Shock Absorbers

Investment ManagementMar 09, 2023

For people trying to decipher what is happening in financial markets and the economy right now, things are pretty… weird. Many experts have been shouting “a recession is imminent!” from the rooftops for a while now (today roof tops means: cable television, Twitter, and research reports not actual rooftops). Inflation is still running too high, which is putting a lot of financial pressure on households and businesses. The Federal Reserve went from not doing anything, to the fastest rate hiking cycle in modern history. Rate hikes work their way through the economy on a lag, so we still don’t know what their true impact will be quite yet. Certain sectors that saw pandemic induced growth like housing and technology are facing some serious rebalancing. There are also geopolitical risks abroad and another potential debt ceiling fight at home that could have far reaching implications.

At the same time, there seems to be just as many experts convinced a recession or another market sell off is far from a sure thing. So far, what has been called “the most anticipated recession of all time” has just not come to pass yet, no matter how much the talking heads want to talk about it. We are still seeing a historically strong labor market. The consumer has continued to spend despite the Federal Reserve’s aggressive approach. Earnings for companies have not been as bad as feared. While inflation has remained sticky in some areas, supply chains have been cleaned up and overall inflation numbers continue to decline from their peak levels.

In short, economic data has been erratic as we continue to move further away from the pandemic, emergency stimulus, and all of the distortions that came with them. Markets are choppy because investors are struggling to process what the varying data means. It is a mixed bag where you are able to see whatever you want to see. So, how do investors position themselves moving forward?

The truth is, predictions are next to impossible. Bob Seawright wrote about this in a recent investor letter. Individual data points can be useful, but they never tell the whole story. He went on to say: “The universe and its component parts are far too complicated and nonlinear to offer ready predictability. In other words, the world is far messier and less predictable than we think and desperately want to believe. We always know less than we think and assume. Information is cheap; meaning is expensive.” If you remove “universe” and insert “financial markets” or “economy” this statement holds true. They are all complex adaptive systems. They can’t be predicted by reducing them to the sum of their parts.

Phil Huber recently explored this concept in his blog Bps and Pieces. He wrote about how at the one year anniversary of the war in Ukraine, the things everyone expected to happen have not (regarding financial outcomes, not humanitarian). Experts predicted an energy crisis in Europe, Ukraine’s economy would fall off a cliff, the Russian Ruble would lose its value, and that European stocks would underperform the U.S. stock market. All of those things seemed not only logical but certain. Remarkably, the opposite has happened in each of those scenarios one year later.

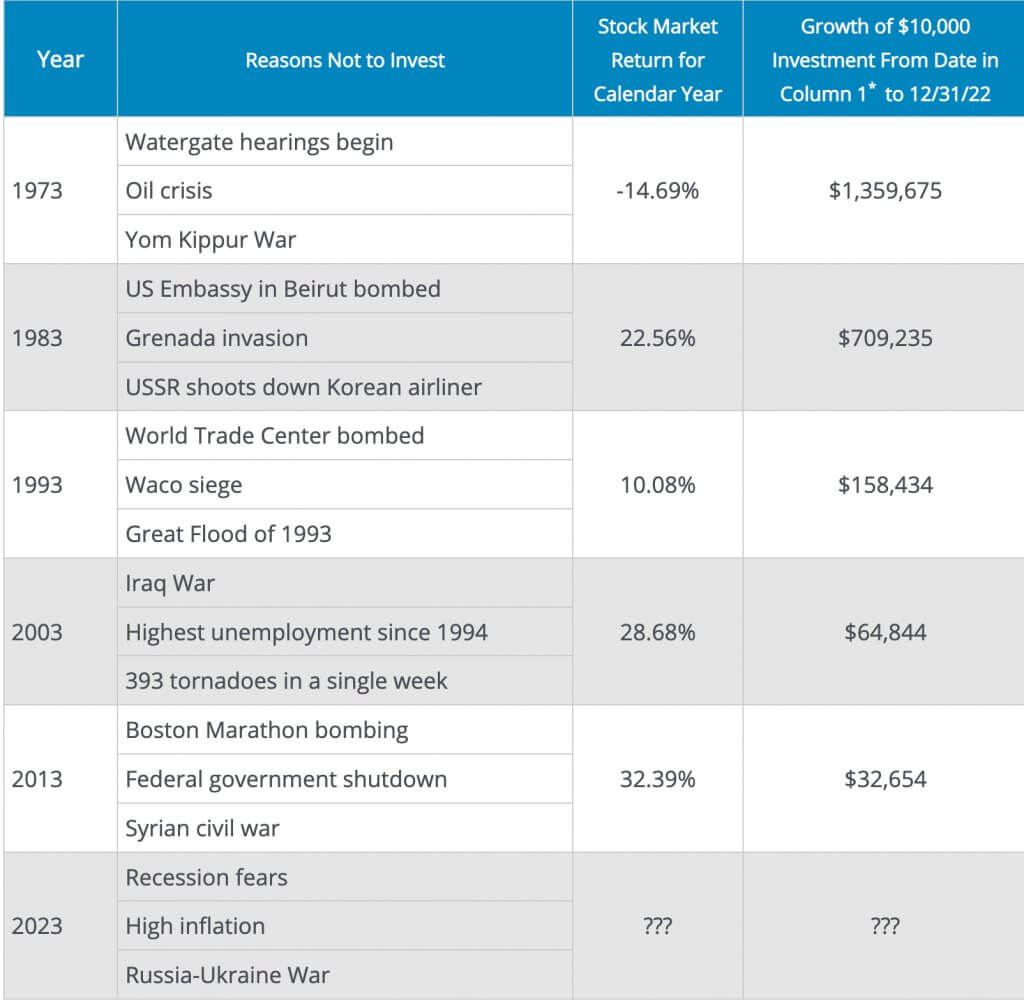

Regardless of what happens next, the truth is short-term uncertainty is the price investors pay for long-term gains. The world has always been an unpredictable place, and history shows that is not a good reason to stay on the sidelines. Take a look at the below chart. There have always been crazy things happening that made being in the market scary at the time:

Source: Hartford Funds. Past performance does not guarantee future results. * Assumes an initial investment of $10,000 in stocks beginning on January 1 of the date in column 1 through December 31, 2022, reinvestment of dividends and capital gains, and no taxes or transaction costs. Stocks are represented by the S&P 500 Index, which is a market capitalization-weighted price index composed of 500 widely held common stocks. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data Sources: Morningstar and Hartford Funds, 1/23.

Obviously this doesn’t mean you can throw your life savings into the stock market and call it a day either. Let’s see how two of the best investors alive today have managed positive returns in a world of negative headlines-

Chuck Akre may not have the same name recognition as others, but he has an incredible long-term track record. He put his approach like this in a letter written after the onset of Covid-19: “we spend little time trying to anticipate shocks like global pandemics or oil-price wars, but we spend a lot of time thinking about “shock absorbers” in our investment strategy”. Warren Buffet, who is just a tad more famous, recently released his annual shareholder letter. He describes what I would argue is this same concept in the context of Berkshire Hathaway’s habit of holding a lot of cash and safe bonds: “As for the future, Berkshire will always hold a boatload of cash and U.S. Treasury bills along with a wide array of businesses. We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses.” In other words, the best investors don’t predict when bad things will happen, they prepare for them. Akre and Buffett both confidently allocate capital for the long-term while always being prepared for the fact that the world is unpredictable in the short-term.

For individuals and families, this will look different in every situation, but the same principle applies. The key is setting up a plan to benefit from the market in the long run, while insulating yourself from it as much as you can in the short run. We need “shock absorbers”. We need to have a balance sheet and a portfolio designed to handle the sudden changes that life, the economy, or markets may bring. Regardless of where we are in life, building and preserving wealth is not about predicting the unpredictable, it is about creating a strategy that allows us to withstand the unpredictable.

Citations

Why The Data Makes No Sense, Kyla Scanlon, March 2, 2023

We’re All Reasonabilists Sometimes-The Better Letter, Bob Seawright, March 2, 2023

Nobody Knows Nothing- Bps and Pieces, Phil Huber, February 23, 2023

Investing in Crisis, Value Investor Insights, Chuck Akre, April 30, 2020

Berkshire Hathaway 2022 Annual Letter, Warren Buffett, February 2023