Why is the Market Rallying with all of this Bad News?

Investment ManagementBy: Jude McDonough, CFP® AIF®

May 01, 2020

Almost every conversation we’ve had over the past month has included questions about why the market is going up with all of this terrible news about the economy. You can make a lot of arguments. The most common theories are:

- It is a bear market rally and we’re going back to retest the lows

- Once the news sets in, it will go back down

- You can’t fight the Fed

- Microsoft, Apple, Google, Amazon and Facebook make up 20% of the S&P 500 and they have been carrying the weight

I even had one client tell me early in the month that he read that it is going to start going back down on April 17. Timing the market is hard enough, but pinpointing an actual date is a bold strategy. One thing you can learn from this recent rally is that nobody knows where the market is going on any given day, month or year for that matter.

As I explained in a post back in March, the market is forward looking and is generally looking out 6-9 months. If we look out 6-9 months, we are between November and February. There are fears that the virus will resurface in the fall so those months don’t exactly have a rosy outlook at the moment. Furthermore, the virus needs to go away before it resurfaces and that hasn’t happened yet. We’ve plateaued in many areas, but the cases are still growing daily nationwide. This may leave you scratching your head and asking the very question that prompted this post.

If you look at history, there have been rallies like this in bear markets. Here is a chart from Bloomberg that highlights past bear market rallies Post World War II:

| START DATE | DURATION (DAYS) | ADVANCE |

| May 19, 1947 | 393 | 23.9% |

| Feb 12, 1957 | 153 | 15.9% |

| Apr 04, 2001 | 47 | 19% |

| Sep 21, 2001 | 105 | 21.4% |

| Jul 23, 2002 | 30 | 20.7% |

| Oct 27, 2008 | 8 | 18.5% |

| Nov 20, 2008 | 47 | 24.2% |

Well, there you go. The answer is that simple. April was a bear market rally and it will end sometime soon. Sell in May and go away. I wish it was that simple. There are many reasons why it isn’t. I’ll list a few:

- The federal government and the fed have taken unprecedented steps to stimulate the economy and stabilize the markets

- There are dozens of companies working on treatments and vaccines

- Maybe the market is looking out further than the traditional 6-9 months

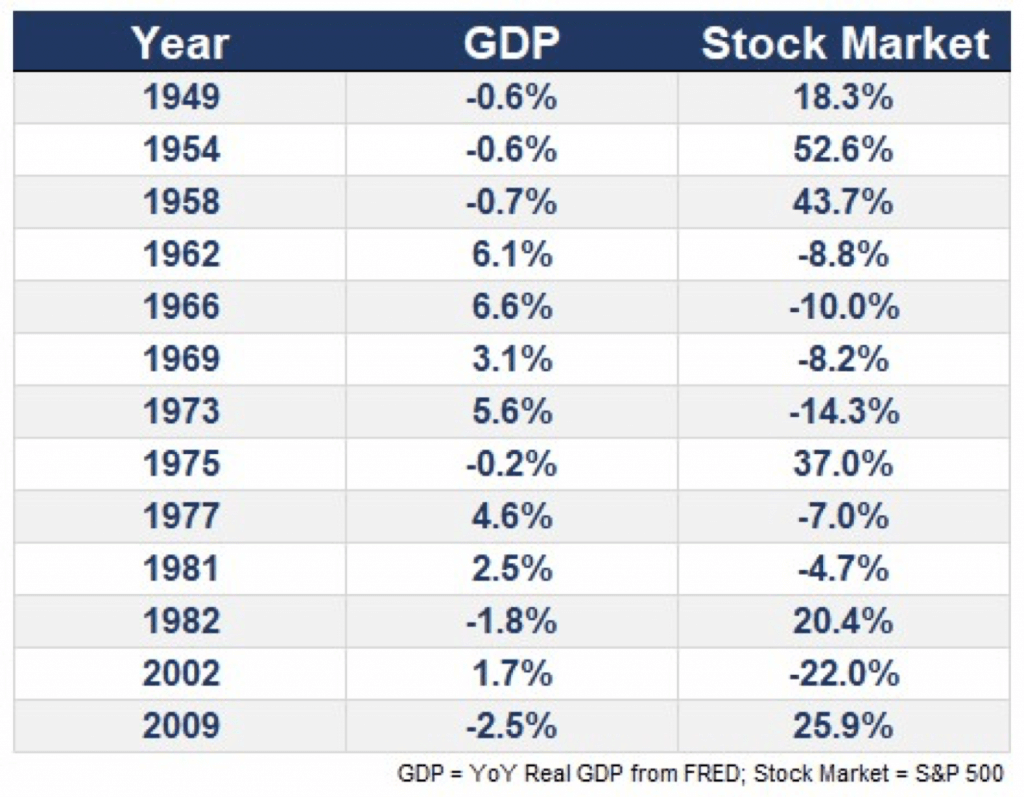

In many times like this, the market can experience a significant dislocation from the current state of the economy. The economic data will continue to be ugly. Unemployment numbers are going to compete with the Great Depression. The decline in GDP for the 2nd quarter is more than likely going to be the worst reading in the Post-World War II era. If April is any indication, it appears that this time may be no different than in the past. To put it as simply as possible, economic data is backward looking and the market is forward looking. One more chart that really drives this point home is the below chart that highlights years where performance of the stock market was not in line with GDP:

As you can see, after the financial crisis of 2008, the market bottomed in March of 2009, rallying 25% that year while GDP was negative. Did we bottom on March 23 or was it a bear market rally? Time will tell. In the meantime, don’t get too consumed with the short term, stick to your plan and focus on what you can control.