CONTRIBUTING TO YOUR RETIREMENT PLAN IN 2024

RetirementDec 13, 2023

The contribution limits for 401(k), 403(b) and 457 plans have been increased for 2024 to $23,000 for savers that are under 50. For those that are 50 and older, an additional $7,500 can be added for a total contribution of $30,500. These limits apply to traditional contributions, Roth contributions or a combination of both. It is worth noting that no matter how you contribute, the aggregate total cannot exceed the limits. For savers that utilize Simple IRA plans, the contribution limits have increased to $16,000 for those that are under 50 and savers over 50 can contribute an additional $3,500 for a total contribution of $19,500.

Many people ask us how much they should contribute. The simple answer is to start early and contribute as much as possible. If you are fortunate enough to be able to contribute the maximum, then you should take advantage of it. If you are not even close to being able to max it out, that is completely fine as well. No matter where you stand, it is most important that you participate on some level. While there are maximum contributions, there are no minimum contributions. Whatever amount you can put in will leave you with more than you would have had without participating. Furthermore, the funds that you do contribute will allow you to take advantage of the power of compounding.

One goal to start with is to contribute enough to maximize the employer match. Many retirement plan providers have technology that lets you add automatic escalation to your contribution. This will help you build up your contribution rate in small increments over time. If you’re not able to contribute enough to get the full match initially, you can start small and work your way up. For example, you can start at 2% to get the ball rolling and then commit to increasing by 1% each year until your contribution rate reaches the rate to get the full match (or a higher rate of your choosing). This enables you to get started without putting too much stress on your monthly cash flow and the annual increases will make a significant difference over time.

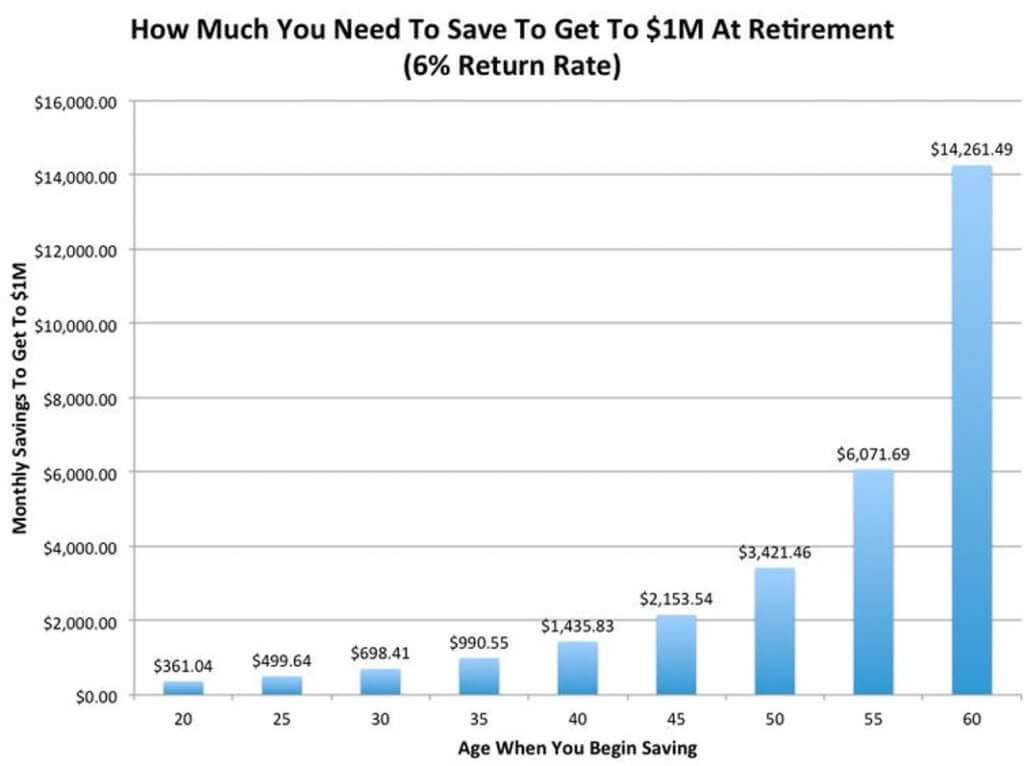

Whether you are maximizing the employer match or don’t have an employer match, it is imperative to start as early as you can. The chart below demonstrates both the power of compounding and the rewards of starting to save early.

It is no secret that the path of least resistance to having $1 million at age 65 is to start early. If these numbers are intimidating to you and feel unrealistic, don’t get discouraged. Remember, there is no minimum. The chart is a simple guide to highlight the benefits of starting early. The main point is that whether you make $30k, $50k or over $100k, don’t put off contributing to your retirement plan. The barriers to entry are low. No matter how much or how little you end up contributing, it will add up in the long run.