A Smarter Way To Give: Understanding Donor-Advised Funds

Financial PlanningDec 18, 2025

When it comes to charitable donations, the traditional “giving model” is evolving. For thoughtful, tax-savvy donors, especially those with higher income or appreciated assets, a donor-advised fund (DAF) can be one of the most powerful and flexible tools available.

A donor-advised fund allows you to make a charitable contribution when it makes the most sense financially and decide later which organizations to support. That means you can lock in a tax deduction in a high-income year, allow the assets to grow tax-free, and distribute funds to qualified charities over time, all without the administrative burden of a private foundation.

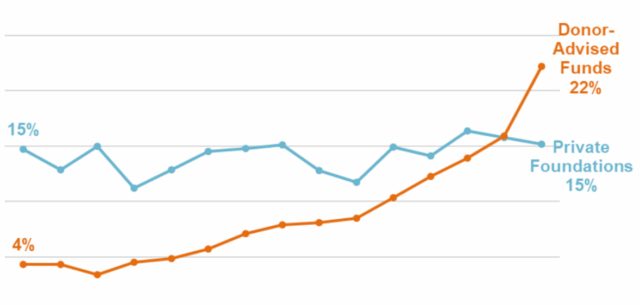

Percentage of U.S. individual charitable giving going to private foundations and DAFs over the last several years.*

With a DAF, you contribute cash, appreciated securities, or other eligible assets to fund that sponsors a public charity. While the charity becomes the legal owner of the contribution, you retain advisory privileges, giving you the ability to recommend when and where grants are made to qualified charitable organizations.

One of the most compelling benefits of a DAF is the ability to donate appreciated assets directly. By doing so, you avoid the capital gains tax you would otherwise incur if you sold the asset, while still receiving a charitable deduction for the full fair market value. Although annual deductions may be limited to a percentage your adjusted gross income (AGI), unused deductions can generally be carried forward for up to five years.

DAFs are appealing from a simplicity standpoint. Because the fund handles administration, recordkeeping, compliance, and tax reporting, donor-advised funds are far more cost effective and easier to manage than private foundations. This makes them an attractive option for individuals and families who want to give intentionally without the complexity. DAFs also offer meaningful flexibility. You can separate the timing of your tax deduction from the timing of your charitable grants, allowing you to research organizations, align giving with personal or family goals.

Who Might Benefit Most from a Donor-Advised Fund?

A donor-advised fund may be especially attractive if you:

- Experience years with unusually high or uneven income, such as from a business sale, bonus, or capital-gain event, and want to capture the deduction in those years

- Hold appreciated securities or other non-cash assets and want to give without triggering capital gains tax

- Prefer a streamlined charitable giving process without the complexity of running a private foundation

- Want to create a charitable legacy by contributing now and recommending grants over time

- Flexibility- the ability to pause, research, or respond as needs evolve rather than committing to recipients immediately

A donor-advised fund offers a powerful way to align charitable intent with thoughtful financial planning. By allowing you to give when it makes sense, enjoy tax benefits upfront, grow assets tax-free, and grant strategically over time, a DAF balances simplicity and flexibility in a single charitable fund. As with any tax or planning strategy, donor-advised funds are most effective when implemented as part of a coordinated approach. Working closely with your financial advisor and tax professional helps ensure your charitable giving fits within your broader financial plan, maximizes available tax benefits, and supports your long-term financial goals.

Citations:

- Chart source- Inequality. DAF giving is from the National Philanthropic Trust. Foundation giving is from the Giving USA.

- irs.gov

- fidelitycharitable.org

- vanguardcharitable.org

Disclosure:

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. Alliance also does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party mentioned in this communication and takes no responsibility. Federal taxes; states may differ. This is not intended to be individual tax advice. Please consult your tax professional. Additional disclosures can be found by visiting alliancewealthadvisors.com/legal-disclosures.