Risky Business

Investment ManagementSep 21, 2022

Unless you’ve been living under a rock, it is probably not news to you that 2022 has been a tough year for investors so far. It hasn’t mattered what you own. Almost all asset classes and sectors are down materially this year. However, it wasn’t too long ago, everything just kept going up. So, what changed?

Market prices are driven by billions of inputs being interpreted by millions of investors across the world. The variables that are important change each day, as does how people feel about them. It is this fact that leads us to believe trying to predict what will happen in the short-term is not really a great long-term strategy. However, there are things that investors can study that don’t change quite as often to help explain current market conditions. Two examples would be investor psychology and the general pattern of market cycles. Unlike most variables that drive market prices, these things don’t really change a whole lot over time, it’s just the timing in which they change that does.

A third core variable to understand is what is called the risk-free rate. If you are trying to understand the selloff in asset prices this year, this is a good place to start.

What is the risk-free rate and why is it important?

It is the return you can expect from a U.S. Treasury Bill that matures at the same time as your investment horizon. That is a lot of jargon at once, so let’s translate. The risk-free rate (unlike many things in the financial world), is pretty much exactly what it sounds like. It is the rate of return you could expect if you took the least amount of risk possible with your cash, by buying a government bond.

The reason investors use this as a barometer is because the U.S. Government can always print money and raise taxes, so the risk of losing money is as close to zero as one can get. So, if you want to invest for 1, 10, or 30 years and don’t want to take any risk, the yield on U.S. Government bonds for those time horizons will tell what kind of return you can expect for your money. To help understand why it matters, let’s turn to investor Rubin Miller, who explains this well in a recent article for his (excellent) blog Fortunes and Frictions:

The risk-free rate is the starting block for all investing, and it’s intuitive why: if there is a rate of return we can get risklessly, why accept any rate below that? Like life, we only want to pursue additional risks if they are accompanied by additional expected rewards… stocks and bonds must have higher expected returns than the relevant risk-free rate. Investors wouldn’t take the additional risks of stocks and bonds without expecting additional return.”

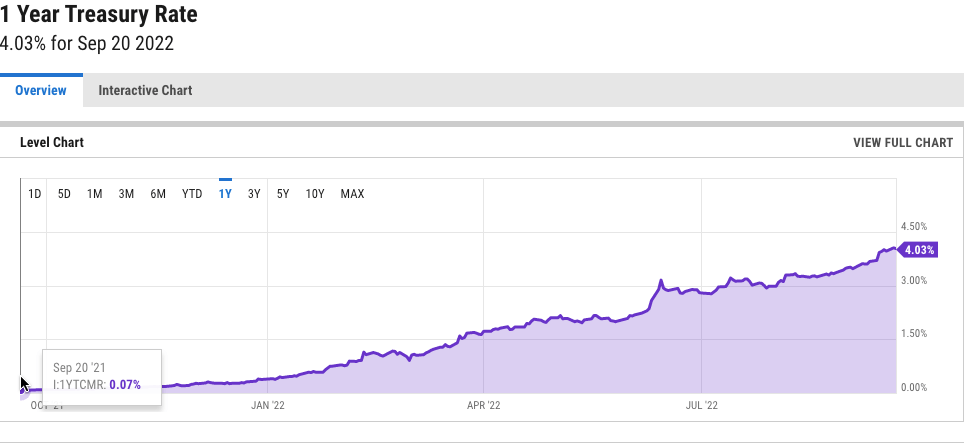

So then, if the current price of any investment is based on the risk-free rate, logic would dictate that when the risk-free rate changes everything else needs to get repriced accordingly. Well, let’s look at the change in the 1-year risk free rate over the last 12 months:

On September 20th of last year, a 1-year treasury was paying 0.07% (as Rubin mentions, this means you were getting $7 dollars back every year for a $10,000 investment). As the Federal Reserve raises interest rates to combat inflation, that same treasury is now paying 4.03%. That is an increase of 5,657% in 12 months! Investors have had to change their risk vs. reward calculus very quickly. When things change fast people become uncertain moving forward, and markets hate uncertainty. This is a major reason you have seen asset prices decline broadly this year. With the Fed hiking rates so quickly, it has become a repricing exercise for everything from bonds, to stocks, to real estate and even crypto.

This goes much further back than the last year though. Rates have been kept at historic lows by central bankers since 2008. Now that they are fighting inflation and raising interest rates, the investing environment has changed drastically. Paul Levin recently posed the question many investors are asking themselves: “Would you rather buy a risk-free long-term Treasury bond yielding more than 3.5% or take your chances in the stock market? The jury is apparently still out among investors, but at least they’re debating the matter — as has rarely been the case in the post-financial crisis era.”

Since 2008, that really hasn’t been much of a question. In a world of record low interest rates, investors were forced to take more risk to get the returns they needed (which one could argue, creates more risk). There was even a term in the investing world coined over the last decade: T.I.N.A, which stands for “there is no alternative” to buying stocks. More people were buying stocks and other assets, which pushed prices even higher. For investors making decisions based on the risk-free rate remaining low for a long time, the ground has shifted under their feet. Said another way, if you priced any asset based on assuming a 0% risk free rate, you have had to go back to the drawing board and start over.

Investors are now grappling with a new environment and new choices around risk, returns, inflation, higher interest rates, and increased volatility. The world can change fast, and so can risk appetites. No amount of data about the past can perfectly predict the future. Any investment decisions made based on assumptions of permanently low interest rates have proven costly. By investing and planning for a wide range of possible outcomes, we can avoid that old saying about assuming.

Citations

More Hemingway, Less Faulkner, Rubin Miller, Fortunes & Frictions- July 26, 2022

Don’t Look Now, But TINA Has an Alternative, Jonathon Levin, Washington Post- September 21, 2022