The Big Mo

Investment ManagementMar 19, 2021

In physics, the more mass and velocity an object has the greater amount of momentum. While the math can get complicated quickly, the concept intuitively makes sense. A train moving at full speed will have more momentum than someone out for a jog, and thus would need a larger outside force to slow it down or change its course. When you step outside of physics the same concept holds, but momentum can no longer be predicted using a formula with specific variables. Whether it is competitive sports, a political election, or the stock market, “the big mo” can be responsible for wild outcomes and big surprises.

When it comes to investing , Investopedia describes momentum investing as: “a strategy that aims to capitalize on the continuance of an existing market trend.” In other words, as the name suggests, it involves buying stocks that have already been moving upward in price (there are all sorts of ways investors can measure or invest in momentum which we will not get into here). Momentum stocks have dominated in recent years and have been heavily concentrated within large technology companies.

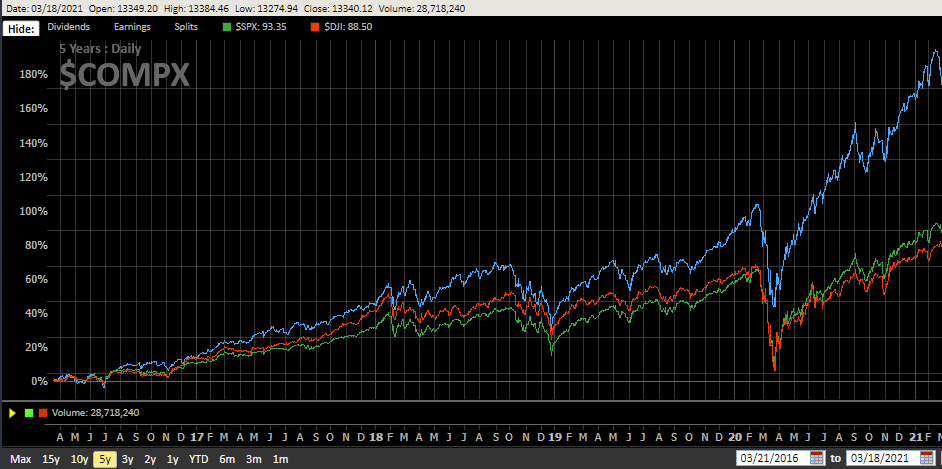

Source: Alliance Wealth Research

As you can see in the above chart, the Nasdaq Composite Index (blue) which is very Technology focused has dwarfed both the S&P 500 (green) and the Dow Jones Industrial (red) Indexes, which are less tech heavy. Momentum investors have piled into Technology names like Facebook, Amazon, Apple, Netflix and Google which have contributed greatly to the overall market’s upward trajectory over this period of time. These stocks have become such a force they have been given their own nickname based on their initials: The FAANG stocks.

These companies have conquered the industries they operate in, innovated and created great products, and in doing so led many investors to believe there is nowhere to go but up. Momentum is funny in that it can become self-reinforcing, as investors who were not originally invested pile in. Fund managers who are underperforming from having less exposure to these stocks have had to decide between joining the party or continued poor performance, which directly impacts their pay. Think of this as investing FOMO.

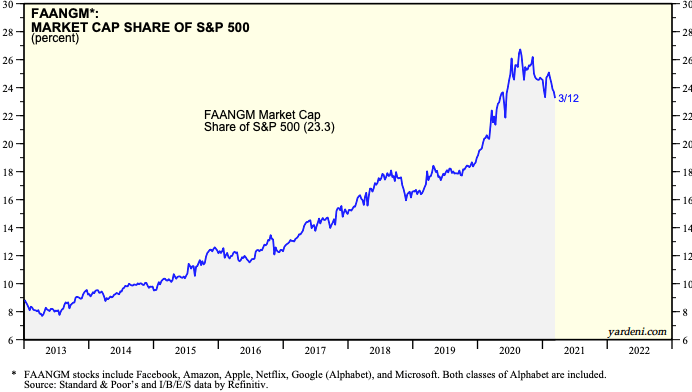

In the process these companies have become absolute behemoths in terms of their market capitalization (size) over the last five plus years. In fact, if you throw in Microsoft, these six companies have become worth close to 25% percent of all of the companies in the S&P 500 index. Going back to physics, their mass and velocity have shown no signs of slowing down. Until recently.

Source: Yardeni Research

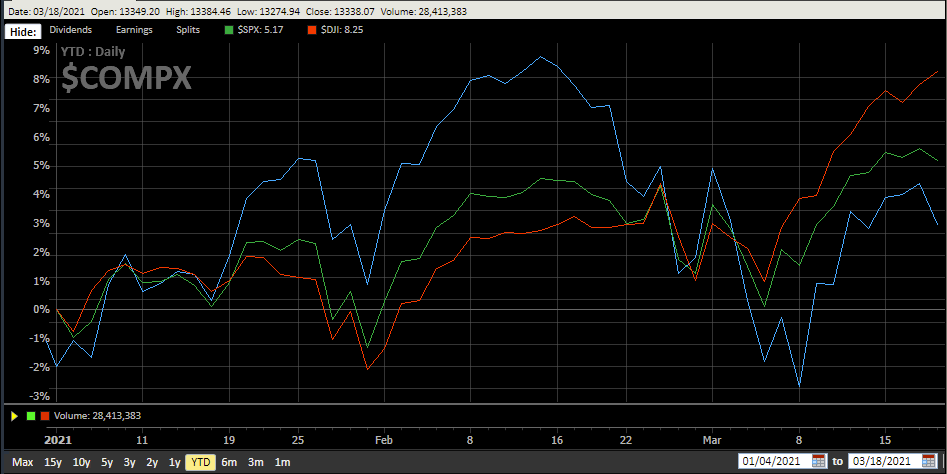

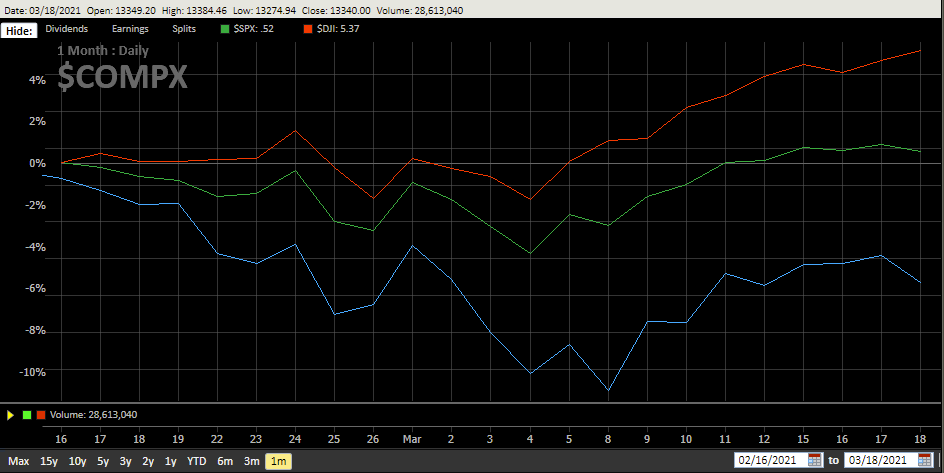

2021 has brought the question of if “Big Tech” stocks may run out of steam to the forefront. See below, the highflying Nasdaq has underperformed the S&P and Dow so far this year. The divergence has been even more pronounced in the last month. To be clear, these are ridiculously short periods of time. These Technology companies certainly aren’t going anywhere, and this has been far from a big sell-off. However, there is a rotation going on within the market as investors consider if the big technology stocks that have driven this market, and then continued even higher as they benefited from the pandemic, will lead the market higher in a post Covid world. Are there factors big enough to change the course of this momentum trend?

Source: Alliance Wealth Research

The first is the expectation of an economic re-opening with a lot of pent-up demand. Will that dent potential growth for these largely online based technology businesses, and will other sectors of the market finally have their day? Another factor to consider is interest rates. The momentum stocks of the last year have largely done so under the assumption that interest rates would stay low for the foreseeable future. If rates moved higher quickly, would this impact their valuations moving forward? Rates are still near all-time lows, but their recent move higher has enforced this narrative, which is being covered ad nauseam by the financial media.

Another factor is the sheer size of these companies. When you become that big, but investors still want to see the same growth that involves doubling your revenue and earnings every few years, it gets harder and harder to meet expectations. It’s the double-edged sword of being a hot growth stock that becomes a giant. If you don’t satisfy growth expectations investors may go elsewhere. This is why these Big Tech companies have gone into other industries that are big enough to move the needle (like healthcare). As Scott Galloway said recently: “Google and Facebook could wipe out the entire radio industry, and they’d still wake up hungry for more profits within 24–36 months based on investors’ expectations.” That is a tough spot to be in.

Finally, there is the increased risk of government regulation. As Big Tech has become a more and more integral part of people’s daily lives, their impact on everything from elections to privacy and beyond has come under more scrutiny (you could argue the government was a little late to the party). Could regulations or anti-trust litigation impact their trajectory in the years ahead?

While no one knows for sure what is in store for these stocks moving forward, the bottom line is earnings growth still drives long-term stock performance. The price you pay still matters because price doesn’t always equal value. As expectations grow, so too does the risk that they may not be met. If these companies can meet lofty investor expectations, this momentum trend will likely continue until they don’t.

While all of this is helpful to understand and interesting to ponder, the reason for why it will end at some point isn’t necessarily important. A long-term investor’s portfolio should not be designed using guesswork or speculation. It should not depend on certain trends continuing or ending. Instead, it should be built to withstand different environments and trends, and to succeed with a wide range of outcomes. Trends change eventually, as does investor sentiment. Momentum can swing in the other direction on a dime. Often for no apparent reason and without warning. The behavior of markets is impossible to predict because unlike physics, there is no scientific formula to understand what drives momentum in the stock market: human psychology.

Citations

The Great Mental Models, Volume 2: Physics, Chemistry and Biology, Shane Parrish & Rhiannon Beaubien, 2020

Investopedia.com

Stock Market Briefing: FAANGM’s, Edward Yardeni- Yardeni Research, March 12, 2021

Tech Giants Can Only Get Bigger by Backstabbing, Scott Galloway, June 16, 2020

Tech Stocks Slip Ahead of Fed Meeting, Will Horner- Wall Street Journal, March 17, 2021

The Day The Growth Trade Topped, Josh Brown- The Reformed Broker, March 8, 2021