Advisory Team

Financial Planning

Retirement Planning

Investment Management

Estate & Trust

Advisory Team

At Alliance Wealth Advisors, we are an experienced team dedicated to your success. Whether you’re in need of individual financial advice, succession planning, or robust institutional strategies, we’ve built our business to address the varied needs of our diverse clientele. We take pride in working alongside our clients, ensuring our strategies are consistently angled toward their ideal financial outcome. We see your goals as an extension of our own, and we work tirelessly to help you achieve every one of them.

Financial Planning

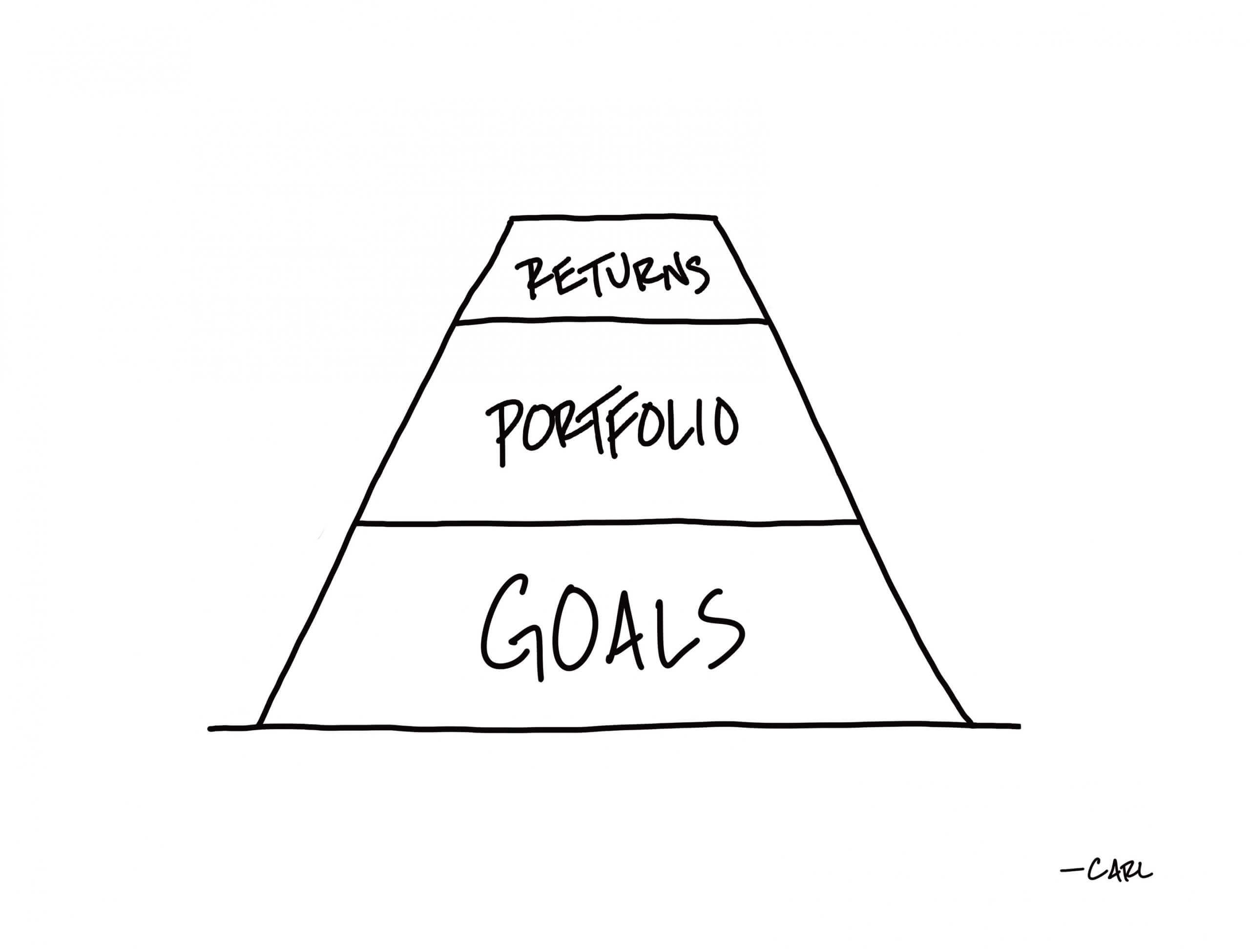

Financial planning can mean different things to different people, but there are certain characteristics all plans should have in common. Working with a team of advisors who deeply understand your situation and the way you think about money is essential. It is also not a one-time exercise, but an ongoing strategic process that changes as your life does. As writer Morgan Housel says: “Planning is important, but the most important part of every plan is to plan on the plan not going according to plan.” Good financial planning should incorporate your goals and values. It should be a dynamic process rooted in giving you flexibility as the environment changes, not about needing the market to behave a certain way.

Retirement Planning

With retirees living longer, more active lives, it’s essential for your retirement plan to work for you, helping you enjoy the life you’ve envisioned while also mitigating risk that could make your nest egg vulnerable. We help pre-retirees and retirees overcome the challenges of such a profound lifestyle change. Working together, we talk about what you need and want your money to do for you and assess the likelihood that you’ll be able to achieve these goals. If you have to make tradeoffs, we help you there, too, showing you how small compromises might make a big impact over the long term. We also talk about the things that concern you, and solutions that can help alleviate those concerns. As your lifestyle changes, we update your financial plan to keep you moving in the direction you want to go.

Investment Management

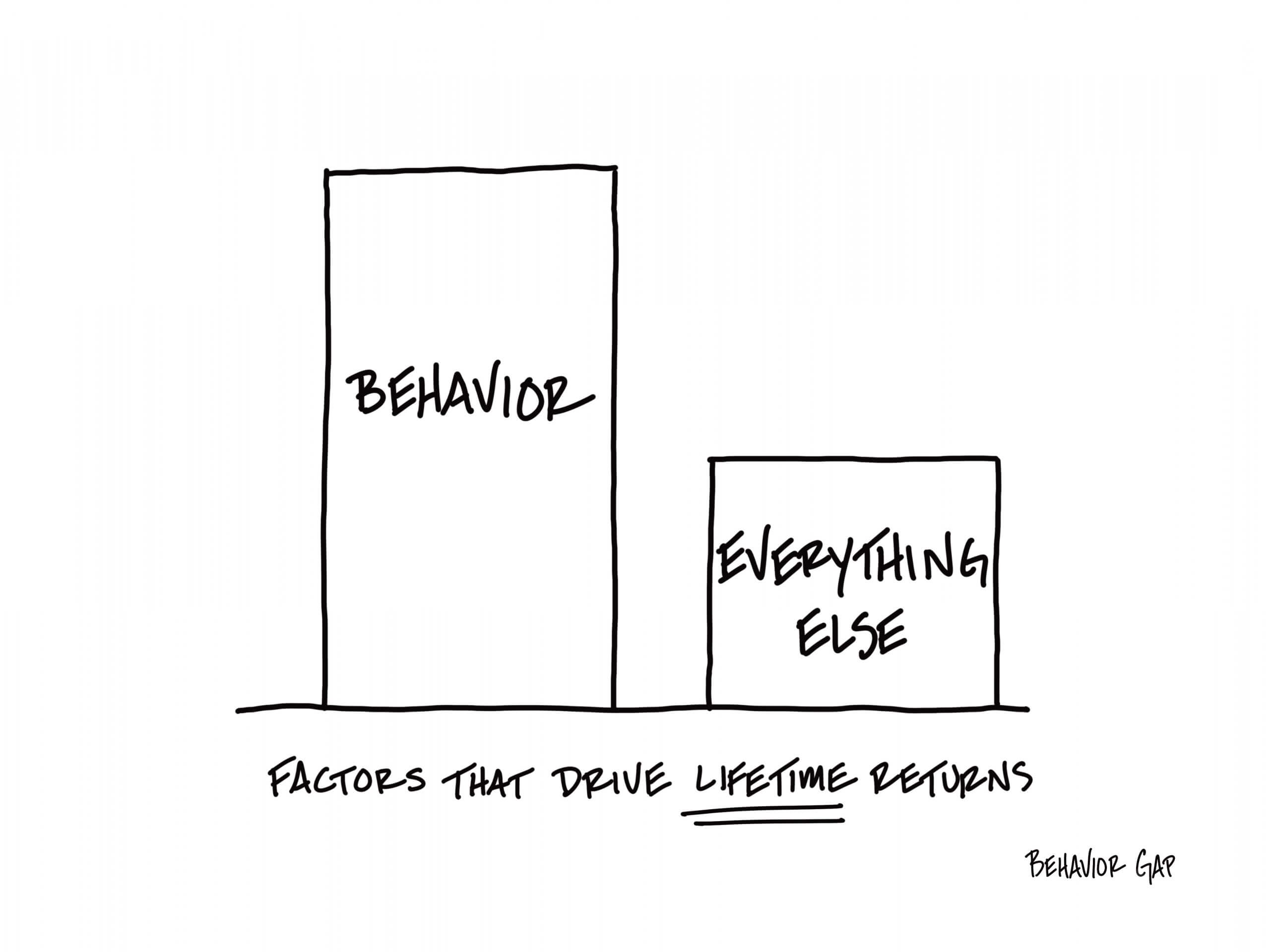

When it comes to investing success, people shouldn’t need to perfectly forecast the future to get good results. That is not a repeatable process. Many investors tend to focus on the short-term and make decisions based on the emotion of the current moment. For these reasons, our foundations of investing are focused on things that don’t change that often. As investors, this helps block out the short-term noise and focus on what matters. We are not short-term traders; we are long-term investors. We want our clients to succeed in a wide range of future scenarios. We believe good outcomes result not from concerning ourselves with the latest investment fad of the moment, but in having a good process to make sound investment decisions over the long run. Having a deep understanding of things like human psychology, market cycles, and the power of compounding can prevent mistakes and build long-term wealth.

Estate & Trust

One of life’s greatest rewards is sharing your wealth with others. Managing assets to take care of one’s own needs and wants is one thing, but it takes additional planning and knowledgeable guidance to help ensure your financial legacy makes an enduring difference in the lives of loved ones. Having an estate plan to control the distribution of your assets benefits everyone – you, your family and the causes you care about – and can help mitigate potential pitfalls in the future. Our experienced team has the resources to assist your attorney and CPA with a personalized plan that not only preserves your assets but also helps you share your wealth with the people and charities you care about most.