Let’s Talk About Debt, Baby

Financial PlanningNov 13, 2020

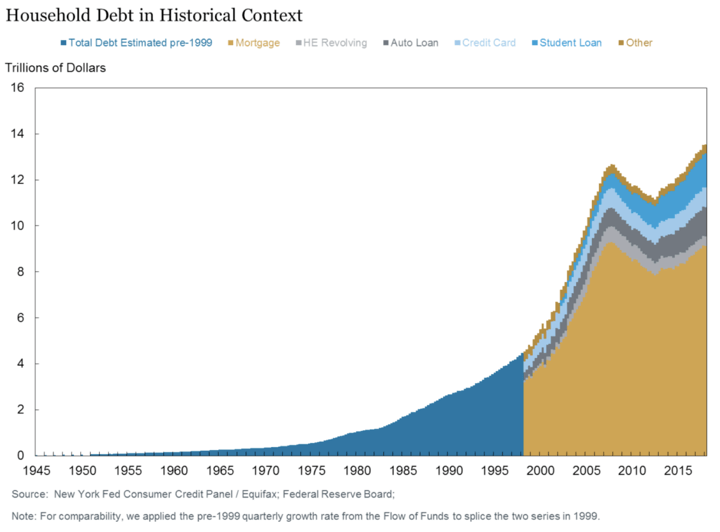

Since the end of World War II, much of the US economy has been built on spending by the American consumer (today consumption makes up 70% of the economy). It was this period in time after the war that American families began relying more and more on debt to help finance their lifestyles. From the G.I. Bill providing returning American soldiers with the ability to buy their first homes, to the first ever credit card which was introduced in 1950, Americans had more access to credit (debt) than ever before.

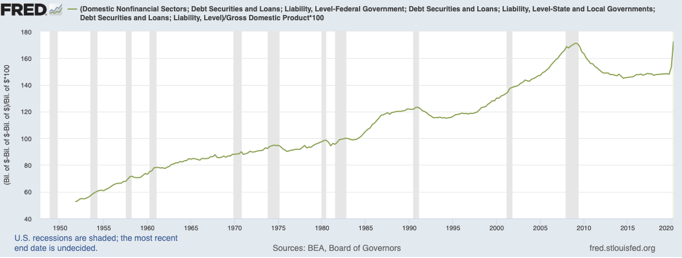

As people were gaining more access to debt, their wages were also growing rapidly and so debt grew largely in line with incomes until the late 1970s. As the growth of people’s incomes slowed from about 1979 through the Global Financial Crisis of 2008, household debt as a percentage of GDP exploded. During this time people had gotten in the habit of spending more and more but wages for many did not keep up as it had in the past. A generation of Americans who grew up dirt poor in the depression and despised debt and financial complexity gave way to a generation who viewed debt as “normal” with teenagers who got credit card offers in the mail.

At the risk of boiling 80 years of financial history into a couple of paragraphs, the point is this: debt became a larger and larger factor in the economy and for American households in a relatively short amount of time. Credit card debt, credit scores, pay day loans, stores asking you to apply for credit cards when you buy a pair of jeans, the sub-prime mortgage crisis, student loans- the list goes on. They are all based on new ways to monetize debt and are fairly new in the grand scheme of things. Now, debt on its own is like anything else: it is neither good nor bad. It simply is. Further, debt cycles have been around for as long as money has existed. Increased access to credit has also prevented economic recessions from being as severe or as long as they once were. Just like you can’t only look at one side of your balance sheet, you need to look at the whole picture and zoom out for historical context.

So, why does any of this matter to you? As cited in Morgan Housel’s book The Psychology of Money, Angus Campbell wrote a book called The Sense of Well-Being in America that studied what caused happiness and contentment in people. The answer was having a strong sense of control over their lives and decision-making. In other words: having options when it comes to how to spend their time and money. Leaving a job that you don’t like to pursue a new line of work that pays less is harder if you are saddled with debt. So is spending more time with your children, traveling, or donating to causes that you care about.

Debt, if taken beyond a certain point, is a gigantic weight that limits how agile and flexible you can be when it comes to your quality of life. It is like Wile E. Coyote carrying an anvil while chasing the Road Runner. Today, more people than ever are chasing the Road Runner with an anvil on their backs.

If you do not include your debt as part of your financial plan, everything else you do right won’t matter as much. Deciding to pay down debt versus contributing to a retirement account is something that needs to be weighed carefully. A financial plan helps create a process for these decisions and should be based on your personal situation and goals in life. To be clear, the only guarantee is that your goals will change, and your plan will change with them. However, even with that constant change, it is still a framework you can use to help build the life you want and keep your options open every step of the way. As the saying goes, a goal without a plan is just a wish.

Citations:

New York Federal Reserve

Federal Reserve of St. Louis Economic Data

Congressional Research Service: COVID-19 Household Debt During the Pandemic

The Psychology of Money, by Morgan Housel

The Sense of Well-Being in America by Angus Campbell