More Uncertainty, More Predictions

Financial PlanningMar 05, 2021

Last week, Federal Reserve Bank Chairman Jerome Powell testified in front of both houses of Congress. If you’re ever in need another reason to be dumbfounded by Washington D.C., check out the Fed Chair’s semi-annual tradition of appearing before Congress. As Will Rogers said, “Congress is so strange; someone gets up to speak and says nothing, nobody listens, and then everybody disagrees.” Despite the political theater, when the Fed Chair speaks, markets listen. This was especially the case last week as Congress debates another stimulus package. This latest round is an eye popping $1.9 trillion. If this bill passes, total stimulus from the Federal Government will be more than four times what was spent after the Global Financial Crisis. This comes as the Fed continues its ultra-loose monetary policy combo of low rates and asset purchases.

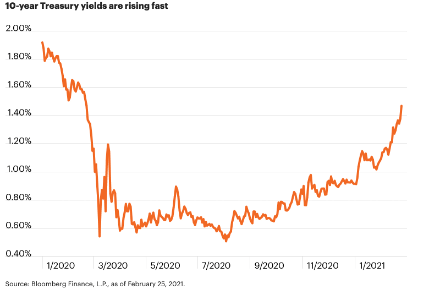

This unprecedented flood of coordinated monetary and fiscal support will continue to have a profound impact on investor behavior and asset prices for a long time. In the last week, the possible consequences of these policies have become the focus for markets and the broader media. There is concern about a period of higher inflation. As rates have ticked higher from all-time lows in response, so have worries about the impact rising rates may have on fixed income investors and the stock market’s ability to continue its march upward. Media coverage about a potential stock market bubble and the explosion of corporate and government debt have also come to the forefront. All of these things are risks investors must consider, and we have researched and written about them extensively. Understanding them is essential for sound decision-making when it comes to everything from your portfolio to your mortgage.

Not surprisingly, predictions and forecasts related to all of the above abound. Making predictions is one of Wall Street’s favorite past times. Getting them right is another story. Here’s the thing talking heads on television, day-traders on twitter, and so-called expert forecasters won’t admit: The biggest risks are always things no one is thinking about, because if no one’s thinking about it they aren’t considering it as a possibility. This may be the single most consistent rule when studying the history of markets. 2020 certainly reinforces this concept.

Your risk model is only as good as its inputs. Carl Richards once said: “Risk is what’s left over when you think you’ve thought of everything else.” The things that drive big market events are surprises, and surprises by definition cannot be predicted. Things that appear unsustainable can last a long time, and timing the market is a good strategy only if your goal is to lose money.

For economic forecasters and “experts” prone to making predictions, it’s important to consider their incentives. Maybe they are paid to have an opinion, or maybe their number of subscribers or followers goes up whenever they make brash statements. Perhaps positions they own would benefit from certain events coming true. It could also just be about their egos. When a forecaster gets an extreme prediction right, you can likely attribute it to them making extreme predictions consistently.

Human-beings’ inability to forecast the future makes us uncomfortable. It is why everyone from economists, to people who get paid for sports gambling picks, to tarot card readers always have job security despite poor long-term job performance. It’s also why studies show 97% of day-traders lose money. We want to believe we can anticipate what will happen next, even though we are constantly taught the hard way that the future is unpredictable. Human behavior is funny like that. Throughout history, this need increases in times of stress. Steve Rivkin once said: “The more unpredictable the world is the more we rely on predictions.”

When it comes to financial success, people shouldn’t need to perfectly forecast what will happen next in order to get good results. That is not a repeatable process. Instead, it should be about creating a financial plan that allows you to accomplish your goals with a wide range of future outcomes. Having a margin of safety and flexibility is key. You need to be willing to play a different game. Rather than trying to predict the future, we spend our time helping clients better understand their situation while becoming more financially resilient today. By doing this we can then build wealth for tomorrow more effectively. Focusing on things you can control like a strong household balance sheet, a well-constructed portfolio, and organizing your assets strategically can give you peace of mind and help you accomplish your goals down the road regardless of what comes next.

This approach can help you become financially “shatterproof” and prevent poor decision-making. It also helps remove stress and anxiety when it comes to your money.

As Howard Marks once wrote: “You can’t predict. You can prepare.“

Citations

Rates are Rising with Big Implications for Investors, Lara Rhame- FS Investments, February 26th, 2021

Rising Interest Rates May Continue to Test the Stock Market in the Week Ahead, Patti Dom- CNBC.com, February 26, 2021

The Laws of Investing, Morgan Housel- The Collaborative Fund, April 12, 2019

Wall Street Wises Up to the Folly of Forecasting, Barry Ritholtz- Bloomberg, December 15th 2017

Some Friendly Reminders About Day Trading, Ben Carlson- A Wealth of Common Sense, February 7, 2021

You Cant Predict You Can Prepare, Howard Marks- Oaktree Capital, February 24, 2001