Why Diversify?

Investment ManagementApr 06, 2022

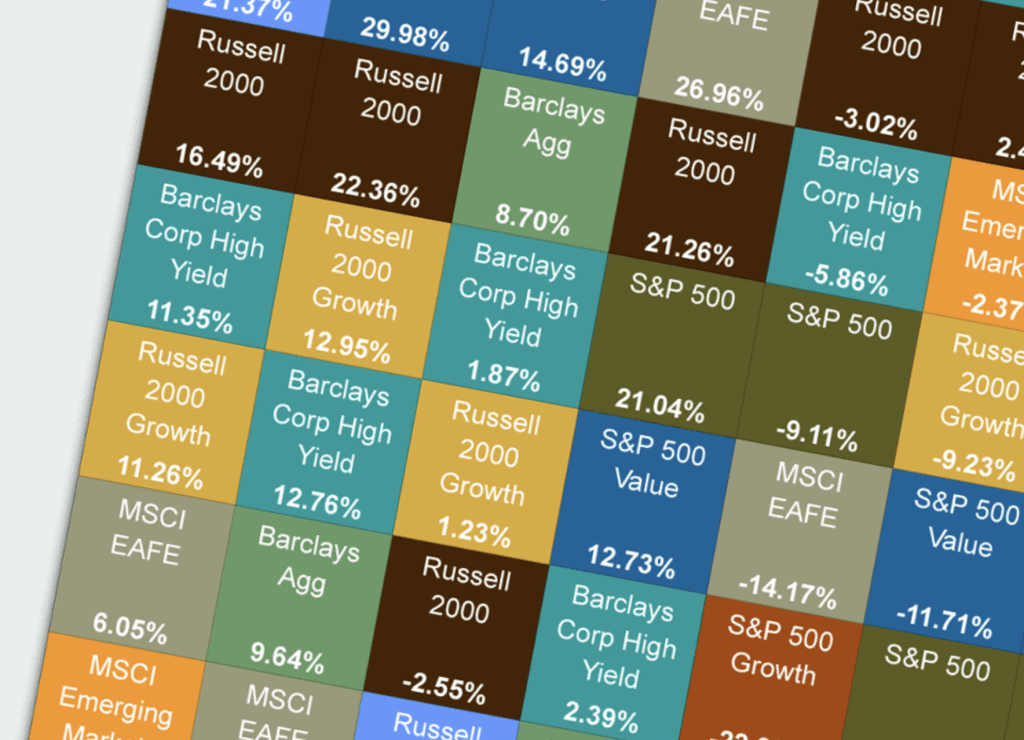

With more and more predictions of another “lost decade” on the horizon, we thought it would be a good time to discuss diversification. The last 13 years coming off the March 2009 lows have seen a significant outperformance of growth stocks and the S&P 500. As we’ve all heard many times in our lives, “All good things come to an end.” We don’t make forecasts in our writing, and we won’t start today. We are of the belief that short term predictions and market timing are not sustainable long-term strategies. Instead, we are going to use this as a reminder of why we diversify.

The last 10+ years have had some periods of frustration with the diversified portfolio. Why do I need international stocks? How come I am not all in tech? I should just buy an index fund. Why do I own bonds? I should have bought Bitcoin. The list goes on. We also live in a world that is constantly asking the question, “what have you done for me lately?”

The reality is that investing is a long-term game. Your average investor is putting money away with the hope of being able to retire someday. Retirement is usually decades away and with average lifespans increasing, people are planning on being retired for extended periods of time. The last decade is over and so is the one before that. While the talking heads may sound like they know what is coming in the next decade, they are making educated guesses.

To offer some context, we ran a globally diversified mutual fund against an Index fund that tracks the S&P 500 from the first trading day of 2000 to the last trading day of 2009. The globally diversified fund significantly outperformed the index fund. The index fund actually averaged a negative annual return over the 10-year period. A $10,000 investment in the index fund was worth just over $9,100 while the same $10,000 investment in the globally diversified fund was worth over $23,000.

We ran the same comparison from the first trading day of 2010 to the close of business at the end of Q1 2022. The index fund significantly outperformed. A $10,000 investment in the index fund was worth over $51,000 while the $10,000 investment in the globally diversified fund was worth a little over $21,000. It became more interesting when we ran it from the first trading day of 2000 until the end of Q1 2022. The globally diversified fund won with an ending value of just over $50,000 while the index fund was worth $47,000. Not only did the globally diversified fund outperform, it had less volatility along the way.

This is one of the many reasons why most investment advertisements end with the phrase “past performance is not indicative of future results.” Nobody knows what the next cycle will bring. Diversification and discipline work over extended time periods. While watching the current trends and talking about where the market is headed is fun (at least for some people), you shouldn’t let it interfere with your goals. Making a plan and committing to it will win over the long term.