Part III: Accumulation of Assets

Financial PlanningJan 25, 2022

In Part I of our Taking Inventory Series, we walked through the incredibly important exercise of putting together a balance sheet to get an idea of where you stand. Part II then took it a step further in highlighting how to think about organizing the asset side of the balance sheet. In Part III, we will take you through the thought process of applying the balance sheet and buckets to the goal of one day achieving the flexibility to retire comfortably.

Many retirement planners equate asset accumulation to climbing a mountain. You spend the majority of your working life building towards that goal of being able to walk away and have enough assets to last for the rest of your life. As you make your way up the mountain, you inevitably run into hurdles. Some deterrents to retirement saving can include education for children, major purchases, and vacations to name a few. The reality is you have to balance between thinking about the long term and living your life today. The Bucket approach that we discussed in Part II is very helpful in maintaining that balance. For example, your mid-range bucket can be earmarked for some of the hurdles while you let your long-term money accumulate.

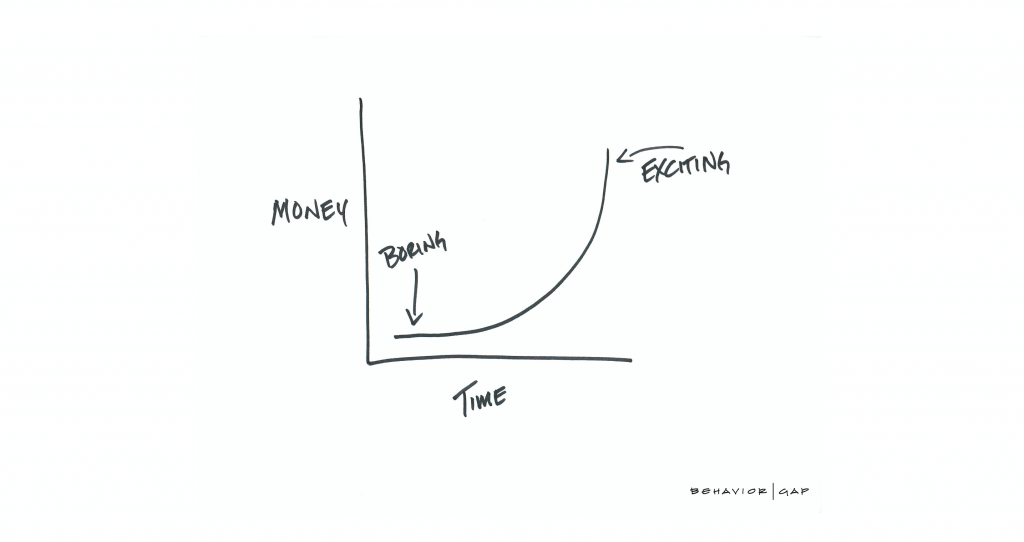

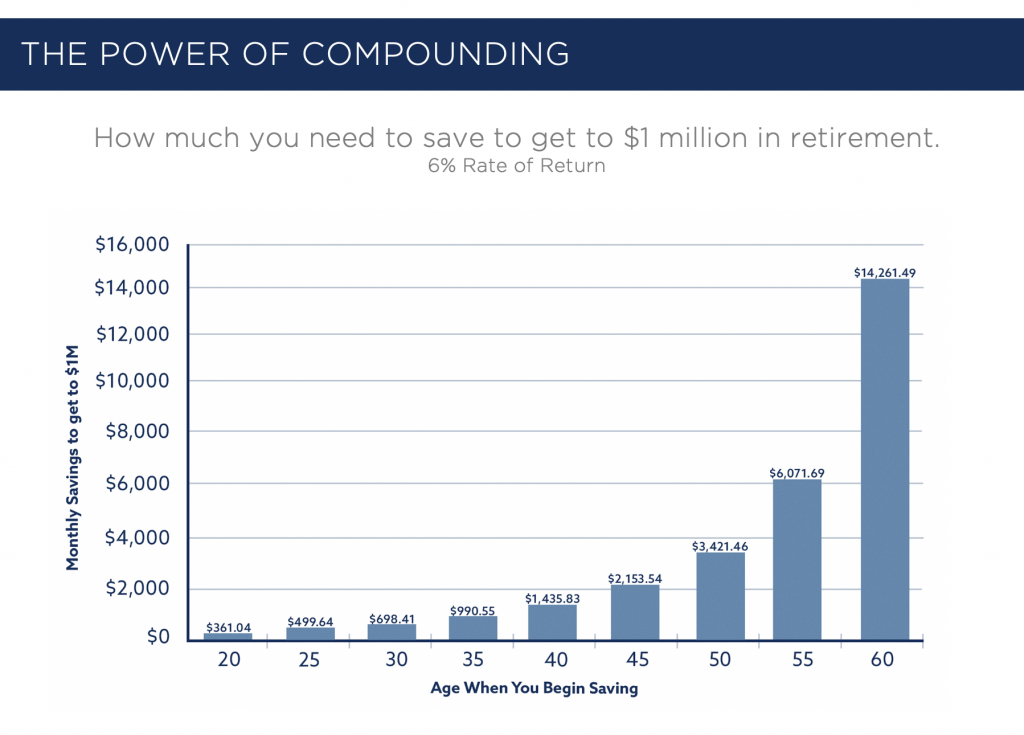

The importance of saving early and cleaning up your balance sheet cannot be stressed enough. The power of compounding can be your best friend or your worst enemy. If you commit to putting away some money for the long term early while eliminating crippling debt like credit card debt, the compounding will be working for you instead of against you. It is the equivalent deciding whether you would rather have the best player in the league on your team or on the other team. The faster you have compounding on your team, the easier it will be to build wealth.

The balance sheet essentially acts as the scoreboard during the accumulation years. Your goal is to increase the assets and decrease the liabilities as time goes on. It really is that simple. On the liability side of the balance sheet, high interest credit card debt should be prioritized to be paid off before lower interest mortgage debt that can have some potential tax benefits. As you get closer to the end of the accumulation phase, you should be thinking about finishing off that mortgage. It is also important to remember that each debt you pay off creates more cash flow that can be applied towards other debt or systematic savings. That cash flow can also be factored in when you are determining how much money you need to retire.

As you work through the accumulation phase and climb the mountain, there are clearly a lot of factors to consider. You have to be realistic in prioritizing different goals along the way so that you can build your assets and reduce your liabilities. The whole process emphasizes the importance of making a plan and monitoring it regularly. While there is no magic bullet, having a plan will undoubtedly put you in the best position to make it to the top of the mountain and enjoy the fruits of your labor.