The Fed- Part II

News & CommentaryDec 18, 2020

As we discussed in Part I, Fed policy has a huge impact on the market and overall economy. To quote Ray Dalio: “it all comes down to interest rates”. This week we will focus on some concepts related to that policy and the results in recent years. We will also consider how these things may shape our financial lives and portfolios as we get ready to enter a new decade.

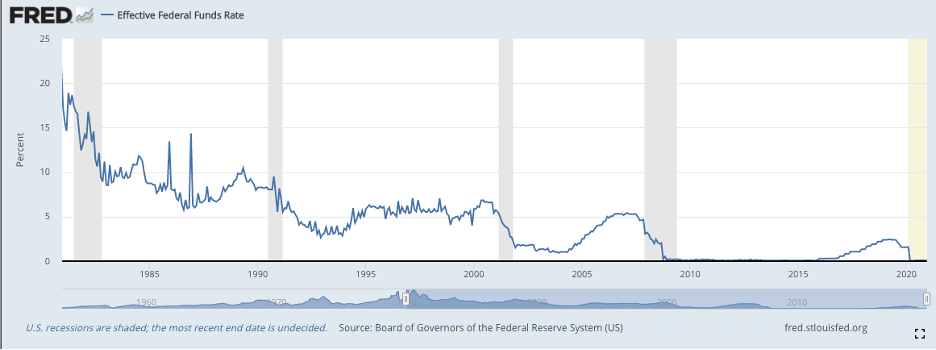

There are many reasons for the steady decline in interest rates in the chart above. Some are simple, but others are openly debated and very complex. We will not get into that here. We are instead focused on the consequences of lower rates over time. They affect investment returns and debt levels. Interest rates can also change investor expectations and behavior.

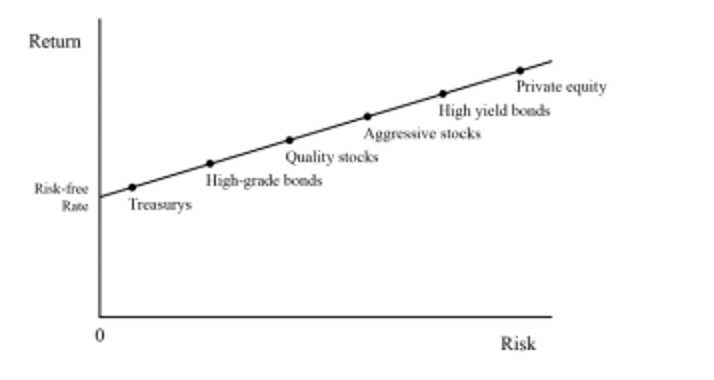

1. Lower interest rates tend to bring down future returns for all types of investments

The above chart is known as the capital market line and taken from a recent Howard Marks memo. It references various types of investments and their risk vs. reward relationship. Treasury Bills (30 Day US Government Bonds) are the least risky because they only have a month in duration, and the government can raise taxes and/or print money to pay back its debt. This is called the risk-free rate. As you move out on the above risk curve, you should expect to receive a better return for taking that additional risk. While not always the case in reality, it makes sense in theory and is directionally correct. Traditionally, risk averse investors would be able to invest in bonds which have a lower risk profile while providing a decent return. Unfortunately, as interest rates decline, the expected return for bonds as well as everything else is affected.

Source: Oaktree Capital/Howard Marks, “Coming Into Focus”

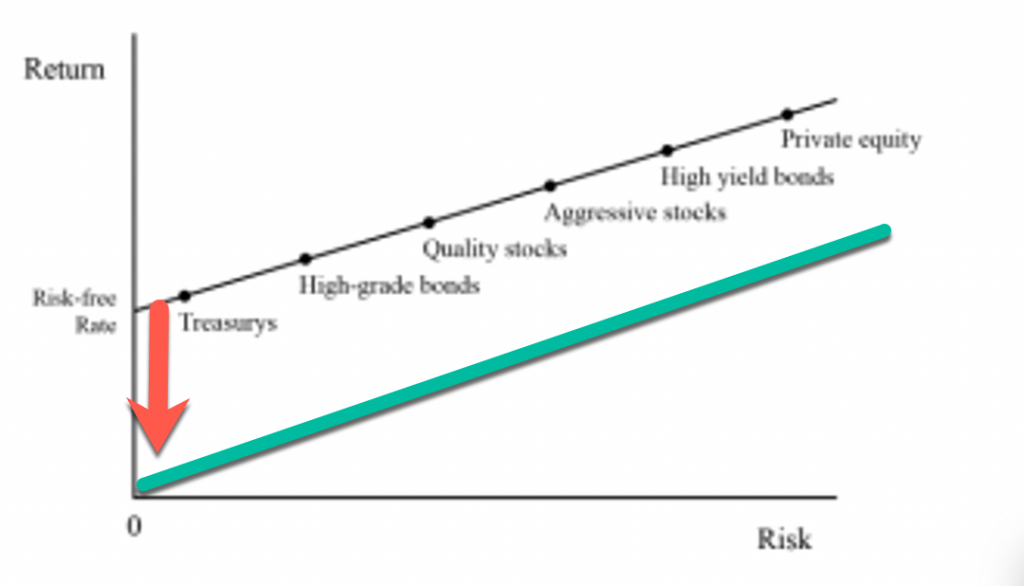

2. The decline of interest rates forces investors to choose between lower returns and taking more risk

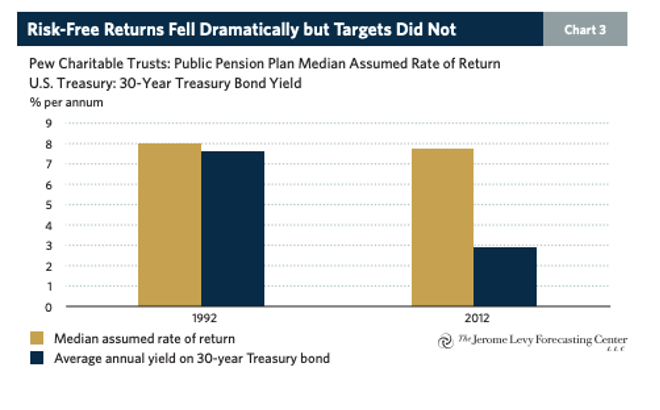

This has forced investors to go further out on the capital market line and take more risk to get the same returns. For example, in 1992 you could invest in ultrasafe 30-year Treasury bond and receive fairly high returns. If you were managing a pension plan with a target return of 7% annually, your job was a lot easier than it is now. Today you are forced to take more risk to get the same return.

This doesn’t just affect pensions though; it affects every type of investor from individuals to large institutions. As the cyclical decline in interest rates has continued, many investors have been forced to take more risk to meet their objectives, whether they are aware of it or not. With rates at historic lows, many have made the decision to move more money to riskier assets like high yield bonds, stocks, and private equity funds.

3. The Global Financial Crisis, The Covid-19 Pandemic, and the 2020s

In 2008, many who had taken more risk were impacted severely. In their response to the crisis, the Fed’s policies went to a whole new level. They lowered interest rates to zero and pulled out new tools like asset purchases (think printing money) to create an environment where access to credit was cheap and easy. While they succeeded in avoiding another Great Depression, things never really went back to “normal”. Asset prices in general have soared in this low rate era of quantitative easing, especially the stock market. This has happened despite a slower recovery and limited growth in the real economy. As a result those who didn’t own many assets didn’t really benefit (a major driver of the increasing wealth gap).

To respond to the pandemic, from March to July, the Federal Reserve did twenty times the amount of asset purchases it did during the 18-month period following the Global Financial Crisis. If you have scratched your head wondering why the stock market has recovered so fast during this crazy year, this is the biggest reason why. The Fed has taken the strategy from 2008 and injected it with steroids. The scale of money printed this year is hard to comprehend. This helped markets and the economy stabilize, but it also drove asset prices even higher (housing, stocks, and even bitcoin are examples). Can the same trends of the last ten years continue into the 2020s? It’s hard to say, but it seems unlikely since the value of lower rates start to have diminishing effects once interest rates hit 0%.

Reflecting back allows us to better prepare for the what is ahead, but it is not enough. Everything from home prices to your 401(k) will be impacted by these factors. Taking a haphazard approach to financial decision-making in this environment can have serious consequences and impair your ability to build wealth long-term. Understanding your whole financial picture, the amount of risk you are taking, and staying focused on doing the things that really matter over the long run are essential to succeeding financially. This may sound boring, but in an increasingly complex world, this straightforward approach is still the best way to get you where you want to go.

Citations/further reading:

Coming into Focus, Howard Marks- Oaktree Capital, October 13, 2020

Bubble or Nothing, David Levy- Levy Forecasting Center, September 2019

Thank the Fed for This Years Run in the Stock Market, James Mackintosh- Wall Street Journal, December 7, 2020

FRED, St. Louis Federal Reserve Data

The Implications of Hitting the Hard 0% Interest Rate Floor, Ray Dalio- Bridgewater Associates, March 16, 2020