Lessons from the First Half

Investment ManagementJul 17, 2025

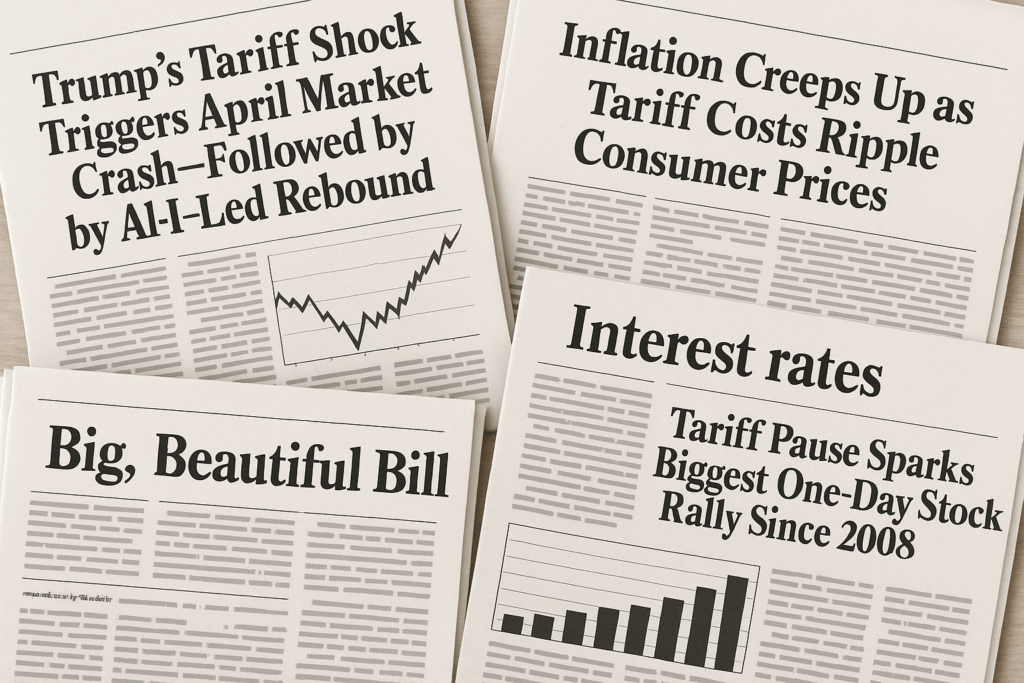

With the 4th of July behind us and the dog days of summer setting in, it is often a good time to reflect on the first half of the year. While every year has its ups and downs, this one seemed to have a full year’s worth in the first half. As you look at the major headlines of the first half of 2025, it might leave you scratching your head when you see the markets at or near all-time highs.

The year started with the new administration taking over the White House. President Trump wasted no time implementing his agenda, particularly with trade policy and tariffs. He began to aggressively pursue trade deals with all our major trading partners across the globe using tariffs to level the playing field. The uncertainty associated with trade had the market trading on hourly headlines leading to volatility that we haven’t seen since the beginning of Covid in early 2020.

On the geopolitical front, the war between Russia and Ukraine passed its third anniversary with no end in sight. If that wasn’t enough, tensions between Iran and Israel escalated to the point where we intervened and bombed Iran’s nuclear facilities.

In economic news, GDP was negative in Q1 for the first time since 2022. In case you don’t remember, that was an ugly year for stocks and bonds. Inflation remains persistent, putting the Fed in a difficult position. Many people think that rates should be lower, but the Fed is on pause due to inflation fears. This is causing tension between President Trump and Fed Chair, Jerome Powell. The level of interest rates continues to be a topic of debate. We wrote about this in more detail last year and you can find that article here.

Finally, our debt continues to swell to record levels with no relief on the horizon. Although it technically happened right at the beginning of the second half, the highly criticized “Big, Beautiful Bill” was signed into law on the 4th of July. Many critics including Elon Musk have been very vocal about how this does nothing to address our debt and keeps our country on a poor fiscal path.

If you didn’t watch the market and just read all the headlines, would you expect the market to be trading at all-time highs or would you think we’re in a bear market? This is a perfect depiction of why markets are so unpredictable and serves as another reminder of why market timing is not a viable long term investment strategy. We’ve written about it many times and it is one of our Foundations of Investing.

Every year is filled with learning opportunities that apply to all aspects of life. The first half of 2025 was a great lesson in investing. Markets fluctuate. Sometimes at higher rates than others. Volatility is the price you pay for long term growth. Don’t let the headlines drive your emotions. Zooming out and focusing on the long term will pay off over time.

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. This publication should not be interpreted as legal, tax, or investment advice. For more information, please visit alliancewealthadvisors.com/legal-disclosures