Rate Realities: What is a “Normal” Interest Rate Anyway?

Investment ManagementMay 30, 2024

We can all agree that things cost a lot more these days. The Federal Reserve has used higher interest rates to try to cool demand and bring down inflation. While they have had some success in taming the pace of inflation, they are still not where they want to be. The result has been a continuation of higher rates. This is despite most predictions going into 2024 calling for multiple rate cuts. As we enter mid-year, there are no rate cuts in sight even though some are stubbornly committing to their calls for lower rates.

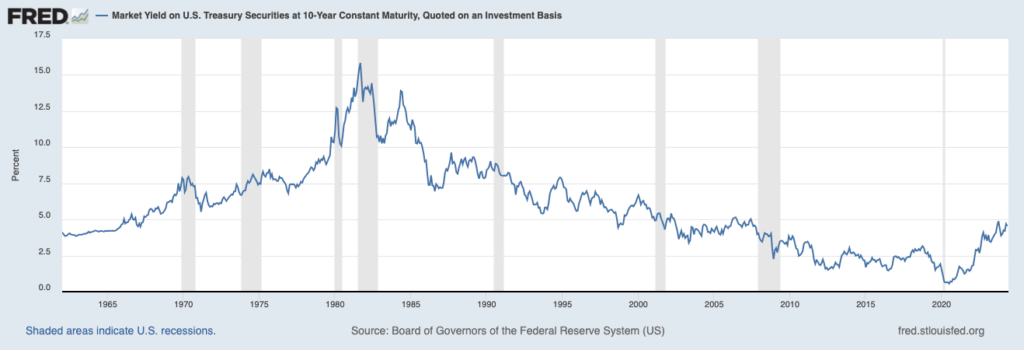

Should they be cutting rates though? More importantly, are rates really high? From a historical perspective, the answer is no. We were spoiled by the low interest rate policies from late 2008 into 2022. However, if you go back to life before the 2008 financial crisis, today’s rates are normal, and some would even argue that they are a little low. Some of the baby boomer readers can relate when they think back to their mortgage rates when they bought their first homes. Below is some historical information on interest rates including the average 10-year Treasury rate, average 30-year mortgage rate and average Fed Funds rate for the years 1980, 1990, 2000, 2010, 2020 and current. The links in the citations to each source include information on every year in those decades for those that are interested.

1980

Average 10-Year Treasury Rate – 11.43%

Average 30-Year Mortgage Rate – 13.74%

Average Fed-Funds Rate – 13.35%

1990

Average 10-Year Treasury Rate – 8.55%

Average 30-Year Mortgage Rate – 9.97%

Average Fed-Funds Rate – 8.10%

2000

Average 10-Year Treasury Rate – 6.03%

Average 30-Year Mortgage Rate – 8.08%

Average Fed-Funds Rate – 6.24%

2010

Average 10 Year Treasury Rate – 3.22%

Average 30 Year Mortgage Rate – 4.86%

Average Fed Funds Rate – 0.18%

2020

Average 10 Year Treasury Rate – 0.89%

Average 30 Year Mortgage Rate – 3.38%

Average Fed Funds Rate – 0.36%

May 2024*

10-year Treasury Rate – 4.46%

Average 30-Year Mortgage Rate – 7.16%

Average Fed-Funds Rate – 5.33%

*Data through May 24, 2024

While that is certainly a lot of data, you can see the drop off in rates after the 2008 financial crisis with the preceding years being higher than today’s rates. There are plenty of arguments for lower rates. Easier money leads to more investment and development, which leads to job creation and prosperity. However, it comes at a cost. Inflation. The decade plus of easy money caught up to us after Covid and we’re all paying for it in the grocery store, at the gas pump and anywhere else we purchase goods or services.

The major benefit to investors from higher rates is better returns on your safe money. Bonds haven’t been a strong contributor to portfolio returns in the past 15 years and cash was literally returning a fraction of a percent. Fortunately, equities had above average returns during that period. The next 15 years will likely be different than the last 15 years and you can already see it on the safe side of a diversified portfolio. We’re excited to invest money in a time where we can actually expect some return out of bonds and cash.

We are living in a different environment than we lived in from 2009-2022. There were a lot of things about that time period that weren’t normal and there will likely be new abnormalities in the years ahead. So far, the economy has been resilient despite the higher rates and that is a good thing. If the economy can continue to function without the support of easy monetary policy, that is a sign of stronger footing in the economy. More importantly, it gives the Fed more options next time the economy slows down.

We can’t control the performance of the economy, interest rates or the market. The interest rate predictions going into 2024 are another reminder that nobody really knows. We’re much better off tuning out the noise, maintaining our discipline, and focusing on what we can control.

Sources:

macrotrends.net – 10 year Treasury