Paycheck Protection Program: Small Business Guide & Checklist

Financial PlanningBy: Christopher D. Ross, CFP®

Mar 29, 2020

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the Paycheck Protection Program, the initiative provides 100% federally guaranteed loans to small businesses.1

Below are questions you might be asking and what you need to know about the Paycheck Protection Program prepared by the U.S. Chamber of Commerce.

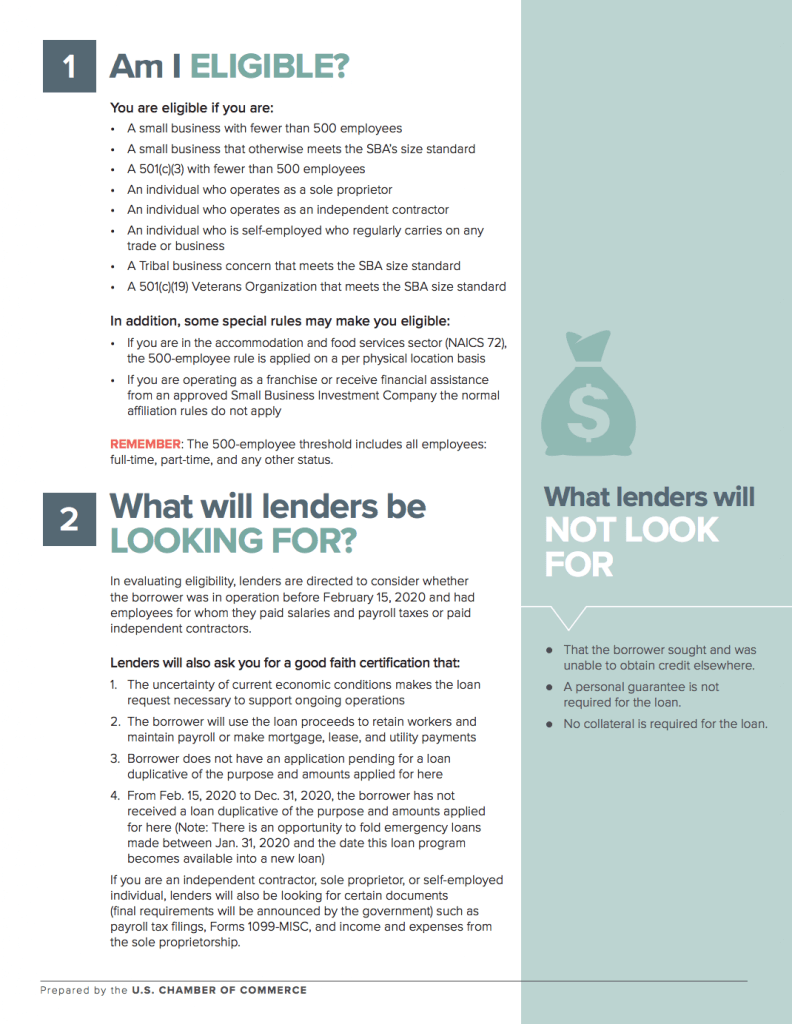

- Am I eligible?

- What will lenders be looking for?

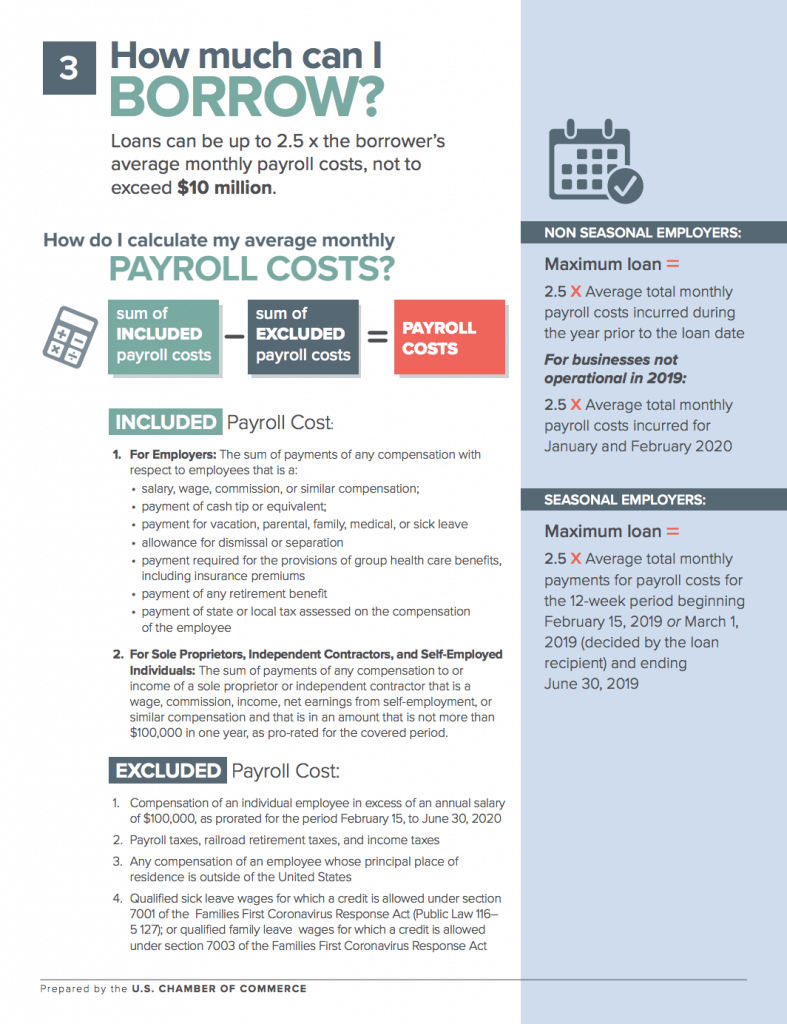

- How much can I borrow?

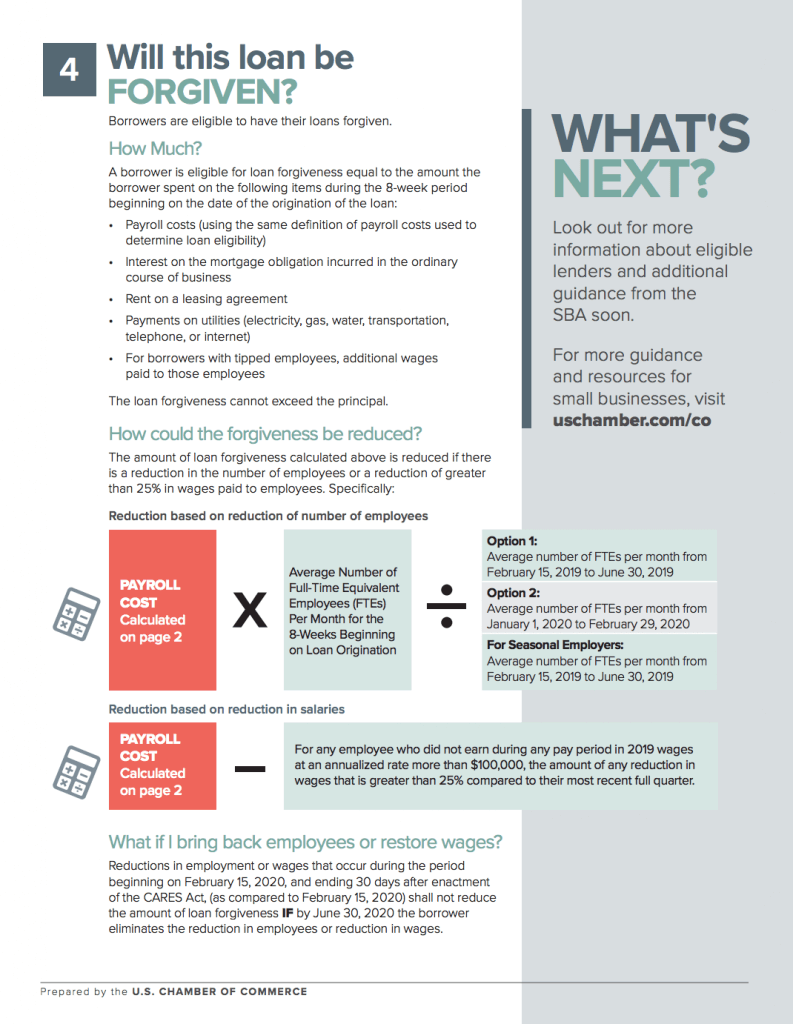

- Will this loan be forgiven?

Click here to view PDF.

1: U.S. Chamber of Commerce 2020

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information.

The views and opinions expressed herein are those of the speaker or writer and do not necessarily reflect the views of Alliance Wealth Advisors, LLC. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market.