Black Friday

News & CommentaryBy: Michael J. Cordaro

Nov 27, 2020

With today being Black Friday, I thought it would be appropriate to take a look at the state of the American consumer. One of the few positives from the pandemic may be that there’s less videos of insane shoppers rushing into stores and fighting each other over things they probably don’t need. When it comes to shopping, Melissa and I often debate what actually constitutes “a great deal” and when it comes to Black Friday I never understood the appeal of getting off the couch to go stand in the cold or run around a store on my favorite holiday (but I digress). However even before this year, Black Friday had already become less of an event for retail stores and their bottom lines as the rise of ecommerce and Amazon changed our behavior. The pandemic will further accelerate this trend.

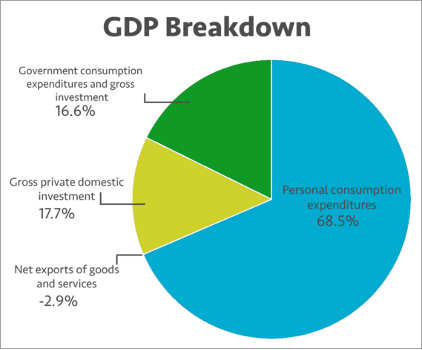

Understanding the American consumer and studying trends in behavior is important because personal consumption makes up 70% of gross domestic product (GDP). Economists love sentences like that, but what does this even mean? Without the jargon, when you think about the term “GDP”, think about it simply as the sum of all of the economic activity of a country. This is why data points like household income and debt, unemployment, consumer confidence, and other items are tracked closely by the economists and the markets: they help signal how American consumers are doing which drives the broader economy. As you can see, government spending, business spending, and trade (exports subtracted by imports) are much smaller pieces of the pie.

Bars, restaurants, travel, movie theaters, sporting events and other elements of the “experiential economy” have obviously taken the brunt of the damage caused by lockdowns and safety policies and will likely be the last things that return. For millennials especially, this had been where a good portion of their discretionary income was spent, and much of this has shifted to things related to the home. Home sales have surged, fueled by renters and city dwellers seeking more space combined with record low interest rates. Sales for things to create home office setups and items like grills, air fryers, and fancy coffee makers have exploded as people get used to spending more time at home and in the kitchen. At home fitness equipment has been another major area of explosive growth. Which of these trends will stay and which are temporary? The prevailing consumer spending choices will have a huge impact on what the future looks like.

There is a lot of research being done regarding HOW consumer spending habits may change. However, when thinking about the broader economic recovery we must focus first on IF consumers will have the same ability and willingness to spend. To that end, two trends we have seen broadly this year has been households paying off their credit card debt in a big way, while savings rates have also jumped. This is common following an economic shock, and especially makes sense given the factors of this specific situation. While this behavior is a great thing for the long-term health of the economy and household balance sheets that were overextended, it could also lead to slower economic growth as these things limit people’s spending. While there will be many changes that come from the pandemic, one thing is sure to remain constant: the economic recovery in this country will be determined by the American consumer.

Citations:

Back to the Future: The New Normal After COVID-19, Scott Clemons/ Brown Brothers Harriman, August 6th, 2020

Federal Reserve Economic Data, St. Louse Federal Reserve, fred.stlouis.org

Consumer Sentiment And Behavior Continue to Reflect The Uncertainty Of The Covid-19 Crisis, McKinsey and Company, October 26, 2020

New York Federal Reserve, newyorkfed.org