The Fed – Part I

News & CommentaryDec 11, 2020

Although the Federal Reserve (the Fed) is one of the most influential institutions in the world, many of us are not really sure what it actually is or what it does. Fed officials are appointed not elected, and financial policy is not the most interesting or easy to understand topic, so it is not surprising that this is the case for most people. One cannot overstate the impact that Fed policy has on the economy and the markets though, and the policy decisions made this year will impact Americans for years to come. As economist Robert Fogel said:

“The president has very limited effect on the economy. If you want to put blame or credit, the main person who influences the business cycle is the head of the Federal Reserve Bank.”

This is as complex a financial topic as there is to write about, so the goal in part one is to focus on just a couple of broad concepts that help provide some historical context. In part two we will discuss what we have seen in recent years and in 2020, and what we might expect looking forward.

1. What is the Federal Reserve

The Fed is the central bank of the United States. Its job is to conduct monetary policy (this just means to promote price stability, or to put it more simply keeping the value of a dollar from changing rapidly on us), to promote maximum employment in the economy over the long-term, and to regulate and oversee the economy and financial system. If you’re interested in diving in a bit further, click here. The current iteration of the Federal Reserve was created by Congress in 1913 after a number of severe financial panics gave Congress the realization that the government was not well equipped to step in as a backstop when these damaging economic events unfolded.

2. How does the Fed do any of these things?

Prior to 2008, the Fed’s main tool to accomplish its goals was to manage interest rates depending on the situation facing the broader economy. To keep it simple, you can think of interest rates simply as the cost of money (if you take out a mortgage for example, the interest rate is the percentage that you are paying the bank in order to borrow the money). By regulating interest rates the Fed’s aim is to control the supply of money and provide support as needed to the economy during different parts of the economic cycle.

Historically, in times of economic weakness the Fed lowers interest rates in order to incentivize scared people and companies to lend, borrow, and spend to help stimulate the economy and help it recover. Howard Marks explains the impact of lowering rates in a recent memo:

“Everything that entails financing is made more attractive (from lower rates). It becomes cheaper to buy a house because the monthly payment is smaller. Ditto for cars and boats. Monthly payments on existing adjustable-rate mortgages decline, leaving consumers with more disposable income. …fear of missing out on the low rates gives people a reason to act now, accelerating transactions that might otherwise have taken place in the future.”

Conversely, in situations when the Fed believes the economy may have been getting overheated and excesses were visible, or they think inflation is going to impact people’s ability to purchase things they need, the Fed would raise interest rates thus incentivizing people and companies to save rather than to lend, borrow, and spend. This has often led to recessions in the short-term as spending decreased, but stabilized things and created a healthier economic environment in the long-term.

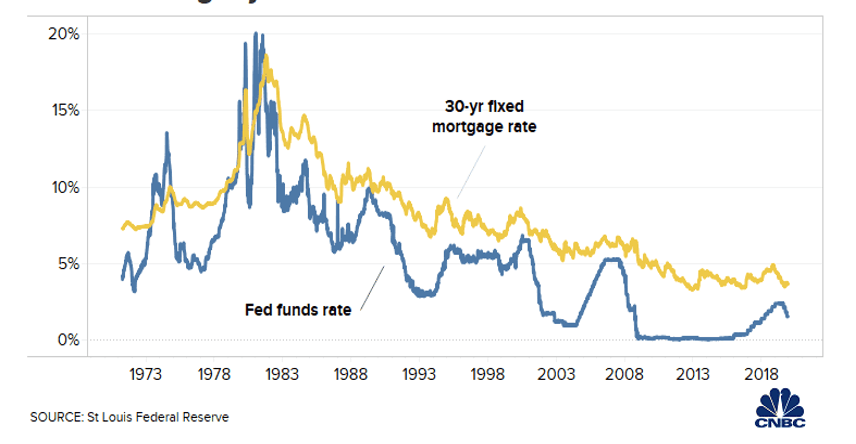

The most dramatic example of this came in the 1980’s as Fed Chairman Paul Volker made the hard choice to raise interest rates to historic highs to end the devastating inflation and economic stagnation of the 1970’s. While he was often vilified for this, many also credit Volker’s decisions with setting the table for the stable prices and economic growth in the United States in the 1980’s and 1990’s.

3. Fed policy and results in recent history

As you can see, interest rates have been on a steady downward trend since the 1980’s. For those of us born after that period, we have been lucky to not experience the staggering inflation of the 1970’s or the insanely high interest rates of the 1980’s. It is important to understand the way these things impacted prior generations, even though many of us have not had to experience them yet during our lifetimes.

The Federal Reserve is not without its fair share of critics, and much of it is warranted. They have certainly not gotten things right all of the time. To be fair, managing the world’s largest economy as it grew more and more complex is no easy job, and they have tried to do the best they can with tools they have at their disposal while remaining apolitical. The Fed’s policies have also enabled Americans to experience fewer economic recessions than they did in the past (there have only been four since 1990 including the current COVID-19 recession).

All areas of the financial markets are interconnected, so interest rates don’t just influence lending or debt markets, they have an effect on everything from commodity prices to the stock market. Fed policy and the ultra-low interest rate policy in place since 2008 have had an outsized impact on many areas of the markets and the economy, some of which has been unintended. We will get into this and how it could impact the road ahead next week in part two.

Citations:

Coming Into Focus, Howard Marks, October 13, 2020

Paul Volcker, the Carter-Reagan Fed chairman who beat inflation, dies at age 92, CNBC.com, October 9, 2019

Federalreserve.gov