Age Based Planning – 20’s

Age Based PlanningOct 04, 2023

As we enter the final quarter of the year, we decided to spend the next six weeks focusing on age-based planning from your 20’s up to and beyond your 70’s. Our inaugural issue will pertain to those in their 20’s.

Below are a couple financial planning ideas you should be thinking about in your 20’s:

Save Early for Retirement

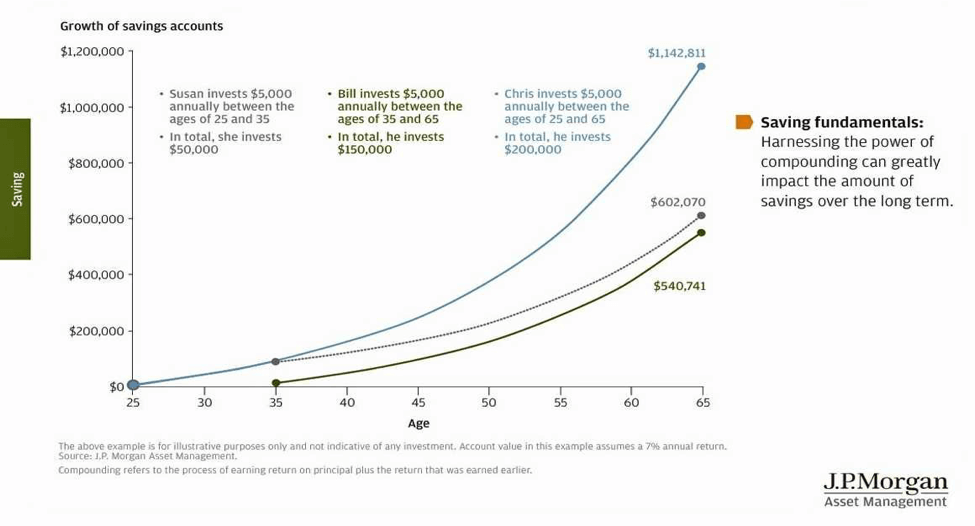

The power of compounding interest is fascinating when you look at it. It is more than just interest on the money you invest. It is interest accumulated on the interest earned over the years. The compounding gets more powerful with time.

The chart from J.P. Morgan shows an example of three different savers. Susan starts investing $5,000 per year at age 25, but stops investing at age 35. Her total investment is $50,000. Bill gets a later start at 35, but he invests $5,000 per year until he is 65 for a total investment of $150,000. Finally, Chris starts investing $5,000 per year at 25 and continues until age 65 for a total investment of $200,000. The end results in the chart are very interesting. Even though Susan invests $100,000 less than Bill, she still has more money at the end because she had the extra 10 years of compounding. Chris ends up with the most because he committed to the plan for the full 40 years. He ends up with over $1 million dollars.

The biggest takeaway is that starting early takes some weight off of your shoulders in accumulating assets in retirement. Susan invested $50,000 over 10 years, but it still grew to over $600,000 because she let it grow for another 30 years. Even if $5000 sounds like a lot to you, any amount is better than not starting at all.

Furthermore, if your employer has a retirement plan with a company match, you get some free money to add to whatever you are able to commit. Our advice is to contribute at least enough to take advantage of the company match if possible.

Home Ownership

Take your time. Before you jump into buying a house, there are some things you should know. Home ownership has become more accessible to people over the years. There are mortgages being offered with a 3% down payment. You should know that if you don’t have a 20% down payment, you will have to pay a premium called Private Mortgage Insurance (PMI), which generally ranges from .5 to 1% of the loan value. That really adds up over the years and you don’t get it back. Before you make the commitment of buying a house, you should consider how long you will want to stay in it, how much maintenance comes along with it, how you’re going to furnish it and if you will have money left after the down payment to pay for any unforeseen issues that inevitably come up when you own a home. It is a big commitment so make sure you’re ready for it before you do it.

Emergency fund

As a follow up to the end of the home ownership piece, you should work on saving an emergency fund. The general rule of thumb is that single income households should have 6 months of expenses and dual income households should have 3 months of expenses in an emergency fund.

Spending

Do you want something really bad or do you need it? What are you sacrificing to buy it? This applies to everything from clothes to cars. Live within your means. Create a budget and try to live by it. Another good rule of thumb is to think about the markups on certain products. If it cost $3.00 at Walmart vs. $4.50 at CVS, that is a 50% premium you’re paying to skip the trip to Walmart. While that $1.50 may not sound like a lot, think about that percentage markup on everything you buy. If you treat every purchase that way, that’s an additional $500 for every $1000 that you spend. It all adds up.

Credit card debt

This goes hand in hand with spending. Don’t run up credit card debt to keep up with your friends. If you do have some, check the interest rates and try to pay the higher interest debt down first. Remember when we talked about how great compounding interest is for retirement? Well, that phenomenon works against you when it comes to credit card debt.

Student loans

They are certainly part of many people’s lives. Like anything, try to pay down the higher interest debt first. Student loans are installment debt and are generally good for your credit. That should be considered when you’re trying to pay down debt.

Your 20’s are a very fun time in your life. You’re starting a career, meeting new people and solidifying your independence. A lot of the financial decisions that you make in your 20’s will impact the rest of your life. Don’t underscore the significance of it. Take the time to talk to a professional and determine the best course of action for your personal situation.