Money Market Funds: Cashing In or Missing Out?

Investment ManagementDec 07, 2023

Stocks are staging a major rally so far in 2023. Bonds are also positive. After over a decade of record low interest rates kept returns in the fixed income world muted, many believe “bonds are back” as a source of returns in a portfolio moving forward. Assets like gold and Bitcoin have also seen positive returns so far this year. Despite all of this, none of these asset classes are getting the most attention. In 2023, cash is once again “king” for many, as investors have poured record amounts into money market funds so far this year.

Before going any further, let’s explain what a money market fund even is. Money markets are mutual funds that generally hold very short-term and safe assets like government debt. To remove the jargon, think of a money market fund like a parking spot for your cash that provides cover from the ups and downs you experience while invested in other assets like stocks and bonds. Investors utilize them because they provide price stability while paying you income based on where interest rates are. While they are not completely free of risk, investors anticipate that the value of a money market fund will rarely move up or down very much. Money market funds are also liquid, meaning they can be sold to raise cash easily if an investor needs it. If you don’t need the money, the fund will pay you interest for as long as you stay invested.

Over $1 trillion has flooded into money market funds since January 1st. While that is a big number, it probably doesn’t mean much on its own. So for context, from 2012-2022 the average net inflow for money market funds each year was $179 billion.

Let’s discuss why this is happening and what it means.

Money market funds are paying you again

There are a few reasons for the reinvigorated love affair with cash, but the first one is simple – interest rates have gone up at a breakneck pace as the Federal Reserve continues its efforts to tamp down inflation. To put it more simply: money market funds are paying investors to hold cash again. Since the 2008 Global Financial Crisis savers have had to make a choice: take more risk or settle for less return. Right now that is no longer the case. Cash appeals to people at all stages in life, albeit for different reasons. For many people who joined the work force after 2008, the ability to make 5% on your cash savings has been unheard of for their entire adult lives. Meanwhile for people closer to retirement, being able to make a decent return while taking less risk is a welcome development.

An alternative to bank savings

Another reason for the flows into money market funds is that many banks are still refusing to pay depositors any meaningful interest on their cash. If you are getting less than 1% on your cash in a savings account, investing in a money market paying 5% has felt like a no brainer for many people. Further, concern with bank deposits certainly played a role in the flows to money markets as well. The fall of Silicon Valley and Signature Bank last spring made people realize that having an excessive amount of cash in their bank accounts wasn’t as risk free as they thought.

It feels safe

There is more to this flight to cash than interest rates allowing people to get paid a little more on their savings. Holding cash also provides “psychological comfort” at a time when both consumer and investor sentiment remain near historic lows. Polls and data consistently show that people feel uneasy and uncertain about the state of the economy (and things in general). The constant barrage of negative headlines over the last few years have left many feeling mentally exhausted. In short, holding cash can feel like the portfolio equivalent of a warm fuzzy blanket that helps people sleep at night in uncertain times.

One of our investment foundations is that “there is no such thing as a free lunch”. You simply can’t get something for nothing as an investor. Everything has risks and trade-offs. Including cash. Understanding this, what are the potential risks of holding too much cash?

Parking more in cash has provided mental relief from the volatile ride of markets since 2020, but has it actually paid off? While the last few years have not felt “normal” for investors for many reasons, stocks have behaved in line with how they normally do over long-term. It has just been a wild and noisy ride along the way. Look at the last three years for the S&P 500:

2020: +18.4%

2021: +28.71%

2022: -18.1%

2023: +21.5% (as of 12/4)

The average comes to about 10.9%, which is similar to long-term averages. As Howard Marks is fond of saying, stock market returns are like the pendulum on a clock:

“The mood swings of the securities markets resemble the movement of a pendulum. Although the midpoint of its arc best describes the location of the pendulum “on average,” it actually spends very little of its time there. Instead, it is almost always swinging toward or away from the extremes of its arc.”

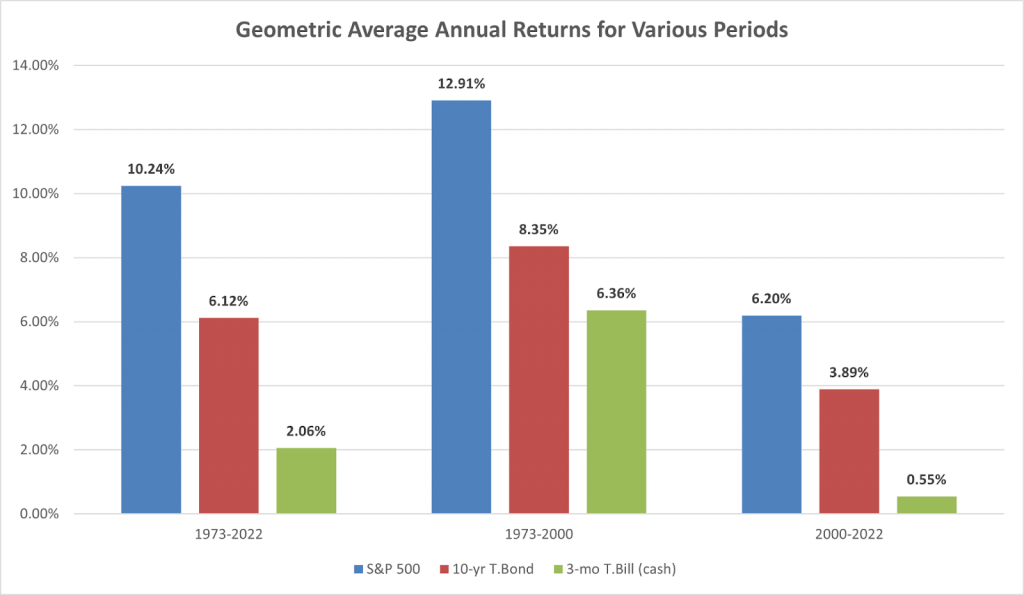

Think about all the doom and gloom headlines that kept many investors on the sidelines over this same period. Unfortunately we do not get to choose when the big up markets are going to come. We also can’t reliably time when to buy and sell to avoid the down markets. Over the long-term cash simply does not provide the upside that other asset classes do in order build and protect wealth:

Source: Barbara Friedberg Personal Finance, NYU Stern

Over longer time horizons, holding a lot of cash can go from being a source of psychological comfort to what Ben Carlson aptly labeled a “cash addiction”. He explains why:

“…once you do it, market timing can lead to a cash addiction. When markets are falling you assume they will fall even further. Cash becomes a safety blanket. When markets are rising you assume they are too expensive and will correct at some point. Again, cash becomes a safety blanket.”

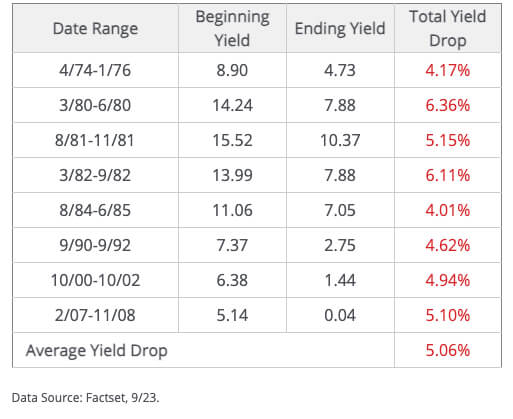

The other major risk in holding too much cash is that historically interest rates have come down very quickly. This is called reinvestment risk, or the risk of holding too much short-term cash and then needing to reinvest that money at a lower rate of return. If you are sitting on a large cash position anticipating you’ll be able to make 4 or 5% for a long time, you might be caught flatfooted if rates drop quickly. For savers and those nearing retirement this is a big deal. We need to preserve our purchasing power from inflation and taxes. The below chart is from a Hartford Funds report, but the title says it all: “Your Juicy Cash Returns Could Disappear Quickly”

So how should investors think about cash in the portfolio?

The short answer is it depends. Cash is simply a tool. To paraphrase Tom Morgan, tools are neutral. The outcome of utilizing cash, just like utilizing a hammer, will depend on the person using it and the situation. Your cash position should be personal to YOU. Working with a financial planner to come up with the proper asset allocation across your balance sheet can help you determine what is appropriate. Diversification- or having a combination of stocks, bonds, as well as cash and other assets should be determined based on your situation. A good financial plan creates different buckets with specific “assignments”. This can ensure you don’t miss out on long-term growth while still having the comfort that comes with holding cash in uncertain times.

Citations:

Gush of cash into money market funds tipped to continue in 2024, Harriet Clarfelt, Kate Duguid and Brooke Masters, Financial Times, December 3, 2023

Overcoming a Cash Addition In Your Portfolio, Ben Carlson- A Wealth of Common Sense, November 30, 2023

Cash’s Big Blind Spot, Callie Cox- The Bottom Line, November 17, 2023

Your Juicy Cash Yield Could Disappear Quickly, Hartford Funds, November 2023