Markets in Perspective

Investment ManagementBy: Christopher D. Ross, CFP®

Mar 12, 2020

Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to solve one problem, it creates several others:

- When do you get back in? You must make two correct decisions back-to-back; when to get out and when to get back in.

- By going to the sidelines you may be missing a potential rebound. This is not historically unprecedented; see charts below.

- By going to the sidelines you could be not only missing a potential rebound, but all the potential growth on that money going forward.

We believe the wiser course of action is to review your plan with your advisor and from there, decide if any action is indeed necessary. This placates the natural desire to “do something”, but helps keep emotions in check.2

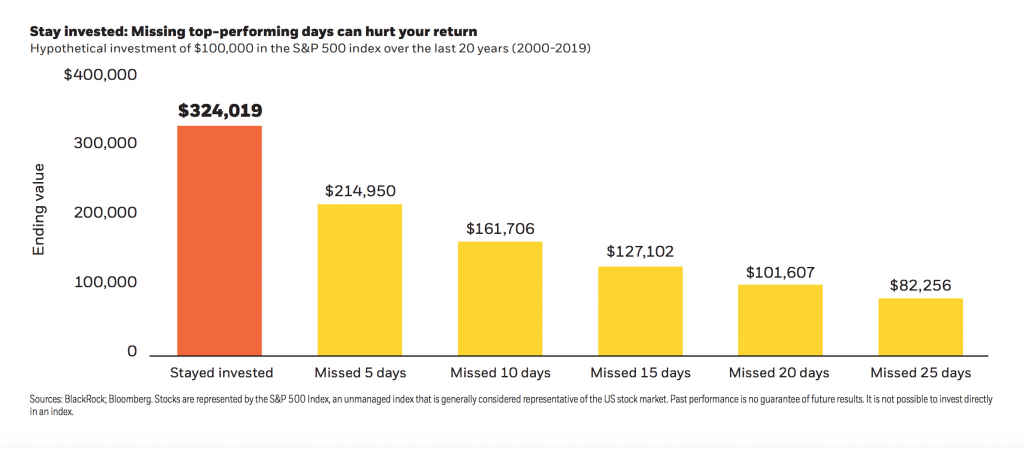

Missing top-performing days can hurt your return

The graph below shows how a hypothetical $100,000 investment in stocks would have been affected by missing the market’s top-performing days over the 20-year period from January 1, 2000 to December 31, 2019. For example, an individual who remained invested for the entire time period would have accumulated $324,019, while an investor who missed just five of the top-performing days during that period would have accumulated only $214,950.1

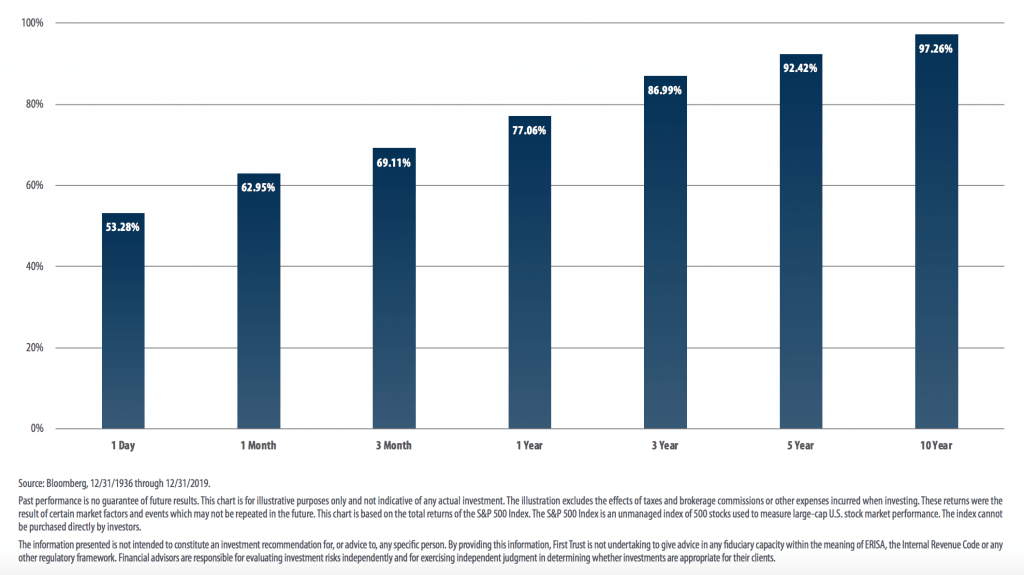

Probability of Positive Returns

Investing in the stock market can be volatile. For this reason, we believe it is important to keep proper perspective when stocks rise or fall over short periods of time. History has shown the odds of achieving a positive return are dramatically increased the longer the investment horizon.2

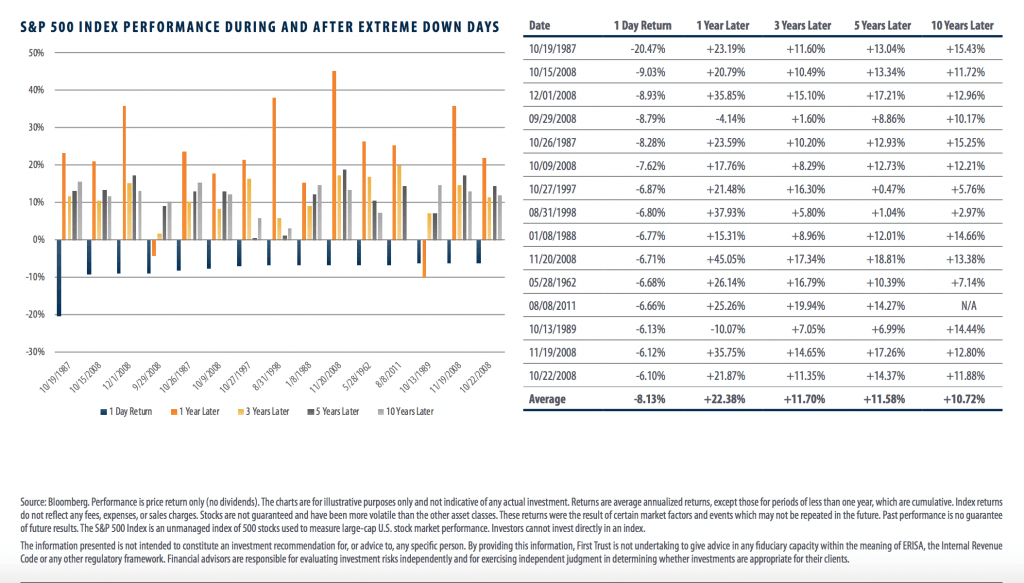

S&P 500: Performance After its Worst Days

The chart and table below list the 15 largest single day percentage losses in the S&P 500 Index since 1960 and the subsequent price performance of the index for the 1-, 3-, 5-, and 10-year periods that followed. Looking back, the S&P 500 Index produced positive price appreciation, on average, in each of the periods. While stocks have sometimes experienced extreme volatility over short periods of time, we believe investors who remain committed to their long-term investment plan will continue to be rewarded over longer periods. Of course, past performance is no guarantee of future results.2

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information.

Charts and material was developed separately by Blackrock and First Trust Portfolios, LP. Blackrock and First Trust Portfolios, LP are not affiliated with Alliance Wealth Advisors, LLC.

The views and opinions expressed herein are those of the speaker or writer and do not necessarily reflect the views of Alliance Wealth Advisors, LLC. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. All indices are unmanaged and may not be invested into directly.

1. Blackrock, Strategies for Volatile Markets 2020

2. First Trust Portfolios, LP, Markets in Perspective-Client Resource Kit 2020