The Bear Necessities

Financial PlanningMay 19, 2022

Bearish sentiment, or investors who feel negatively about the stock market moving forward, has reached levels not seen since 2009 over the last few weeks. We do not have to wonder why. Let’s start with the Nasdaq Composite, which tracks technology stocks and has outperformed broader stocks by a mile over the last ten years, and especially the last two. As of this writing it is down 28% so far this year. The S&P 500, which is a broader measure of the overall stock market is down almost 17%. The Dow Jones Industrial Average is down over 12%. Bonds have been no help either, as they were down 10% at their lows as the Federal Reserve raises interest rates to combat inflation.

There has been nowhere hide in this selloff. No matter what chart you look at, it seems to be moving downward and to the right. 2022 has not been fun for investors. If you don’t read the financial news (or any news) I can sum up the headlines easily for you rather than repeating them: everything stinks and it’s going to get worse. It is not a coincidence this intense selloff has followed a year where it seemed everything went up, everyone was making money on paper, and investors assumed the party would never end. Today, volatility and uncertainty abound. In investing, just like in life, things are never as good or bad as they seem. Markets act irrationally at times because human emotions can be irrational, especially in times of euphoria and stress.

Here are two things we think it’s worth reminding ourselves of when a bear market rears its head.

- Context is key. Headlines are generated by companies whose revenue depends on getting you to click on them. Bad news sells and always has. What has changed is the volume and the way we consume it. They also lack any context. For example, despite the recent selloff, over the last 12 months the S&P 500 is actually still positive as of this writing, albeit slightly. Further, it is easy to forget that from the onset of the pandemic in March of 2020 through January 3rd of this year, the S&P 500 rose 120% (including dividends). It did this without suffering a downturn of more than 10% over that entire period. That was not normal! Volatility is. If any investor was asked two years ago if they’d sign up for those returns, even with this year’s sell-off, they would have asked for a pen. Unfortunately, we don’t get to choose what those returns will look and feel like along the way. Speaking of volatility…

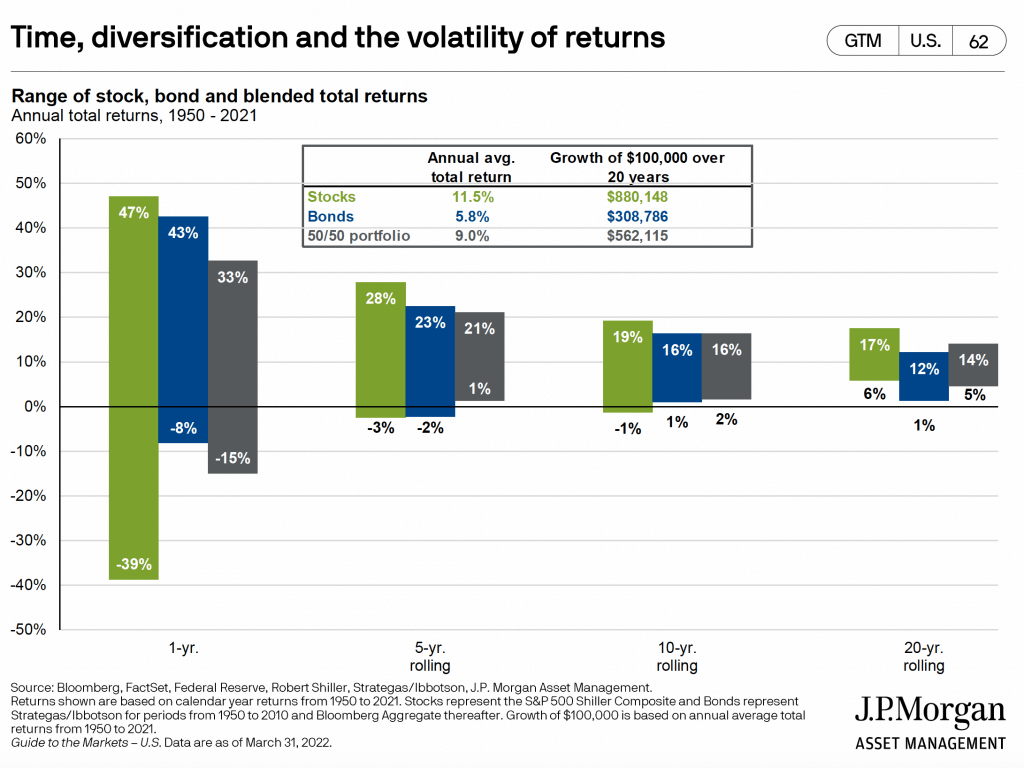

- Volatility and risk are not the same thing. Volatility can be measured by the size of the swings up and down in the short-term for an investment or the overall market. While it makes us uncomfortable, history shows basing decisions on it is a huge mistake. Risk on the other hand should be viewed as the chances you will lose money permanently. We have seen a lot of volatility due to concerns about inflation, the economy, the war in Ukraine, and lockdowns in China just to name a few. However, if you are a long-term investor you would benefit from trying to avoid paying attention to volatility in the short-term. In other words, we should care more about risk than volatility. Don’t shorten your time horizon when things get stressful. Let’s use the below chart from J.P. Morgan to help explain what we mean.

This chart shows the range of outcomes one could expect from 1950 through 2021 for stocks, bonds, and 50/50 portfolios over 1, 5, 10, and 20 year periods. Stocks over one year could range anywhere from -39% to up 47%. That is a roller coaster! However, the further out we go the smoother the ride becomes. As time goes on, the possible range of outcomes for stocks and bonds narrows. It shows clearly that the longer you stay invested, the harder it becomes to lose money. So, what can you do with this information?

Making sure you set up your spending needs in a way that insulates you from short-term swings is the name of the game. The reason financial planning must be part of any good investor’s strategy is that financial success comes down to matching the risk you take with the time horizon in which you may need the money. Know what you own and WHY you own it. You can do this by creating a bucket approach. Good financial planning is about creating a process that gives you flexibility as the environment changes, not needing the market to behave a certain way.

We talk all the time about how attempting to predict the future is not a part of our investment philosophy. No one has ever shown the ability to do it well over time, and we’re not going to pretend to be the first. We prefer to position our clients to accomplish their goals regardless of what happens next, rather than playing a game of pin the tail on the donkey trying to guess what the future might look like. In bear markets, having a disciplined process that allows you to remain patient will not just add value to your bottom line, it will also reduce anxiety. It helps you avoid panic and stay the course. Abraham Lincoln was fond of the saying “this too shall pass”. That is certainly fitting right now. We could also benefit from listening to an equally important message that is more recent- from Dory of Finding Nemo : “Just keep swimming, just keep swimming, just keep swimming.”

Citations

The AAII Investor Sentiment Survey, April-May 2022

JP Morgan “Guide to the Markets”, April 30, 2022

Strategy Insight, On Volatility- Scott Clemons- Brown Brothers Harriman, May 10 2022

Finding Nemo, Pixar, 2003