Get Buckets

Financial PlanningFeb 12, 2021

In basketball, the most succesful teams are usually the ones that have the best offensive and defensive systems to fit their personnel. Talent is important, but a repeatable system where specific roles are assigned and well understood is what creates great outcomes. The “bucket approach” brings this concept to one’s personal finances and asset allocation. It assigns specific functions to various “buckets” of your money to fit different needs and time horizons. It is a straightforward way to think about how to allocate your earnings in a way that reduces anxiety and gives you peace of mind. It creates structure now for freedom later.

This concept was first brought to the forefront by Harry Markowitz in 1952. He would later go on to win a Nobel Prize for his work and is called the father of Modern Portfolio Theory. The idea was built on in the 1980’s and 90’s as lower interest rates forced people to reconsider asset allocation strategies. In short, the idea is to assign roles to your money in order to ensure you are taking your risk in the right places. This approach helps insulate people from poor decision-making in times of stress and market volatility. While everyone’s situation is different, it is a framework that can help anyone.

Big returns sound nice, but the risk involved in achieving them needs to be weighed thoughtfully.

Rather than focusing on picking stocks or big returns in the short-term, it should instead be about being financially durable and independent over the long-term.

The bucket approach is a way to create a household balance sheet that allows your head to hit the pillow each night knowing you are financially secure. You also won’t have to worry as much about what the market is doing.

The root of the idea is this: while asset allocation is important, asset LOCATION is equally important. What does this mean? When bucketing assets using different time frames, the types of vehicles and strategies you should utilize will change. To continue with the basketball analogy, we’ll use a timeframe equivalent to each shot’s distance from the hoop.

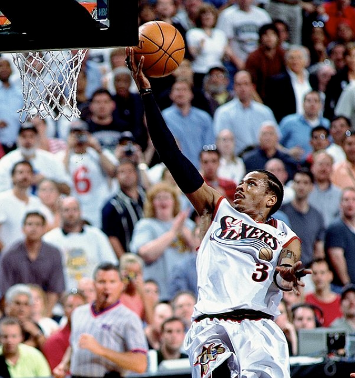

Bucket #1: “The Lay-Up” (0-1 Years)

This should be thought of as a rainy-day fund, and so taking little to no risk with the money you allocate here makes sense. By this we mean being focused on cash and having it be accessible quickly. This ensures you have options as things come up in life.

- Should be considered a “life buffer”

- Differs depending on your own personal situation, but a good general rule is enough cash on hand to cover anywhere from 3-12 months of expenses

- Allows you to avoid getting caught needing to use debt excessively in an emergency and avoid selling investments to fund expenses

- Examples: money market funds, savings accounts

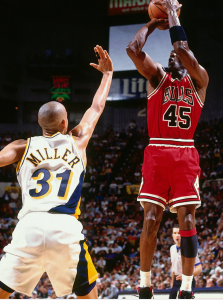

Bucket #2: “The Mid-Range” (2-10 Years)

This bucket should not have too much cash due to the dangers of inflation over time, but the risks you are taking here should be carefully understood. Liquidity should still be a priority in case your situation changes. You should have access to these funds to remain flexible.

- Invested to ensure your money’s purchasing power keeps up with inflation

- Can be invested in a combination of preservation, income, and growth strategies depending on your situation

- Examples: individual or joint investment accounts, revocable trusts, health savings accounts

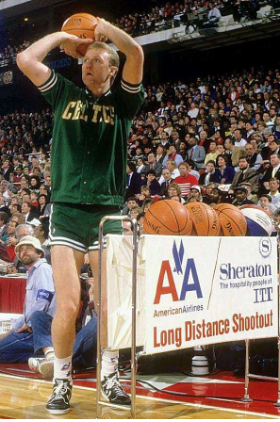

Bucket #3: “The Three Ball” (10+ Years)

This should be where your retirement accounts and long-term money focused on building your wealth are positioned. It is where you should take the most risk when you are younger and adjust accordingly as you get closer to retirement. If you fund the first two buckets sufficiently, you will not have to worry as much about market cycles. You can let your assets remain uninterrupted to participate in long-term compounding. By not interrupting that process, the results have the potential to be truly remarkable.

- Should be focused on growth-oriented strategies to build long-term wealth the younger you are

- Once you build a strategy that fits your goals and personal situation you should not make frequent changes

- Examples: 401(k), IRA, Roth IRA, SEP IRA

It is important to understand the risks you are taking, and where you are taking them. Are those two factors aligned? Having an account to day trade is useful, but is that money you may need soon? What are the capital gains tax implications? Would a market sell-off keep you up at night? Are your retirement accounts invested to fit your timeline and goals? What bucket should fund a major expense like a home renovation? This approach can help you answer those questions and give you more confidence in your financial picture. By focusing on “getting buckets” now, you can make sure you’re not relying on heaving a half-court shot at the buzzer when it comes to your retirement.

Citations

Nobel laureates: Harry Markowitz, Paul Kaplan- Morningstar, July 20, 2018

Designing Your Clients Bucket Plan, Clarity 2 Prosperity, January 25th, 2021

The Bucket Investor’s Guide to Setting Asset Allocation for Retirement, Christine Benz- Morningstar, January 25th, 2021