Playing a Different Game

News & CommentaryFeb 04, 2021

The Robinhood, GameStop, Reddit situation has created some additional noise in what has already been a pretty loud environment. It is a fascinating story that is indicative of the environment we’re living in and it serves as a reminder of how fast the world is changing. The most interesting part is how the small investors stood up to the big Wall Street hedge funds and showed them that they aren’t the only ones who can move the market. The wild swings in some of the targeted stocks have led to more warnings of an impending bubble.

We’ve had some conversations with clients over the last couple of days that were prompted by the story. Some were asking if we were short GameStop. Others were wondering if it had any impact on our business. The answer to both questions was no. Here at Alliance, we’re playing a different game than traders and hedge funds play. While there are certain thrills associated with the story that sound tempting, that type of speculation would breach our fiduciary responsibility to our clients.

So, are the fiduciaries joining the rest of Wall Street in chastising the traders? Well, not really. We’re not saying that what happened was completely wrong. There were a couple of feel-good stories that came out of it where people were lucky enough to make life changing amounts of money. We surmise that there will be some stories that don’t feel so good as well. Regardless of the outcomes, it is a free market and that is how the traders are choosing to participate. Most financial planners take a different approach that has a long-term focus.

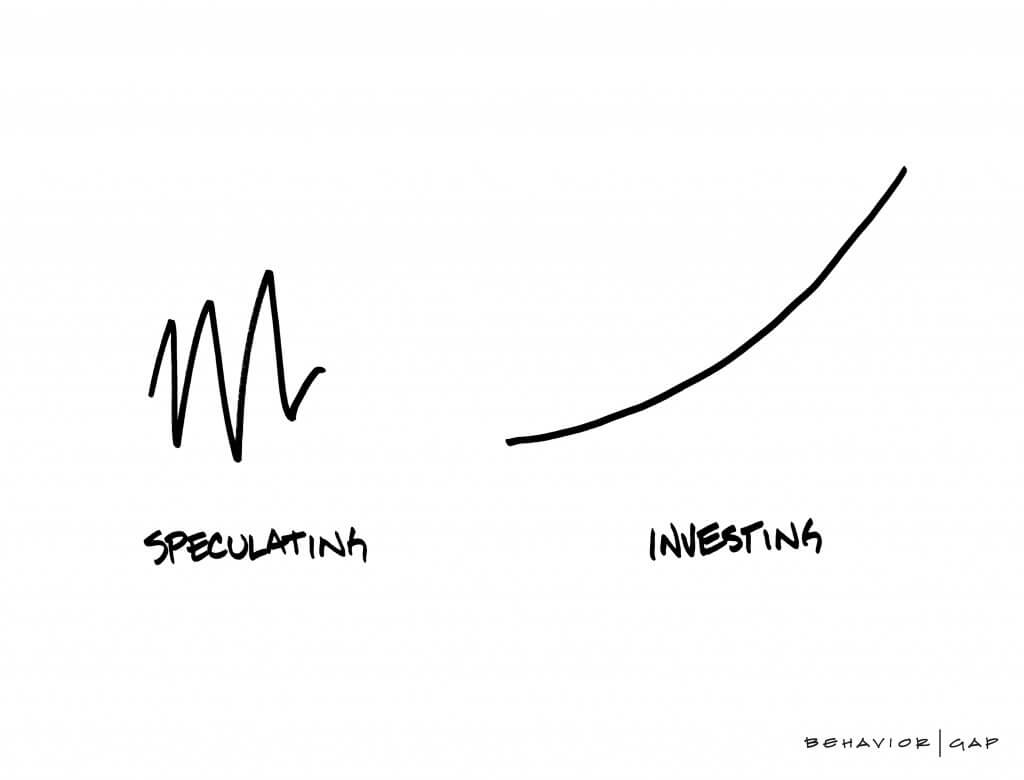

They are two completely different games. Alliance and the financial planners are investing. The traders and the hedge funds are trading.

Both trading and investing involve a lot of time and energy. Neither is easy. The most significant difference between the two is time. The trading mindset is to make money in relatively short periods of time. Think day trader. Trading is often equated to gambling and there is certainly merit to that argument. The investor doesn’t focus on what happens in the coming days, weeks or months. The investor is thinking in cycles that consist of years or even decades. The long-term thinking is not as fun because you don’t get the immediate gratification that trading can provide. That of course is assuming that you are trading with consistent success.

While the long-term approach isn’t going to double or triple your money in short periods of time, it has proven to be a very effective way to build wealth. If you are making those high, short-term returns, then it can be lost just as quickly. Are you comfortable taking that kind of risk? That is a question for you to answer. Our advice would be to make a plan. You can utilize the long-term approach of compounding over time to achieve your goals that are outlined in the plan. If you want to set some trading money aside to scratch your gambling itch, have at it. Just remember the story of the Tortoise and the Hare. Slow and steady ultimately won the race.