Off The Page- Believe the Hype? All About AI, with Stephanie Aliaga, Global Market Strategist at J.P. Morgan

Investment ManagementSep 25, 2024

About Our Guest

As an independent firm, we have the flexibility to partner with market leaders to better serve our clients. Stephanie Aliaga is a Global Market Strategist at J.P. Morgan Asset Management, based in New York. Stephanie helps shape and communicate economic views, deliver timely commentary, and maintains forecasting models for weekly submissions to Bloomberg and the Wall Street Journal. She is also responsible for publications such as the Guide to the Markets and the On the Minds of Investors blog. Additionally, she serves on the committee that produces the Long-Term Capital Market Assumptions, which underpin J.P. Morgan’s strategic asset allocation process. In her research, Stephanie focuses on issues related to the U.S. economy and artificial intelligence. She holds a Bachelor of Science degree in Economics from the Wharton School of Business at the University of Pennsylvania.

Why Listen?

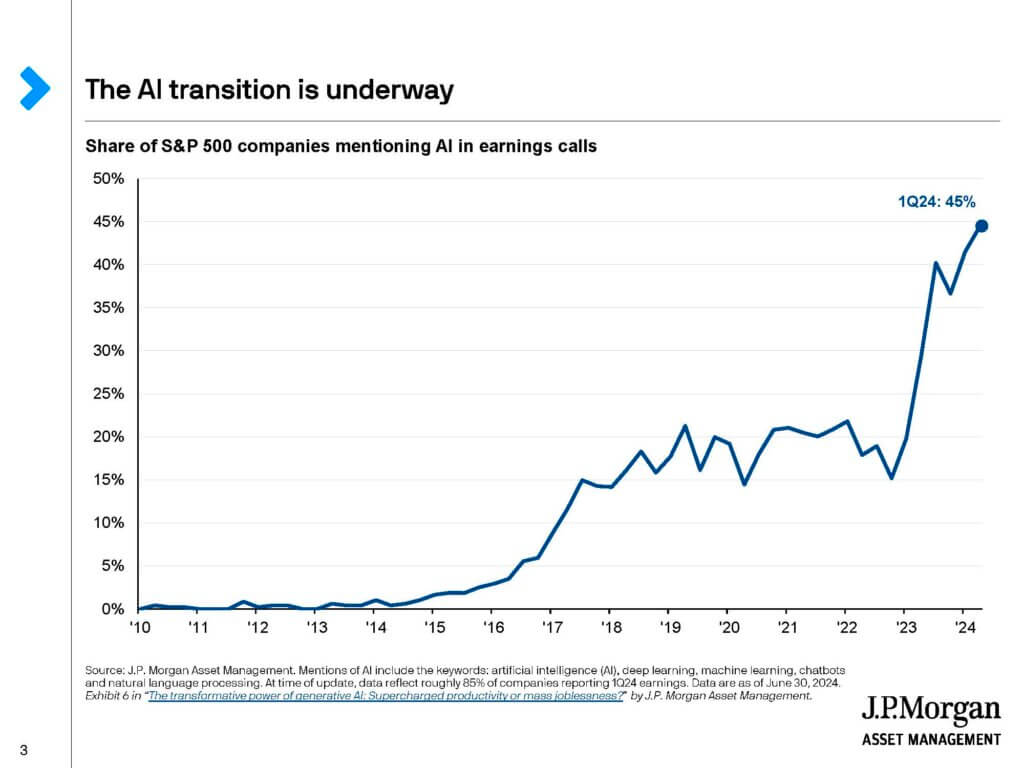

As the chart above shows, artificial intelligence (AI) is being discussed everywhere—particularly by management teams of hundreds of companies within the S&P 500 during their earnings calls. Anyone in the workforce needs to understand what AI could mean for business and everyday life.

Stephanie breaks the AI story into two distinct parts:

- “A.I. 1.0“: The excitement in the markets over the past year has been driven by a handful of technology companies. Stephanie draws an analogy to the companies that sold ‘picks and shovels’ during the gold rush, referring to those who provided the tools rather than the miners themselves. Similarly, she compares today’s tech companies to those selling essential tools that support the broader industry.

- “A.I. 2.0“: The exciting technological transformation story about how AI will change the way we work and live in the coming years, which is still in its very early stages.

Stephanie explains that the first story, A.I. 1.0, is more tangible at this point, while the next phase, A.I. 2.0, has many unknowns and it is incredibly hard to predict who the winners and losers will be this early on.

We also discussed how AI will impact the workforce, with some projections suggesting it could automate up to 25% of everyday tasks in people’s jobs. However, rather than fearing job losses, Stephanie believes history offers valuable insights. In her view, much like with other major technological shifts, AI presents a huge opportunity for people to engage in more interesting, creative, and productive work by automating many of the manual tasks that currently consume a lot of time. Ironically, she also believes AI could lead to increased human interaction and a greater demand for “soft skills” in the coming years. In fact, AI could act as a catalyst for increased productivity and help solve structural challenges related to demographics, economic growth, and quality of life.

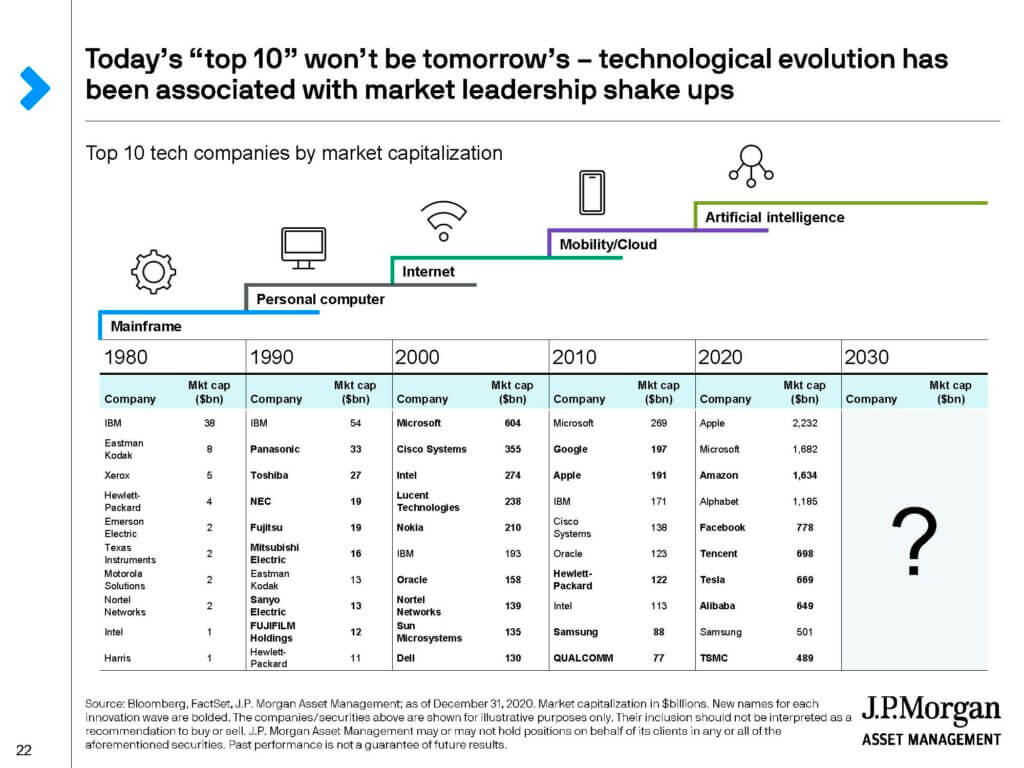

The next part of the conversation focused on how to approach investing during a time of rapid change. The chart below shows how market leadership evolves as technology advances. For this reason, we must not only focus on today’s leaders but also recognize that the companies leading in the future will change as technology evolves. Investors need to remain disciplined and humble to ensure long-term success. Diversification, rather than attempting to cherry pick a few specific companies, is also crucial to be able to stay invested and limit downside risk.

Although AI is currently dominating headlines, the reality is that only 4% of S&P 500 companies have fully adopted it into their businesses to this point. In simpler terms, it’s still early days, and history teaches us that trying to predict the future isn’t a reliable way to invest. As the markets continue to digest these technological changes, two of our “Foundations of Investing” provide a useful framework for making decisions: First, this won’t be a straight line upward. There will be pullbacks and sell-offs, and trying to time the market is not a repeatable strategy. Second, investors must always understand what they own and why they own it.

Thanks to Stephanie for an insightful conversation!

Alliance Wealth Advisors, LLC (“Alliance”) is an SEC Registered investment advisory firm that is independently owned and operated. The information in this interview is provided for informational purposes only and should not be taken as investment, legal, or tax advice. Opinions expressed in this interview are subject to change without notice. It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results and diversification does not guarantee a profit or protect against loss in a declining financial market. Alliance does not guarantee the suitability or potential value of any particular investment or strategy and accepts no liability for reliance on this presentation. Alliance also does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party mentioned in this communication and takes no responsibility. Our guest was an employee of an investment management firm that offers funds and other investments used by Alliance at the time of this publication. Consequently, the guest and his employer received a benefit from participating in this interview. However, the guest was not a client of Alliance Wealth Advisors, the guest did not receive any direct compensation for this interview, and was not otherwise affiliated with Alliance. For more information regarding Alliance, please visit alliancewealthadvisors.com/legal-disclosures.