AI Is Here. The Economics Behind It Are Still Loading.

Investment ManagementNov 19, 2025

Every era has its “big idea”. The one that reshapes the way the world works, changes the economy, and sometimes even drives investment mania in the financial markets. Railroads once did that. So did automobiles, radio, television, and the internet to name a few. As anyone paying attention to the markets and the news cycle these days is constantly reminded, today it’s Artificial Intelligence (AI). Like all transformative technologies, AI comes with an evolving mix of truth, hype, and risk.

While the Dotcom bubble of the late ’90s and early 2000s has been the obvious comparison, writer Derek Thompson recently compared AI to something much further back in our history: the transcontinental railroad build-out. The railroad buildout remade society, but not without a lot of market chaos and panic. Companies overbuilt, and investors got caught up in the excitement. Railroads changed the world, but they crushed investors who confused hype and momentum with a sure thing. Similarly, while AI may transform the next century, as we are fond of saying, there is no such thing as a free lunch in the investment world.

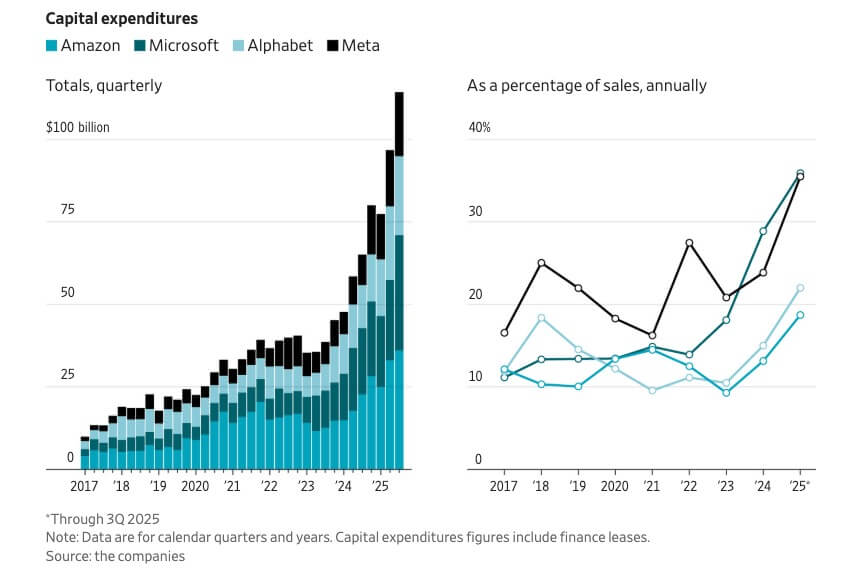

The Wall Street Journal recently wrote about the AI infrastructure buildout and provided several charts that help paint the picture of the magnitude of this build out. The big technology companies that led the stock market higher over the last decade plus were primarily asset-light, software-focused businesses that dominated their competition and were priced accordingly. Today, they are investing insane amounts of their free cash flow on physical infrastructure and power generation to chase new (but unproven) revenue streams. These two facts may now be in direct conflict with one another.

The size of the build out will have all sorts of domino effects. Electricity costs are surging, and the power grid will need to produce a lot more of it to keep up with demand. Chip supply is constrained, and the most cutting-edge chips these companies need often become obsolete in just a couple of years. This is to say nothing of the time constraints that come from constructing the massive data center projects that have been announced so far. The AI buildout will take enormous resources for the foreseeable future. Most of the press releases being announced lack a lot of specific details, and many of the major projects haven’t even broken ground yet.

Will all this investment pay off in the near term? Spending is accelerating, but profits aren’t (at least not yet). When will investors start demanding them from the big AI players? So far, companies have been raising and spending money on the assumption that future revenues will justify the costs, and investors have been content to go along with it. Recently though, we have seen some market commentators begin to question some of these assumptions. Even the leaders of the companies doing all this big spending are struggling to confidently explain how the economics will work in the long run.

The market itself has been “melting up” for a while now, with AI hype being the main catalyst. Investors seem to be pricing in that a perfect scenario will play out with very few setbacks along the way. Even if you believe AI is the next internet, it’s important to remember most of the speculative stocks getting all the hype back then ended up being terrible investments. In fact, the entire S&P 500 produced a negative return from 2000-2009. While past results are no guarantee of future performance, the stock market has historically struggled to live up to expectations when valuations were this high.

In uncertain times, building a resilient household balance sheet and matching different investments with your needs and varying time horizons is essential. Investors rarely make good decisions in moments of hype and euphoria. The same is true in moments of panic. Diversification and a balanced approach rooted in individualized planning aren’t outdated, but they always feel like they are just before sentiment changes.

Dive Deeper: Last year we sat down for an episode of Off the Page with Stephanie Aliaga, Global Market Strategist at J.P. Morgan to discuss the A.I. build out and its impact on the stock market.

Citations:

AI Could Be the Railroad of the 21st Century. Brace Yourself. Derek Thompson, Substack, November 4, 2025

When AI Hype Meets AI Reality: A Reckoning in 6 Charts, Christopher Mims, Nate Rattner, Wall Street Journal, November 14, 2025

Wall Street Blows Past Bubble Worries to Supercharge AI Spending Frenzy, Matt Wirz, Peter Rudegaeir, Wall Street Journal, November 16, 2025

Disclosure:

It is important to remember that investments in securities involve risk, including the potential loss of principal invested. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in a declining financial market. Alliance also does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party mentioned in this communication and takes no responsibility. Additional disclosures can be found by visiting alliancewealthadvisors.com/legal-disclosures.