The “Everything Rally”

Investment ManagementFeb 19, 2021

A term being thrown around in the investment world lately has been the idea of the “Everything Rally”. No matter what you invested money in over the last nine months or so, since the onset of the Covid-19 Pandemic, chances are you probably made money (on paper at least).

The S&P 500, which is the main barometer for large U.S. company stock prices, ended 2020 up 68% from the lows it hit last March and has continued the upward trend into this year. This is after the index lost more than one third of its value back in the spring as panic around the virus began. If ever there was a case study for not trying to time the market, that is certainly a good one. This is despite a health crisis, economic shutdowns, higher unemployment, social unrest, political turmoil and many other factors.

It’s not just US large-cap stocks that have seen huge rallies in prices over this time period though. Small-cap stocks, international stocks, government bonds, municipal bonds all had positive returns in 2020 as well. Commodities like gold, oil, and silver were also positive. Bitcoin was up 300%, and housing prices continue to be borderline absurd in most real estate markets. Even people with enough money to invest in art as an asset class have benefited.

So, what is driving this? Obviously, vaccine news and their continued rollout coupled with declining cases and deaths help people feel better about investing. So to do hopes of a robust global economic recovery, additional stimulus from Washington and historically low interest rates. There are countless factors playing a role in this “Everything Rally” that we won’t get into here. Markets are forward looking and are weighing an infinite number of inputs at all times, and today many of those variables are being viewed positively. Obviously, that can change in a hurry.

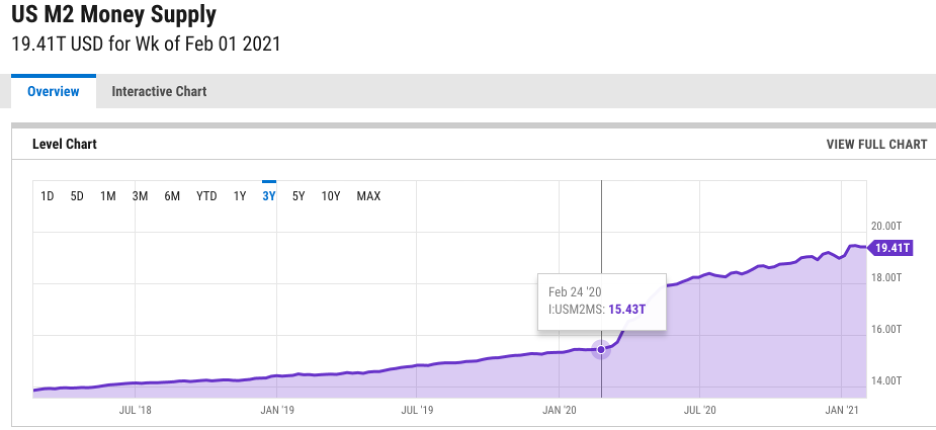

That being said, there is one factor that may not be getting enough attention. The U.S. M2, which is the measure of the money supply, has surged by $4 trillion dollars as part of the Federal Reserve’s response to the economic fallout of the pandemic. What does that mean in English? It means that more than 20% of all U.S. dollars currently in circulation were created in the last 250 trading days. It means that M2 as a percentage of household real estate wealth and financial assets is near all time-highs. Put simply, the Fed has printed a lot of money and much of it is now flowing through the financial system and helping push asset prices higher. (As an aside, if you are trying to understand wealth inequality over the last decade, this is a good place to start. Forget politics- if asset prices are pushed upward by low interest rates and now by money printing, those who own the most assets benefit the most).

Central Bankers around the world created an environment of low interest rates and easy access to capital to support the markets and the economy in the early stages of the crisis. As we look at the markets today compared to the volatility and uncertainty we saw in March, it’s fair to say it worked. Things calmed down, the economy had monetary support, and assets rallied. Compared to what the possible outcomes could have been, this is a pretty good scenario all things considered.

As coach Jack Henzes used to say though, there are no free lunches. What will the implications of this be in the future? This may be pulling forward future returns to the present, so it is possible future returns could be lower. Economists are also voicing concerns about inflation as we look ahead. Inflation is when rising prices for goods can hurt the economy if things people need become more expensive quickly (measured traditionally by the Consumer Price Index, or C.P.I.). That is a debate economists and analysts are having currently. Then there is all the debt that has been created that will need to be serviced.

Regardless of how these things play out, it’s fair to say that a big part of the “Everything Rally” has to do with a lot more money in the system chasing the same amount of assets. This, by definition, is inflation. Rather than seeing it in the real economy where economists are used to measuring it, we have seen it in financial assets and home prices as a side effect to the “easy money” policies of central banks. Does that mean we are due for a correction, or that we are in a bubble? No, not necessarily. In fact, one could argue the opposite. Black Rock’s Rick Rieder explains: “since these liquidity injections are permanent, it is likely that the U.S. nominal economy has also shifted to a permanently higher equilibrium.” Again, in English: this may be sustainable. At the end of the day if people have money to spend, companies can grow their earnings and the economy can recover, the prices we are seeing could definitely make sense.

The bottom line? The great philosopher Puff Daddy’s famous words ring true when it comes to understanding this “Everything Rally”:

It’s all about the Benjamin’s baby.

Citations:

The Return of Inflation, Brian S. Wesbury- Northern Trust, February 8, 2021

It’s All About the Benjamins, Puff Daddy and The Family- Bad Boy Records, 1997

Pandemic-Era Central Banking Is Creating Bubbles Everywhere, Enda Curran & Chris Antsey, Bloomberg, January 24, 2021

Whats the Value of a Dollar?, Rick Rieder- Black Rock, February 2021

Whatever Happened to the Invisible Hand of Capitalism?, Vitaliy Katsenelson- Contrarian Edge, February 2021