Wall Street Goes “Green”

Investment ManagementMay 28, 2021

Consumers today are more conscious than ever about the products they purchase being environmentally friendly. From food, to cosmetics, to cleaning supplies and beyond, people are willing to pay more for products that are eco-friendly (or at least perceived to be). Not surprisingly, the people who sell the products have noticed. Like most things in life, something straight forward like “I want to buy products that are better for the environment” becomes more complicated when you dive into the details. If you walk down the aisle of any store, chances are you will see at least a few of the following terms: “organic”, “made with organic ingredients”, “net-zero”, “all natural”, “free-range”, “chemical free”, “cruelty free”, or “sustainable”. Most of these terms have no clear definition and aren’t really regulated or monitored (there are few exceptions, such as the term organic with agriculture related products).

As more companies market their products as “greener”, it is getting harder and harder to tell the difference between all these eco-friendly buzz words. As you would probably guess, it is hard to audit the substance behind many of them. In many cases they are simply marketing tools that sound nice to an eco-conscious consumer. This marketing approach is so common there is a term for it: greenwashing. Greenwashing is defined as disinformation disseminated by an organization to present a more environmentally responsible public image. This is not to say all companies or products are doing this, just that it is important to be aware of it.

What does this have to do with investing? Well, if ever there was an industry who could give the marketers of food products to Americans a run for their money, it’s the marketers of investment products. As consumers focus more on environmentally friendly products, the investing world has seen a similar trend. ESG (environment social and governance) investing is all the rage on Wall Street these days. The general idea is that ESG funds use various screening methods to only include companies who focus on better practices when it comes to the environment, social issues, and corporate governance. Again, when put that way it seems like a straightforward and positive thing. While generally referred to as ESG investing, it is also called “socially responsible investing” or “sustainable investing” pretty much interchangeably. What do these terms mean? Well, depending on who you ask chances are you’ll get a different answer. Much like with the consumer products discussed above, these are all new terms without clear agreed upon definitions.

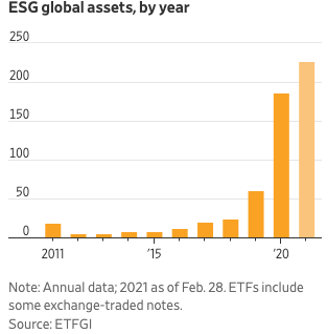

Wall Street certainly doesn’t seem to mind the lack of clarity at the moment. In the first quarter of this year alone ESG related funds took in $15 billion in new cash from investors. Just like with consumer products, funds perceived to be environmentally friendly can also charge a premium. Investor appetite for these funds has been a good way to generate revenue for fund managers who have lost more and more investors to cheap index funds that often perform better. According to Morningstar, there were over 400 funds related to climate alone at the end of last year (and growing rapidly). These funds break down further into subcategories like “low carbon”, “climate conscious”, “green bond”, “climate solutions” and “clean energy/tech”. More buzz words without clear definitions, just like at the store. It’s hard to tell what these funds are focused on and what the difference between many of them are.

While there are fierce arguments on both sides of this ESG investing trend, it’s fair to say both sides make good points. Companies that are good corporate citizens focused on more than the bottom line are often better long-term performers in the stock market. However, skeptics argue there is a lack of clarity around these new investment products and that companies are beginning to game metrics like their carbon footprint to look better on paper to the investing community. For example, companies like Microsoft and Royal Dutch Shell are paying lumber producers to not cut down trees and counting them as offsets to their carbon footprint. How does that get counted? Would the trees being counted have been cut down in the first place? What about if there is double counting of the trees different companies are citing as offsets? There are a lot of questions. Things get complicated in a hurry. From Jason Zweig of the Wall Street Journal: “Carbon footprint isn’t easy for outsiders to verify independently. Estimates of emissions can be unreliable. And auditing the carbon impact of every aspect of corporate operations—from sourcing raw materials to manufacturing and distribution—is complex and difficult. So different analysts can assign wildly divergent scores to the environmental goodness of a given company.”

The question for investors is: are these funds providing a differentiated product based on what they want? Honestly, I have no idea. ESG investing is largely an “eye of the beholder” type thing as it stands today. Companies included in one fund for something like “being committed to being carbon neutral by 2050” and excluded from another for “having too many delivery trucks using fossil fuels” seems arbitrary (these are just examples). Some of these climate funds look a lot like a regular old index funds with a higher fee. For example, the BlackRock US Carbon Transition Readiness Fund’s (more great buzz word usage) top holdings are Facebook, Amazon, Apple, Netflix, and Alphabet which make up about 20% of the fund. If you compare that with a traditional S&P 500 Index Fund, the holdings are pretty much identical. Other than the higher fee of course.

So, is this the new frontier of investing where the focus will be on more than traditional financial metrics, or a shiny new wrapper for funds that don’t look a whole lot different when you pop the hood open? Probably a little bit of both. In a world where people insist that things are straight forward and black and white, the truth is most things are different shades of gray.

So, what should you do when it comes to ESG investing? The same thing you should do at the store when a product is being marketed with a “greener” story: read the fine print and make sure you understand the ingredients.

Citations

What is Green Marketing?, Susan Ward- The Balance, July 20, 2020

There’s no hotter area on Wall Street than ESG with sustainability-focused funds nearing $2 trillion, Pippa Stevens- CNBC.com, April 30, 2021

Think Before You Use These 11 Green Buzzwords, Suzanne Shelton- Builder.com, September 3, 2015

You Can Sell the Trees You Don’t Cut, Matt Levine- Bloomberg, April 21, 2021

You Want to Invest Responsibly. Wall Street Smells Opportunity, Jason Zweig- Wall Street Journal, April 16, 2021