Inflation: The Hidden Tax on Everything and Everyone

Financial PlanningJan 08, 2021

One of the most underappreciated forces that will impact your life financially is inflation. It is the most important hurdle to clear in order to build wealth over the long-term. Unfortunately, it is also arguably one of the least understood things in economics. Regardless of if you are an economist trying to study what causes it, or someone just trying to get by paycheck to paycheck and save for retirement, it can be a confusing subject. The reality is, whether we try to understand it or not, inflation is a factor that needs to be included when it comes to any goal you want to accomplish financially.

So, what is inflation? To put it as simply as possible, it is the decrease in the purchasing power of your money over time. $100 today on a trip to the store is one thing, but that same $100 will buy you a lot less ten years from now. As more money enters the system, the price of everything increases over time. Have you ever heard a relative start a rant with “back in my day…” and discuss how the price of milk, gas, or the house they bought years ago was much cheaper? That is inflation at work. It is important to note that inflation works both ways. What is often forgotten during those moments of nostalgia is that wages (and overall quality of life for that matter) were also much lower back then too.

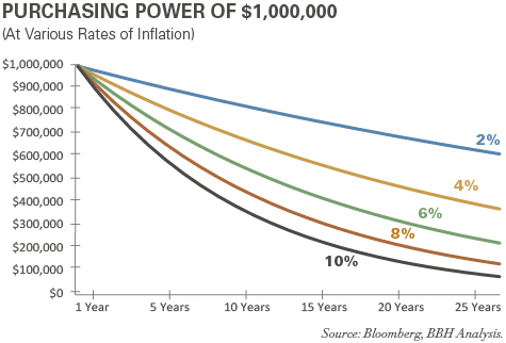

To explain this concept, Scott Clemons, the Chief Investment Strategist at Brown Brothers Harriman & Co., uses the above chart. If you had $1,000,000 and put it into a no interest savings account (or stuffed it under your mattress), in 25 years that would be worth the equivalent of $500,000 if inflation averaged just 4% annually. While those of us who weren’t making financial decisions in the 1980’s probably can’t appreciate the idea of high inflation very much, those who lived through the inflation of that decade certainly can. (See The Fed: Part I). Even at 2% (where inflation has been in recent years), this would wipe out over a third of your purchasing power over that same period.

This is why it is so important to have your assets invested in a way that protects your purchasing power and allows you to preserve and grow your wealth. Holding cash over long periods can erode purchasing power substantially. In other words, the idea is that how much money you have isn’t what matters in the long run, it is how far that money can take you. That is the difference between making money and being wealthy.

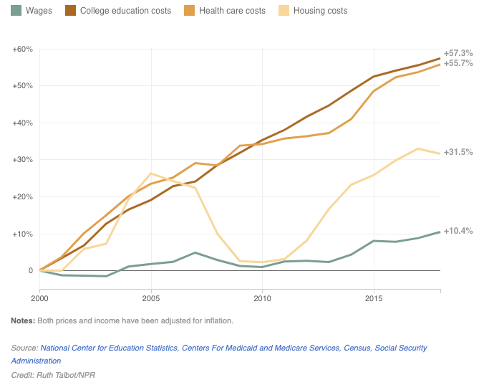

The most widely used measure of inflation is the Consumer Price Index (CPI) which is followed closely by government officials and economists. It measures a basket of common goods purchased by consumers as a barometer for the rate of inflation. However, it’s important to understand inflation isn’t just this one number, but an average of the increase in the price of everything. Like anything else, your success in measuring it depends entirely on what variables you include. While the CPI is helpful, it does not include price increases in areas like education (lol), or healthcare where costs have exploded over the last decade plus (see below).

Traditional measures of inflation also do not include housing, stocks or other financial assets. As Chief Investment Strategist for Charles Schwab Liz Ann Sonders recently said in an interview when asked why we haven’t seen inflation “we’ve had plenty of it (inflation), it’s just been in asset prices and not the real economy.” As the Federal Reserve has focused on lowering interest rates (the cost of capital) and asset purchases (printing money) in the decade following the Global Financial Crisis, we have seen that flow of money drive assets prices higher. It is not a coincidence that whether you look at education, healthcare, housing, or the stock market, as more money was made available you saw the prices for all of them increase substantially.

Given all of this, you therefore have to save for retirement (or to pay for college for your children, save to buy a vacation home etc.) not in today’s dollars, but in tomorrow’s. While this may seem overwhelming, next week we will dive into the best way to beat inflation and build wealth.

Hint: it is another seemingly invisible force, but one you can use to your advantage.

Citations:

What We Believe: Principles of Investing, Scott Clemons- Brown Brothers Harriman & Co., March 12, 2018

The Long View Podcast- We Could See Some Inflation Scares, Morningstar, January 6th, 2021

Paycheck-To-Paycheck Nation: Why Even Americans With Higher Income Struggle With Bills, Alina Selyukh, NPR, December 16th 2020