Compounding- “The Most Powerful Force in the World”

Financial PlanningJan 15, 2021

As those of us in the Northeast hunker down for the remainder of winter, I thought using the snowball effect as an analogy would be fitting to help describe the concept of compounding. While the snowball effect is something all of us can intuitively understand- as the snowball rolls down the hill, it picks up more snow on each revolution and gets very large. The larger the hill the larger the snowball – it is also understating the absurdity that is compounding. Taking advantage of compounding can be the single best way to grow your money faster than inflation erodes it and build wealth. Historians still debate this, but the story goes that Albert Einstein called compound interest the most powerful force in the world. Regardless of who said it, they had a point.

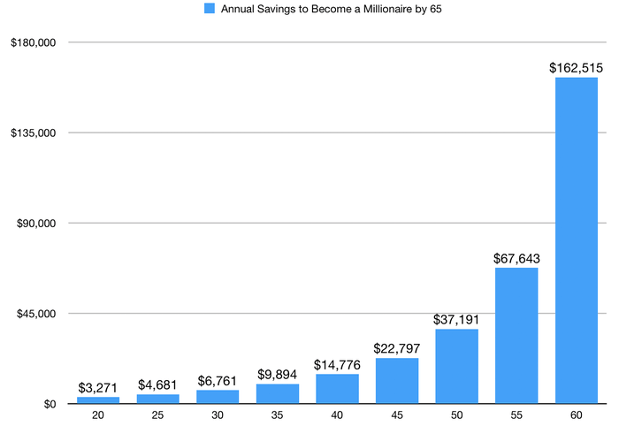

The bottom line is that the longer you consistently invest the larger the hill for your snowball to pick up steam and the bigger it will get. If you start younger, you will also need to start with less snow. The chart below reinforces how absolutely crazy the difference is if you start saving and investing for retirement when you are young. This chart is from Peter Mallouk’s book The Path, and details how much money you need to save and invest each year to become a millionaire by 65 for different ages. It assumes a 7% return annually, which is what a retirement account invested in a well-diversified stock portfolio has returned going back 100 years or so.

Source: The Path by Peter Mallouk

It is even more ridiculous if you break it down to savings by month. If in your early twenties you started saving about $270 a month and invested it, you would be a millionaire when you retired. For a 30-year-old the monthly amount would be $563. While this is a thought exercise and not a guarantee, you get the point. If you save and invest patiently, you can become a millionaire. As Charlie Munger said, “the big money is not in the buying and in the selling, but in the waiting.”

This is doable for most people, yet many of us choose not to. The human brain prefers to focus on what is right in front of it. We want a silver bullet and instant gratification, not incremental progress. Whether it’s the lottery, gambling, or picking the next hot stock on the Robin Hood app, we spend a lot of our time on the sexy thing when the process for building wealth is literally the exact opposite. In any of those examples, repeatable success over the long haul is almost impossible. There is a reason most lottery winners go broke. What many don’t realize is that growing and preserving wealth is as much about psychology and habits as it is about investment strategies and math equations.

What is funny about compounding, is that is not just a force that applies to money. Knowledge, diet, working out, and relationships are a few others that come to mind. The more you put into each every day (or don’t) over a long period of time, the more noticeable the impact will be down the road . Shane Parrish describes this concept: “When we watch people make small choices, like order a salad at lunch instead of a burger, the difference of a few hundred calories doesn’t seem to matter much. In the moment that’s true. These small decisions don’t matter all that much. However, as days turn to weeks and weeks to months and months to years those tiny repeatable choices compound. Our brains have a hard time intuitively understanding time, compounding, and uncertainty. All of those things conspire to work against us when it comes to habits and mental disciplines.”

In our view, working with a financial advisor shouldn’t just be about investments, and it definitely shouldn’t be about products. It should be about designing a repeatable process that creates financial independence which allows you to do what you want. This approach allows you to focus on enjoying life while accomplishing your goals, all while allowing the magic of compounding do its thing.

Citations

The Snowball Effect: How To Compound Your Wealth like Warren Buffett, Bob Ciura- Sure Dividend, September 22, 2020

The Path, Peter Mallouk-Creative Planning, 2020

Why Small Habits Make a Big Difference, Shane Parrish- Farnam Street, 2020