On Pessimism, Prices, & Prudence

Investment ManagementJun 16, 2022

According to a recent Wall Street Journal poll conducted with NORC at the University of Chicago, a non-partisan research organization, found that Americans are feeling the highest levels of pessimism around the economy in years. About 83% of respondents rated the state of the economy currently as “poor or not so good”. Inflation has reached its highest annual rate since 1981. People are feeling the impacts of higher prices and realizing that they may not be going away any time soon.

When it comes to financial markets, people aren’t feeling any better but for the opposite reason- declining prices. Lately, prices of most major asset classes have plummeted back to earth as rates rise and the Fed’s post pandemic stimulus winds down. It hasn’t mattered what you own as prices aren’t going up, they are falling. Blaine Rollins of Hamilton Lane captured the current mood of investors well in his weekly research briefing:

“In the markets, equities are seeing broad-based, high volume selling. Bonds are falling as new Fed plans are drawn up. Credit had its week in the sun and now has turned back lower. Gold continues to confuse investors with its continued selling. Crypto is now in a complete meltdown for those coins that are still trading, while others have stopped trading entirely. The best major asset in the world is the U.S. Dollar, which only melts upward to become the best asset in your wallet and portfolio. But unfortunately, unless it is appreciating at a near double digit annual rate, then you are losing money due to inflation running so hot. Welcome to the worst summer market environment for investors in many years.”

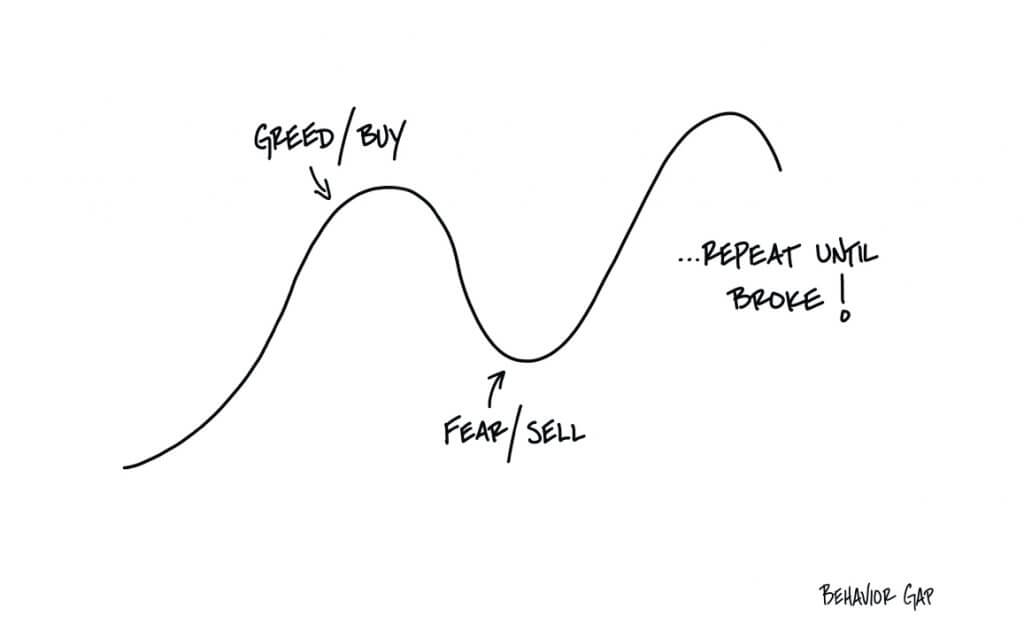

People are feeling pessimistic, and they have good reason. Prices at the pump and the store are going up, while their portfolios have been going down. However, in environments like these we must keep our heads and remain disciplined. Economies and markets move in cycles, and while each is different, they also share many similarities driven by human emotions. This is because they are rooted in the general mood swinging from greed (think of all the craziness of the last two years), to that of fear, which we are seeing in a big way right now.

Markets can swing quickly, as Howard Marks said in his most recent investment memo “the air goes out of the balloon much faster than it goes in…in the real world, things generally fluctuate between pretty good and not so hot. But in the world of investing, perception swings from flawless to hopeless… The key lies in the fact that investors are capable of interpreting virtually any piece of news either positively or negatively, depending on how it’s reported and on their mood.

A huge part of this particular cycle though (and all this pessimism), is the fact that we have more data and information at our fingertips (literally) than ever before. It ups the ante for stress and negativity. Despite all this information, it’s hard to say we are making better decisions today than we used to. This is because our flight or fight response switch is flipped on all day every day. It makes us feel we need to do something. So, what can we do? First, consider if the information you are taking in day to day will be relevant down the road. You can get all the push notifications to your phone about the markets you want, and listen to the talking heads on TV 24/7 with their “breaking news”, but how useful is 99% of it a year from now? Five years? Ten? We don’t say this to shortchange the stresses and anxiety of today, but to add perspective. Consider the source of the information you are consuming. Some questions to consider when you are listening to anyone give an opinion or advice about the state of the economy or the markets: What is their bias, or said another way, are their incentives aligned with mine? Do they understand how I think about money? Do they know what is important to me? In short, consider what they are trying to accomplish in sharing their views.

Remember that environments like this always feel incredibly extreme and stressful in the moment. Think back to March of 2020. Many people sold out at the exact wrong time because of that stress. Still, sometimes, the last thing people want to hear about right now is prior market cycles or the values of dollar cost averaging. We understand that, and we don’t take it lightly. We don’t write academic papers on investment theory to go in a textbook on a shelf. We don’t go on television and make bold economic predictions with no accountability just to get more followers on social media. We help real people manage their money and accomplish their financial goals. The first step in doing that well is in avoiding mistakes when things get severe.

The most important thing a good advisor should be doing right now is listening. They should be helping you stay focused on the long-term and filtering out the short-term negativity and noise that can lead to mistakes. Having someone who acts as a fiduciary on your behalf and understands how what is happening in financial markets today will impact you tomorrow, and maybe more importantly how it won’t, will make all the difference in the long run. Good outcomes come not from concerning ourselves with what others are doing, but in having a good process to make decisions. Especially when anxiety and stress are high. As Warren Buffett famously said, “The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.”

Citations

Inflation, Political Division Put U.S. in a Pessimistic Mood, Poll Finds, Janet Adamy, June 6, 2022

Weekly Research Briefing: The Picture Becomes More Clear, Blaine Rollins- Hamilton Lane, June 14, 2022

Bull Market Rhymes, Howard Marks- Oaktree Capital, May 26, 2022