Know your 401(k) options between jobs

RetirementBy: Christopher D. Ross, CFP®

Apr 21, 2020

Few life events are more stressful than a job loss.

If you or someone you know is in this situation due to COVID-19, you’ll likely have several questions about job hunting, unemployment insurance, and health care. You may also be wondering, “What should I do with my 401(k)?”

People leaving an employer typically have four options with their 401(k) retirement plan, but it’s not an all-or-nothing decision. Depending on your situation, it may be possible to engage in a combination of these options:

- Leave the money in your former employer’s plan, if permitted

- Roll the assets over to your new employer’s plan, if one is available and rollovers are permitted

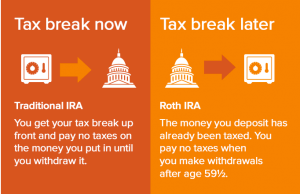

- Roll the assets into an Individual Retirement Account (IRA)

- Cash out the account value

Each choice offers advantages and disadvantages. If you are uncertain what action to take with your retirement accounts, please reach out. Over the years, we’ve found the best financial decisions are the ones that consider all available options.

You also may have heard that the CARES Act waives the 10% early withdrawal penalties on 401(k) plans, giving some account owners up to three years to replace what they took out. Remember, this new legislation may not cover loans unrelated to the COVID-19 crisis.

If you have questions about what rules apply, you may want to get in touch with your former employer’s human resource team. As always, we are here to help, too.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information.

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with Alliance Wealth Advisors, LLC.

The views and opinions expressed herein are those of the speaker or writer and do not necessarily reflect the views of Alliance Wealth Advisors, LLC. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. All indices are unmanaged and may not be invested into directly.