MARKET MADNESS

Investment ManagementMar 23, 2022

“Impossible to predict”, “hard to understand”, “unbelievable”, “shocking”, “anxiety ridden”, “can’t look away”. These are just a few ways basketball fans might describe the annual tradition of March Madness as it enters its second week. It is also how many investors would describe what it has been like to look at their portfolios so far in 2022. At the of the end of last week, 41% of the stocks in the S&P 500 index were trading 20% below their 52-week highs. For the technology heavy Nasdaq index, it was a whopping 71%. Bonds, normally perceived as “safe”, face their own set of risks to consider in the current environment. However, it is during stressful periods like this it is important to remember that overthinking and tinkering can sink your portfolio just like it can sink your bracket.

While the last two years have been smooth sailing upward for investors, they are being reminded the hard way what “normal” in the stock market looks like most of the time. Perspective is key. Let’s “seed” four of the major risks getting headlines during this period of volatility to better understand what each of their impacts on the market and economy may be moving forward. To stick with this analogy just a little longer, it’s important to remember that while the investment world loves predictions, they’re usually worthless faster than most people’s brackets after the opening weekend of the tournament.

(1) Russia’s invasion of Ukraine

The obvious top seed for many reasons. There are certainly better sources of information for the terrible crisis unfolding in Eastern Europe, so we will not go too in depth on the war itself. Our focus is on how investors should think about it. Before getting to that though, it is very interesting just how badly the Russians miscalculated how they would be received by the Ukrainian population upon crossing the border. A report earlier this week stated that “Russian soldiers were evidently carrying dress uniforms for their victory parade in Kyiv rather than extra ammo and rations.” As Happy Gilmore said, talk about your all-time backfires.

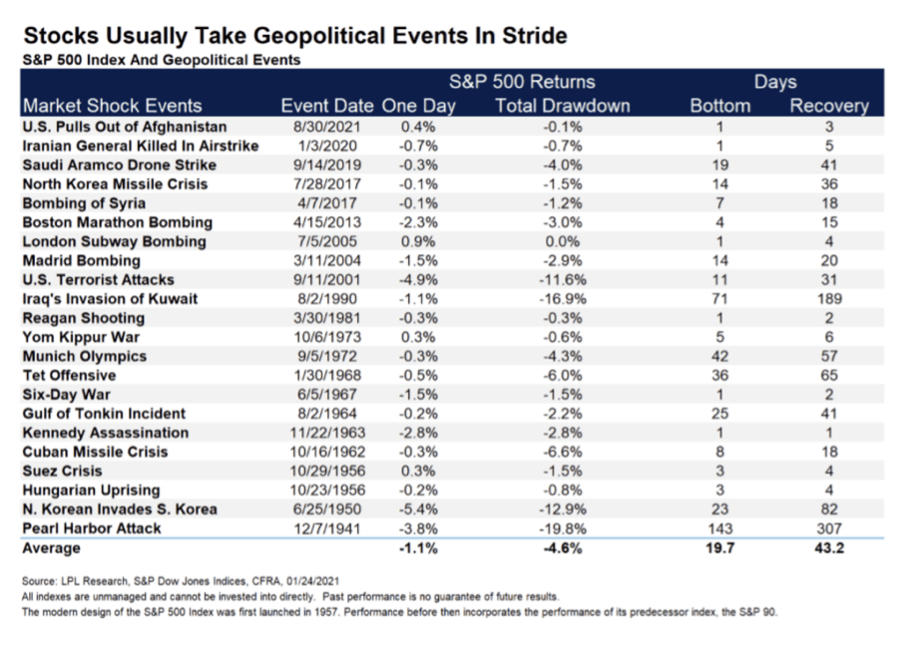

Wars are scary. They make us feel helpless, and the first reaction can often be to want to do something to help make us feel better. History shows this is usually a mistake when it comes to your investments. Markets are forward looking and absorb geopolitical upheaval fairly well for the most part. The above chart shows what the market has done following various geopolitical crisis’ dating back to Pearl Harbor. In virtually every case, selling would have felt good in the short-term and seemed like a huge mistake over the long-term. No one can time the market.

While there is always a chance this grows into a much larger and more damaging conflict, we cannot make investment decisions based on this fact. James Stack put it well in a recent investment note: “Trying to anticipate and invest for a low-probability, worst-case scenario has historically been a foolhardy strategy”. Veteran investor Art Cashin had a similar thought, but he put it more bluntly: “Never bet on the end of the world, because it only happens once.”

(2) Inflation

You are probably sick of hearing about inflation (and of how it is impacting your wallet lately), so we’ll keep this short and sweet. You can read some of our thoughts here, here, and here if you’d like. Unfortunately, prices may not be done rising. Supply disruptions are not going anywhere right away. Regardless of where measures of inflation are over the next month, year, or decade, it was the single biggest threat to anyone who is trying to build wealth or preserve their quality of life even before the recent spike in prices. Because of this fact, it is important now more than any time in recent history to remember that cash on hand is not wealth, but only a tool to help build it. In other words, wealth is not tied to the amount of dollars in our bank account. What dictates wealth is our purchasing power. It makes sense then that we should allocate our capital in a way that outpaces (or at least keeps up with) inflation over time. This is the best way to ensure we can maintain our quality of life and accomplish our goals now and in the future. Which brings us to our three seed…

(3) Rising Interest Rates & The Fed Policy

Another favorite topic on this blog, although we look forward to a day when that won’t be the case and central bankers won’t be as central to markets (you can read more about the Fed here, here, and here if you’d like). The Fed is in a bit of a pickle at the moment. It needs to raise rates to help fight inflation, but risks tightening just as the economy and markets have become more uncertain. The Fed has said it will raise rates and remove the accommodative policies it has had in place for over two years now. Will that impact asset prices that have benefited from these policies? The Fed is aiming to strike the perfect balance and achieve what is being called a “soft landing” for the economy. We’ll see how this plays out, and if their plan changes as the situation evolves. While it’s important to monitor what the central banks are saying, making investment decisions based on this is a really lousy strategy. One thing is for certain, none of us want Jerome Powell’s job right now.

(4) Chances of a recession

As the old cliché you’ve heard from coaches and parents growing up goes “attitude is everything”. This is especially true for the economy, as 70% of gross domestic product is made up by the consumer. If consumer sentiment continues to fall amid all of these factors, people may pull back on spending. This would severely impact the overall economy. While a recession and a market sell-off don’t always follow each other, if people stop spending corporate earnings are likely to suffer so it is important to keep an eye on.

So… what to do?

The financial media has no shortage of topics to scare people into bad decisions with. Things change fast. No one knows what the world will look like 3 weeks from now, never mind in three months or three years. Unlike March Madness, when investing we should avoid the guessing game all together because the stakes are much higher. Risk is what you can measure, and uncertainty is everything that is left over. There will always be plenty of it.

History has continually shown us two things:

1. there is never a perfect time to invest

2. being invested over time will provide the best returns

Create a plan that allows flexibility through uncertainty, but keeps you disciplined so you don’t lose sight of the long-term. We are again being reminded we need to focus on what we can control and not on what might happen. It sounds simple, but that doesn’t mean it is easy.

Citations:

InvesTech Research, James Stack- Volume 22, Issue 3- March 18, 2022

The Fed is in an Impossible Bind, Pragmatic Capitalism- Cullen Roche, March 8, 2022

Managing Uncertainty, Known Unkowns- Allison Schrager, March 21, 2022