Politics, Portfolios & Perspective: Investing in a Crazy Election Year

Investment ManagementOct 02, 2024

Election season feels like it is getting longer and crazier with each cycle, especially for those of us in swing states inundated with constant political ads and junk mail. The good news? There’s only a month left. For investors, the increasingly polarized political landscape makes it harder to tune out the noise and make good decisions. As we speak with our clients about the fiscal, economic and geopolitical ramifications of the 2024 election, we also want to provide some historical context to help you stay focused on what matters most.

First, while we tend to think of ourselves as individuals who are mostly rational, as a society politics are more of an emotional topic than we care to admit. Look at how people tend to view the economy depending on their political affiliation:

U.S. consumer sentiment by party affiliation

U.S. consumers’ economic sentiment now largely reflects partisanship. Political independents, who typically measure near the Michigan survey’s overall sentiment reading, have so far in 2024 swing notably below it. But their views brightened in August for the first time this year, alongside a big increase among Democrats after Kamala Harris became the party’s presidential nominee.

Note: Gray bar is recession; survey was not conducted from November 2016 through January 2017. Source: University of Michigan Surveys of Consumers

As this chart from Reuters shows, how we feel about the economy is directly correlated to if the party we most closely identify with is in power or not. This is regardless of what the economic data actually tells us. In other words, our emotions get the best of us and cloud our ability to stay objective. We tend to do the same thing when it comes to making investment decisions- how we feel about the “other team” can lead us to act on our biases and make mistakes.

Second, it is important to remember that stocks are long-term instruments. They represent an ownership stake in a business, they are not betting slips to be exchanged based on the latest headline or polling data. While traders aim to make profits from short-term price movements, investors build wealth by holding a diversified portfolio of quality assets over the long run. History shows that poltiics rarely impacts how the stock market will behave over longer periods of time.

Here are a few visuals that underscore this point:

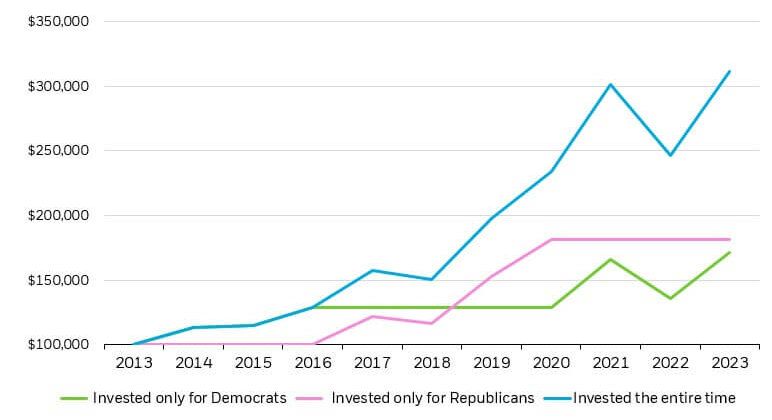

In the past two presidential elections, there were many “expert” predictions claiming that electing both Donald Trump and Joe Biden would cause a significant stock market correction. Yet, both presided over stock market highs at various times. Anyone who made changes to their portfolio based on those election outcomes suffered a serious opportunity cost that will impact them for a long time. To be fair, this is a small sample size. So, let’s zoom out to see the market performance from 2013-2023, spanning three administrations and changing congressional majorities. The chart below compares the outcomes of investing only when Democrats or Republicans held the White House versus staying invested the entire time:

Last 10 years, $100,000 invested in 2013, depending on which party held presidency

Source: BlackRock, Morningstar, as of December 31, 2023. Party presidency period determined by party presidency inauguration to next opposing party presidency inauguration. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/54 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in an index.

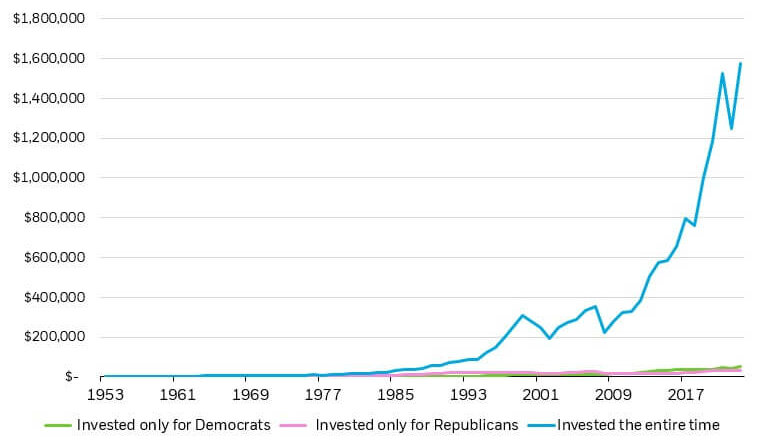

If you invested based on which party held office, you left significant gains on the table. Zooming out even further, the next chart shows the growth of $1,000 invested since 1953:

Last 70 years, $1,000 invested in 1953, depending on which party held presidency

Source: BlackRock, Morningstar, as of December 31, 2023. Party presidency period determined by party presidency inauguration to next opposing party presidency inauguration. Stock market represented by the S&P 500 Index from 1/1/54 to 12/31/23. Index performance is for illustrative purposes only. You can not invest directly in an index.

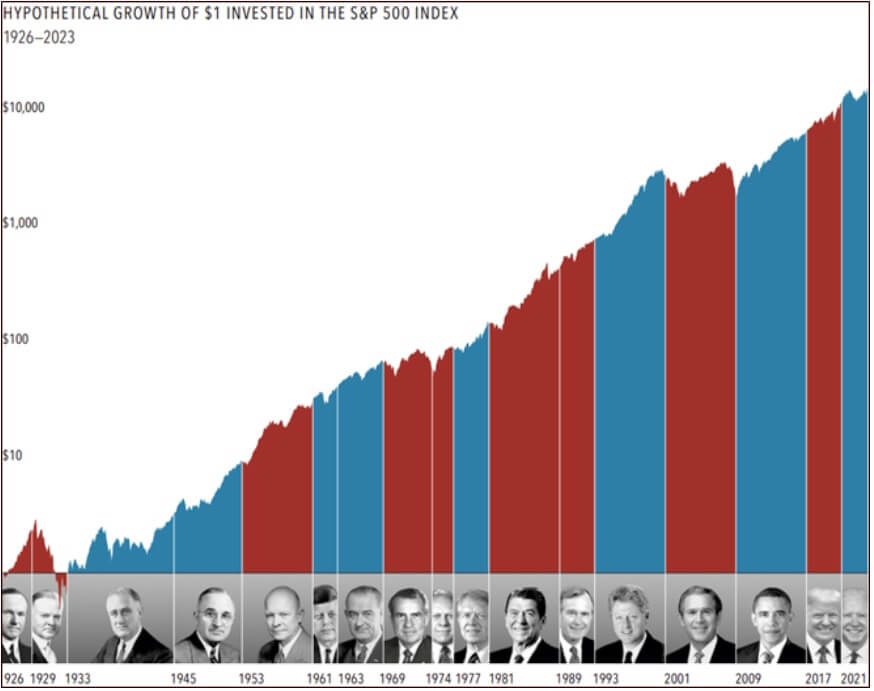

Political outcomes and investing decisions simply do not mix. At the risk of overdoing it, we will give one last example to show this point by zooming out even farther. The following chart illustrates what $1 invested in the S&P 500 in 1926 would look like, while breaking up by party and each administration that occupied the Oval Office:

Source: Demystifying Markets. Past performance is no guarantee of future results.

Third, while policies certainly matter, relying solely on party platforms gives limited insight and carries risks. We are not saying anything new or original when we state that politicians on both sides often promise what it takes to win votes. These days that practice has been taken to a whole new level though. Even if the winner attempts to enact major legislation, they must navigate a deeply divided Congress to implement anything- a tall task in today’s environment to be sure.

Politics aside, the stock market is a complex adaptive system, influenced by countless variables interacting with one another in constantly evolving ways. Companies are dynamic and run by smart people who learn to adapt to new environments. History has shown that companies can react to all kinds of changes and have always been able to grow their earnings over time. When they do stock prices tend to follow. While the past is no guarantee of future results, we do know that trying to time the market is not a repeatable investment strategy. We can’t cherry-pick factors with any certainty, nor can we let emotions drive our decisions.

As the politically driven news cycles get increasingly chaotic in today’s digital world, it’s crucial to separate political anxieties from your investment strategy. No one has a crystal ball. Being diversified, staying dispassionate, and following a plan tailored to your situation will bring you closer to your financial goals—regardless of the latest political drama or what the next month of uncertainty will bring.

We are not political commentators so we will leave forecasts to others. We are experienced long-term investors, so we will make one prediction with confidence: Regardless of how the election plays out, market volatility will certainly show up in the weeks, months and years ahead. That is the price we pay for long-term growth. To quote investor Cliff Asness, “Having and sticking to a true long-term perspective is the closest you can come to possessing an investing superpower.”

Disclosures: It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Any reference to an index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. For more information, please visit alliancewealthadvisors.com/legal-disclosures