Off the Page- Do You Have “Trust” Issues? with Attorney Scott Lynett

Financial PlanningJun 26, 2024

We often receive questions from clients about whether they should have a trust. While the reasons vary, they most often pertain to earmarking money for children or grandchildren, protecting money if they end up in a nursing home or leaving money to charity. The reality is trusts are very complex and there are legal costs associated with them. Furthermore, there are guidelines to follow that often leave the funder with less control over his or her own money. For that reason, we recently sat down with Attorney Scott Lynett of Legacy Planning. Scott joined us to discuss the basics of trusts and estate planning to help listeners understand this very complicated topic.

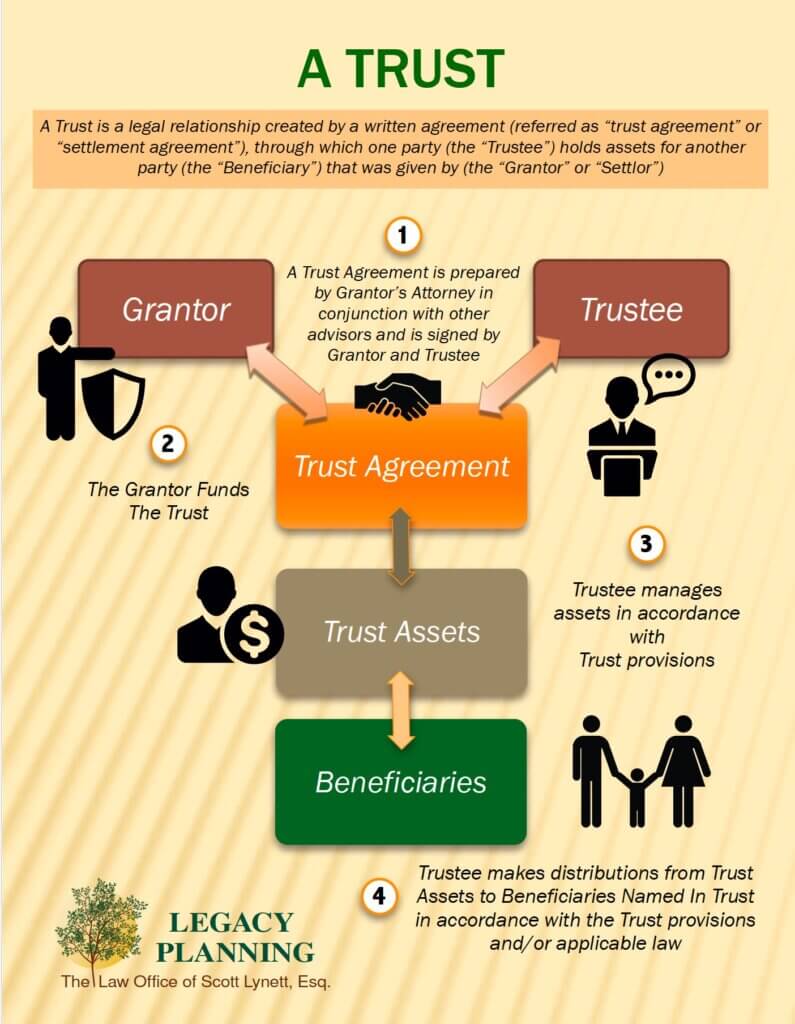

Below is a list some of some common advantages of trusts and some considerations for each benefit. We also included a visual Scott provided to help break down a trust and the roles that are involved.

Bypass Probate

This enables the money to pass through directly to the beneficiaries in a timely fashion without incurring the costs associated with the probate process. There are other ways to avoid probate without creating a trust. Qualified assets such as IRA’s and 401(k)’s have beneficiaries and avoid probate. You can also add a beneficiary to your non-qualified accounts.

Tax Advantages

Certain trusts effectively transfer assets out of your estate, which can reduce estate and gift taxes. It is important to note that this usually pertains to federal estate tax planning. Each state has its own guidelines. On the federal side, the exemption for 2022 is $12.06 million per individual and $24.12 million per couple. This means that if your estate is worth less than these amounts, you don’t have to concern yourself with avoiding the federal estate tax of 40%. However, these limits are subject to change, and it is almost always an item of debate in Washington.

Protecting Assets

The transfer of assets out of the estate also affords you some protection from creditors. This is the attraction to people who are concerned about going into a nursing home. There are different rules that vary by state, so it is imperative to understand those rules before taking any action. There are other ways to protect your assets from the nursing home such as long-term care insurance or cash flow from your assets and income sources. If you have enough assets and income sources, you may not need a trust or long-term care insurance to cover nursing home costs. If not, you need to understand the tradeoffs of purchasing insurance vs. opening a trust.

Control of Assets

While you give up some control of your assets in a living trust, a testamentary trust gives you control of the assets after death. This is sometimes referred to as “control from the grave.” This trust is set up after death according to your will. It can define terms for how your assets are distributed and utilized by your beneficiaries.

A trust can be revocable or irrevocable. You have to be comfortable with the terms and the benefits you are receiving if you choose an irrevocable trust. The tax benefits and asset protection usually pertain to irrevocable trusts. Once you outline the terms they cannot be changed. The revocable trust can be changed at any time, but the main benefits you receive from a revocable trust pertain to probate.

This article only scratches the surface. There are many types of trusts, and it can get very complex. If you are considering a trust, you need to define your objectives. Once you do that, you can work with a professional to determine the best course of action to accomplish your goals and if a trust is necessary. As we have written many times, every financial decision comes with a tradeoff. Take the time to weigh out the options and make the best decision for you and your family.

The information in this interview is provided for informational purposes only and should not be taken as investment, legal, or tax advice. Opinions expressed in this interview are subject to change without notice. It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results and diversification does not guarantee a profit or protect against loss in a declining financial market. Alliance Wealth Advisors, LLC (“Alliance”) is an investment advisory firm that is independently owned and operated. Alliance does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party mentioned in this communication and takes no responsibility. For more information regarding Alliance, please visit alliancewealthadvisors.com/legal-disclosures.

Attorney Scott Lynett did not receive any compensation. He also is not affiliated and not client of Alliance Wealth Advisors at the time of this publication.