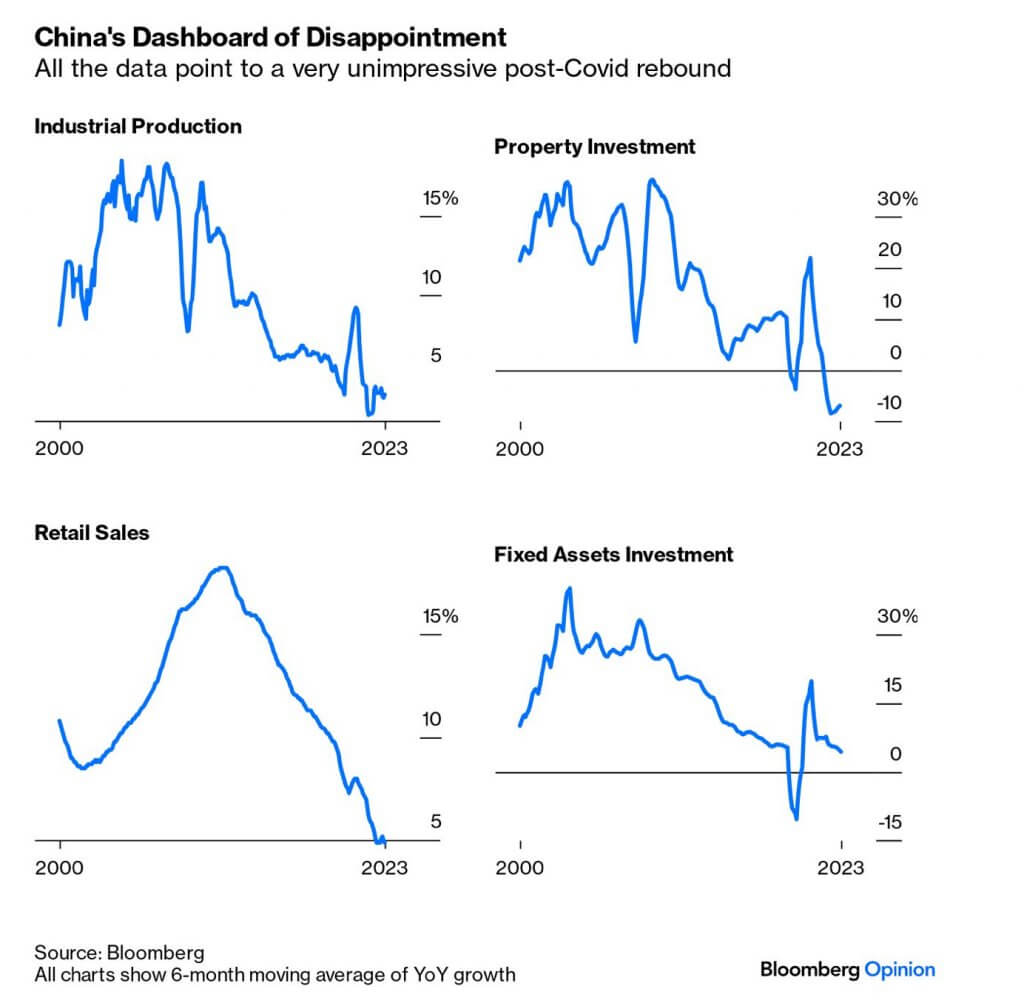

Much like the United States in 2007-2008 housing crisis, there may be a domino effect that reaches far beyond real estate. In China, real estate became the primary way everyday people invested their new found wealth. If real estate suffers a major downturn, millions of people who tied their life savings up in real estate-related investments and speculation will struggle. Their outlook as well as their ability to go out and take risks, start businesses, and spend money will be negatively impacted. As we mentioned above, foreign investment is also declining. The chart below shows just how much investment and economic activity has declined in different areas:

To make things more complicated China’s population is now aging after decades of their “one child only policy.” These demographic issues could make kickstarting growth even more challenging in the years ahead. How will leader Xi Jinping and the Chinese government respond and react? So far, they have resisted injecting more major stimulus. However, they have recently cut interest rates and let the currency depreciate.

In short, the multi-decade Chinese growth narrative that many assumed was a foregone conclusion appears to be in question. The numbers have told a vastly different story for a while now though. It is yet another example of how long a promising investment story can outpace reality. The truth is that China has not been a great place to invest in stocks even during the boom times. Despite the last 15 years of enormous economic expansion, investor Kyle Bass recently stated how an investor in the MSCI China stock index over that same period would actually be down 31%. Tom Morgan of Sapient Capital zoomed out further in a recent investor note. He pointed out that since 1992, that same investment would have returned barely 1% a year. That is shocking when you think about it. While the potential implications of China’s economic issues go far beyond investing, investors are now asking a new question: what does all this mean for the rest of the world?

Citations:

China’s Forty Year Boom is Over. What Comes Next?, Lingling Wei & Stella Yifan Xie- Wall Street Journal, August 20, 2023

China Sneezes, but Will the World Catch a Cold?, John Authers, Bloomberg Points of Return, August 16, 2023

China Slashes Rates, Suspends Youth Jobless Data as Economy Signals Sharper Downturn, Jason Douglas- Wall Street Journal, August 15, 2023

How China used more cement in 3 years than the U.S. did in the entire 20th Century, Ana Swanson- Washington Post, March 24, 2015

Why China’s Economy Ran Off The Rails, Noah Smith- Noahpinion Substack, August 21, 2023

An Important Thing to Watch, Tom Morgan- Sapient Capital, August 22, 2023