Podcast- Money Stories, Markets & The “Millennial Experience” with Callie Cox, Chief Market Strategist at Ritholtz

Inflection PointsJul 16, 2024

We recently sat down with Callie Cox, Chief Market Strategist at Ritholtz Wealth Management. Before starting that role, Callie was the U.S. investment analyst at eToro, where she educated two million customers about markets. She is one of the rising stars in the financial industry, and her work has been featured on CNBC, Bloomberg, and the Financial Times.

We started the conversation around something Callie wrote about a few years ago, which is the idea of a “money story” and how much they shape us into who we are and how we make financial decisions. Callie describes a money story as the summation of how we think about money, our earliest experiences, and what emotions tend to show up when we think about our finances.

We discussed Callie’s career path as a woman in finance and her excellent advice about viewing your careerl like a jungle gym rather than a ladder. Our conversation also covered why the financial industry struggles to serve younger investors, the “millennial experience” since the Global Financial Crisis, and how finance evolves with each generation.

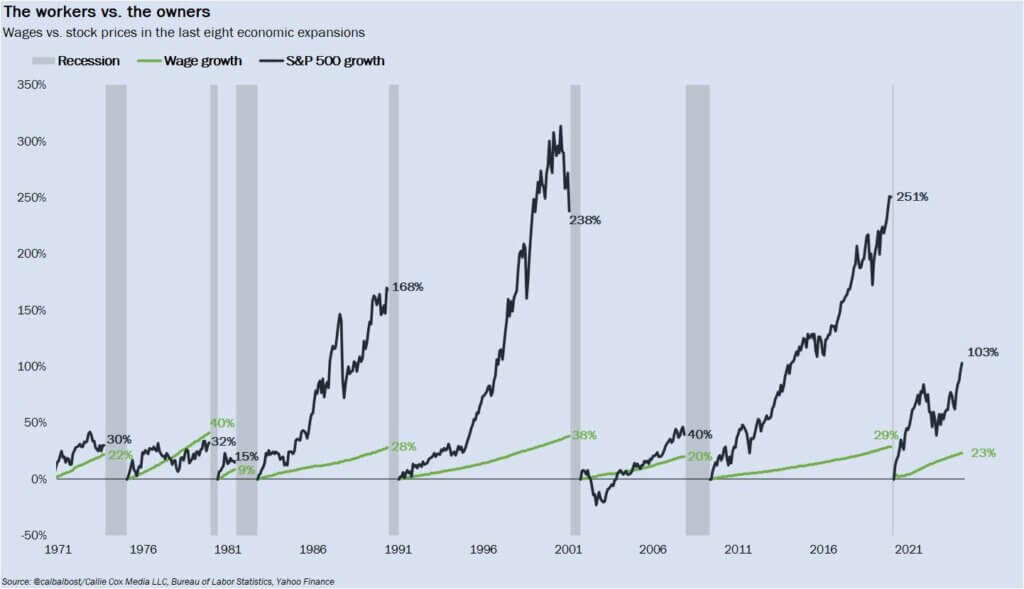

Finally, we dove deeper into markets and the current moment we find ourselves in. Callie also describes why it is historically very expensive to miss out on bull markets, as well as why being an “owner” vs. a “worker” is such an important concept for those looking to build wealth. In other words, we can’t rely on wages alone to build wealth. Below is a chart we discuss on this topic:

This conversation is packed with many useful frameworks to help investors make better decisions, regardless of what stage in life you are in. Thanks again to Callie for a great conversation, and we hope you enjoy this episode.

Subscribe to Callie’s newsletter “OptimistiCallie” by clicking here.

Subscribe to Mike’s newsletter “Earn After Reading” by clicking here.

The information in this interview is provided for informational purposes only and should not be taken as investment, legal, or tax advice. Opinions expressed in this interview are subject to change without notice. It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results and diversification does not guarantee a profit or protect against loss in a declining financial market. Alliance Wealth Advisors, LLC (“Alliance”) is an investment advisory firm that is independently owned and operated. Alliance does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party mentioned in this communication and takes no responsibility. For more information regarding Alliance, please visit alliancewealthadvisors.com/legal-disclosures. Callie Cox did not receive any compensation. She also is not affiliated and not client of Alliance Wealth Advisors at the time of this publication.